FintechZoom S&P 500: A Comprehensive Guide To Understanding The Stock Market Index

The S&P 500 is one of the most widely followed stock market indices in the world, and FintechZoom has become a go-to platform for investors seeking insights into its performance. Whether you are a seasoned investor or just starting your financial journey, understanding the S&P 500 is crucial for making informed decisions. This article dives deep into the S&P 500, exploring its significance, composition, and how FintechZoom provides valuable insights into its movements. With the rise of fintech platforms, investors now have access to real-time data, expert analyses, and actionable strategies to navigate the complexities of the stock market.

Investing in the S&P 500 can be both rewarding and challenging. The index represents the performance of 500 of the largest publicly traded companies in the United States, making it a barometer for the overall health of the U.S. economy. However, understanding its nuances requires expertise and access to reliable information. This is where FintechZoom comes into play. By leveraging cutting-edge technology and data analytics, FintechZoom offers a wealth of resources to help investors stay ahead of market trends and make informed decisions.

In this article, we will explore the S&P 500 in detail, focusing on its history, components, and role in the global economy. We will also examine how FintechZoom enhances investor knowledge through its platform, providing tools and insights that align with the principles of E-E-A-T (Expertise, Authoritativeness, Trustworthiness) and YMYL (Your Money or Your Life). Whether you are looking to diversify your portfolio, track market trends, or understand the factors influencing the S&P 500, this guide will equip you with the knowledge you need to succeed.

Read also:Is Genovia Real Unveiling The Truth Behind The Fictional Kingdom

Table of Contents

- Introduction to the S&P 500

- History and Significance of the S&P 500

- Components of the S&P 500

- FintechZoom's Role in S&P 500 Analysis

- Investment Strategies for the S&P 500

- Risks and Challenges of Investing in the S&P 500

- Real-Time Data and Tools on FintechZoom

- Economic Indicators Influencing the S&P 500

- Long-Term Performance of the S&P 500

- Conclusion and Call to Action

Introduction to the S&P 500

The S&P 500, or Standard & Poor's 500, is a stock market index that measures the performance of 500 large-cap companies listed on U.S. stock exchanges. It is widely regarded as one of the best indicators of the overall health of the U.S. economy. Investors often use the S&P 500 as a benchmark to evaluate the performance of their portfolios. The index is market-capitalization-weighted, meaning that companies with larger market values have a greater impact on its movement.

One of the reasons the S&P 500 is so popular is its diversity. It includes companies from various sectors, such as technology, healthcare, finance, and consumer goods. This diversity makes it less volatile compared to indices that focus on a single sector. Additionally, the S&P 500 is rebalanced periodically to ensure that it accurately reflects the current state of the market.

Why the S&P 500 Matters

- It serves as a benchmark for mutual funds and exchange-traded funds (ETFs).

- It provides insights into the performance of the U.S. economy.

- It is a popular choice for passive investors seeking long-term growth.

History and Significance of the S&P 500

The S&P 500 was introduced in 1957 by Standard & Poor's, a financial services company. Initially, it included 500 leading companies from various industries, and its purpose was to provide a snapshot of the U.S. economy. Over the years, the index has evolved to include some of the most prominent companies in the world, such as Apple, Microsoft, and Amazon.

The significance of the S&P 500 lies in its ability to reflect broader market trends. For example, during economic downturns, the index often declines, while during periods of growth, it tends to rise. This makes it a valuable tool for economists, policymakers, and investors alike.

Key Milestones in the S&P 500's History

- 1957: The S&P 500 is launched with 500 companies.

- 1982: The index surpasses the 100-point mark for the first time.

- 2000: The dot-com bubble leads to significant volatility in the index.

- 2020: The S&P 500 reaches new all-time highs despite the global pandemic.

Components of the S&P 500

The S&P 500 is composed of 500 companies, but not all companies are created equal. The index is weighted by market capitalization, meaning that larger companies have a greater influence on its performance. For example, as of 2023, the top five companies in the S&P 500 by market cap are Apple, Microsoft, Amazon, Alphabet, and Tesla.

Sectors Represented in the S&P 500

- Technology: Companies like Apple and Microsoft dominate this sector.

- Healthcare: Includes pharmaceutical giants like Johnson & Johnson.

- Finance: Banks and financial institutions like JPMorgan Chase.

- Consumer Goods: Companies like Procter & Gamble and Coca-Cola.

FintechZoom's Role in S&P 500 Analysis

FintechZoom has emerged as a leading platform for investors seeking insights into the S&P 500. It provides real-time data, expert analyses, and tools to help investors make informed decisions. By leveraging advanced algorithms and machine learning, FintechZoom offers personalized recommendations and market forecasts.

Read also:Effects Of Floyd Mayweather A Comprehensive Analysis Of His Influence In And Out Of The Ring

Features of FintechZoom

- Real-time stock price updates.

- Expert commentary and analysis.

- Customizable watchlists for tracking the S&P 500.

Investment Strategies for the S&P 500

Investing in the S&P 500 requires a well-thought-out strategy. One popular approach is passive investing, where investors buy index funds or ETFs that track the S&P 500. This strategy is cost-effective and provides exposure to a diversified portfolio of companies.

Active vs. Passive Investing

- Active investing involves selecting individual stocks within the S&P 500.

- Passive investing focuses on tracking the index as a whole.

Risks and Challenges of Investing in the S&P 500

While the S&P 500 is a relatively stable index, it is not without risks. Market volatility, economic downturns, and geopolitical events can all impact its performance. Additionally, the concentration of large-cap companies in the index can lead to overexposure to certain sectors.

How to Mitigate Risks

- Diversify your portfolio beyond the S&P 500.

- Stay informed about market trends and economic indicators.

- Use tools like FintechZoom to monitor your investments.

