How To Schedule A Public TXDP Appointment: A Complete Guide

Scheduling a public TXDP (Tax Debt Payment) appointment is a crucial step for individuals or businesses seeking to manage their tax obligations effectively. Whether you're dealing with overdue taxes or need guidance on resolving tax-related issues, the TXDP scheduler provides a streamlined process to book appointments with tax professionals. Understanding how to navigate this system is essential to ensure timely resolution of your tax concerns.

With the increasing complexity of tax regulations, many taxpayers find themselves overwhelmed when it comes to addressing their liabilities. Public TXDP appointments offer a lifeline, connecting taxpayers with experts who can provide personalized advice and solutions. These appointments are not just about resolving current issues but also about planning for future financial stability.

In this article, we will guide you through every step of the process, from understanding the TXDP system to successfully scheduling your appointment. You'll also learn how to prepare for your meeting, what to expect, and how to make the most of the resources available. By the end of this guide, you'll feel confident and empowered to take control of your tax situation.

Read also:Fantana Body The Ultimate Guide To Achieving A Healthy And Sculpted Physique

Table of Contents

- What is TXDP and Why is it Important?

- Benefits of Scheduling a Public TXDP Appointment

- Step-by-Step Guide to Scheduling Your Appointment

- How to Prepare for Your TXDP Appointment

- Common Questions About Public TXDP Appointments

- Tips for a Successful Appointment

- Additional Resources for Taxpayers

- Conclusion and Call to Action

What is TXDP and Why is it Important?

The TXDP, or Tax Debt Payment, system is a government initiative designed to help individuals and businesses manage their outstanding tax liabilities. It serves as a bridge between taxpayers and tax authorities, facilitating communication and offering structured solutions to resolve financial obligations.

TXDP appointments are particularly important because they provide taxpayers with direct access to professionals who specialize in tax resolution. These experts can offer tailored advice based on your unique financial situation, ensuring that you comply with regulations while minimizing penalties and interest.

For many, navigating the complexities of tax laws can be daunting. Public TXDP appointments simplify this process by offering clear guidance and actionable steps. Whether you're dealing with back taxes, installment agreements, or penalty abatement requests, a TXDP appointment can provide the clarity and support you need.

Benefits of Scheduling a Public TXDP Appointment

Scheduling a public TXDP appointment comes with numerous benefits that can significantly impact your financial well-being. Below are some of the key advantages:

- Expert Guidance: You’ll have access to tax professionals who are well-versed in resolving tax debt issues.

- Customized Solutions: Each appointment is tailored to your specific situation, ensuring the best possible outcome.

- Reduced Stress: Knowing that you have a plan in place can alleviate the anxiety associated with tax debt.

- Compliance Assurance: By working with experts, you can ensure that you remain compliant with tax laws and avoid further penalties.

These benefits make TXDP appointments an invaluable resource for anyone looking to regain control of their financial future. The peace of mind that comes with professional assistance cannot be overstated.

Step-by-Step Guide to Scheduling Your Appointment

Scheduling a public TXDP appointment may seem complex at first, but by following these steps, you can ensure a smooth and efficient process.

Read also:Ultimate Guide To Choosing The Perfect Vinyl Tarps For Any Purpose

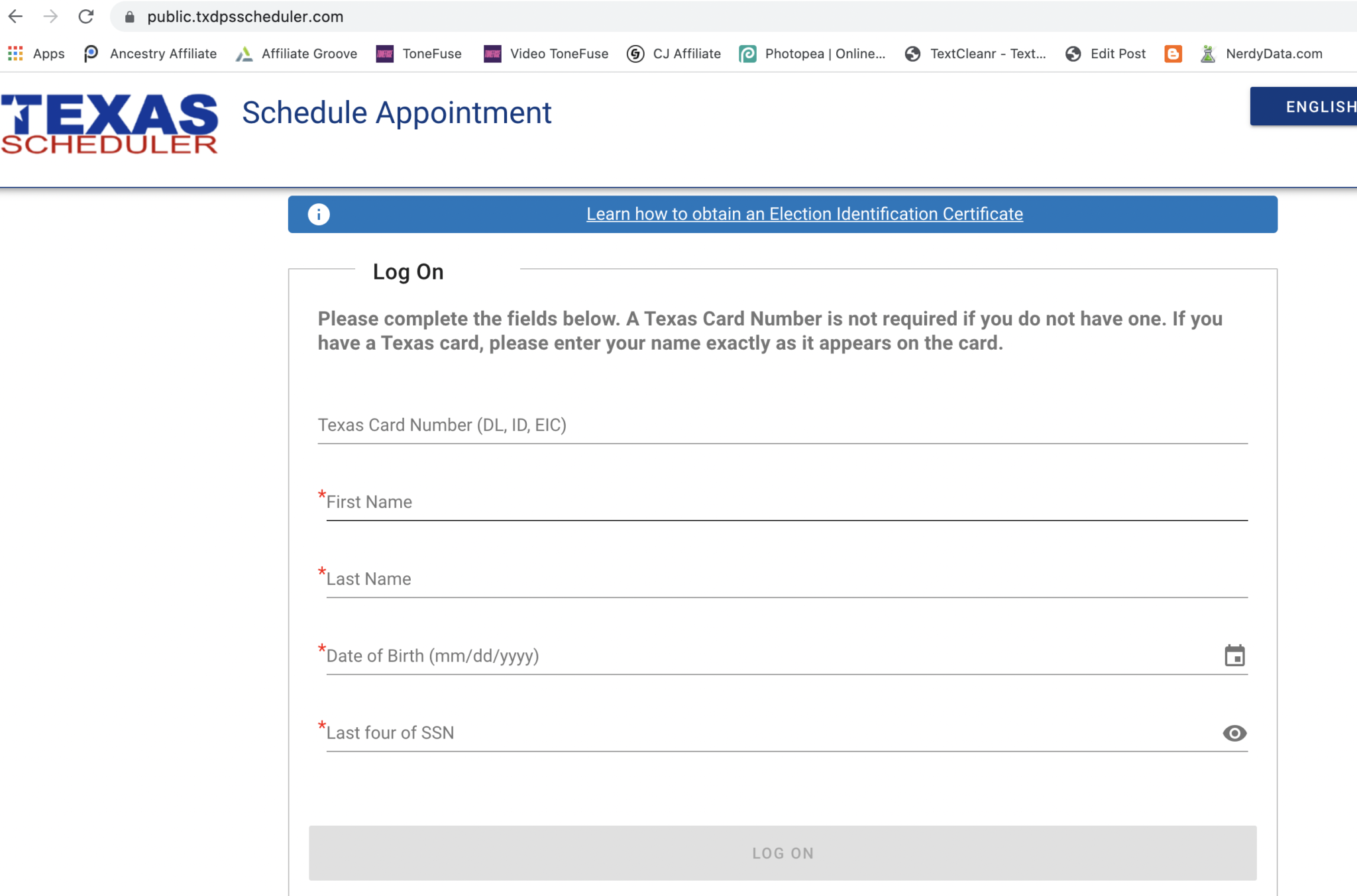

Step 1: Accessing the TXDP Scheduler

The first step in scheduling your appointment is to access the TXDP scheduler platform. This can typically be done through the official government tax authority website. Ensure that you are using a secure connection to protect your personal information.

Once on the platform, you’ll need to navigate to the appointment scheduling section. Look for clear instructions or prompts that guide you through the process. If you encounter any difficulties, most platforms offer a help section or customer support contact information.

Step 2: Creating an Account

Before you can book an appointment, you’ll need to create an account on the TXDP scheduler. This usually involves providing basic personal information such as your name, email address, and tax identification number.

After submitting your details, you may be required to verify your identity through a confirmation email or SMS. This step is crucial to ensure the security of your account and the accuracy of your appointment details.

Step 3: Selecting Appointment Type

Once your account is set up, you can proceed to select the type of appointment you need. The TXDP scheduler typically offers various options, such as:

- General tax consultation

- Installment agreement setup

- Penalty abatement request

- Offer in compromise discussion

Choose the option that best aligns with your needs. If you’re unsure which type of appointment to select, the platform may offer a brief questionnaire to help guide your decision.

How to Prepare for Your TXDP Appointment

Being well-prepared for your TXDP appointment can make a significant difference in the outcome. Here are some essential steps to take before your meeting:

- Gather Documentation: Collect all relevant tax documents, including past returns, notices from the tax authority, and financial statements.

- Review Your Tax Situation: Take time to understand your current tax liabilities and any issues you need assistance with.

- Prepare Questions: Write down any questions or concerns you want to discuss during the appointment.

By preparing thoroughly, you’ll be able to make the most of your time with the tax professional and ensure that all your concerns are addressed.

Common Questions About Public TXDP Appointments

Many taxpayers have questions about the TXDP appointment process. Below are answers to some of the most frequently asked questions:

- How long does the appointment last? Appointments typically last between 30 minutes to an hour, depending on the complexity of your case.

- Is there a fee for the appointment? Most public TXDP appointments are free, but some specialized services may have associated costs.

- What if I miss my appointment? If you miss your appointment, you can usually reschedule through the TXDP scheduler platform.

These answers should help clarify any uncertainties you may have about the process.

Tips for a Successful Appointment

To ensure that your TXDP appointment is productive and successful, consider the following tips:

- Be Honest and Transparent: Provide accurate information about your financial situation to receive the best advice.

- Take Notes: Write down important points discussed during the meeting to refer back to later.

- Follow Up: After the appointment, follow up on any action items or recommendations provided by the tax professional.

These practices will help you maximize the value of your appointment and move closer to resolving your tax issues.

Additional Resources for Taxpayers

In addition to scheduling a TXDP appointment, there are several resources available to help you manage your tax obligations:

- IRS Website: The official IRS website offers a wealth of information on tax laws and resolution options.

- Taxpayer Advocate Service: This independent organization within the IRS provides assistance to taxpayers facing challenges.

- Local Tax Clinics: Many communities offer free or low-cost tax clinics where you can receive additional support.

Exploring these resources can provide further guidance and support as you work to resolve your tax liabilities.

Conclusion and Call to Action

Scheduling a public TXDP appointment is a vital step in managing your tax obligations and achieving financial stability. By following the steps outlined in this guide, you can navigate the process with confidence and ensure that you receive the support you need.

If you found this article helpful, please consider sharing it with others who may benefit from this information. Additionally, feel free to leave a comment or question below—we’d love to hear from you! For more resources on tax management and financial planning, explore our other articles and guides.

Central Cee Physique: The Fitness Secrets Behind The Rising UK Rapper

Discovering Esme Louise Sutter: A Rising Star In The Entertainment Industry

Milly Alcock: Rising Star In The Entertainment Industry

Request for Certification Securities and Exchange Commission

Texas DMV Appointment Schedule Guide DMV Details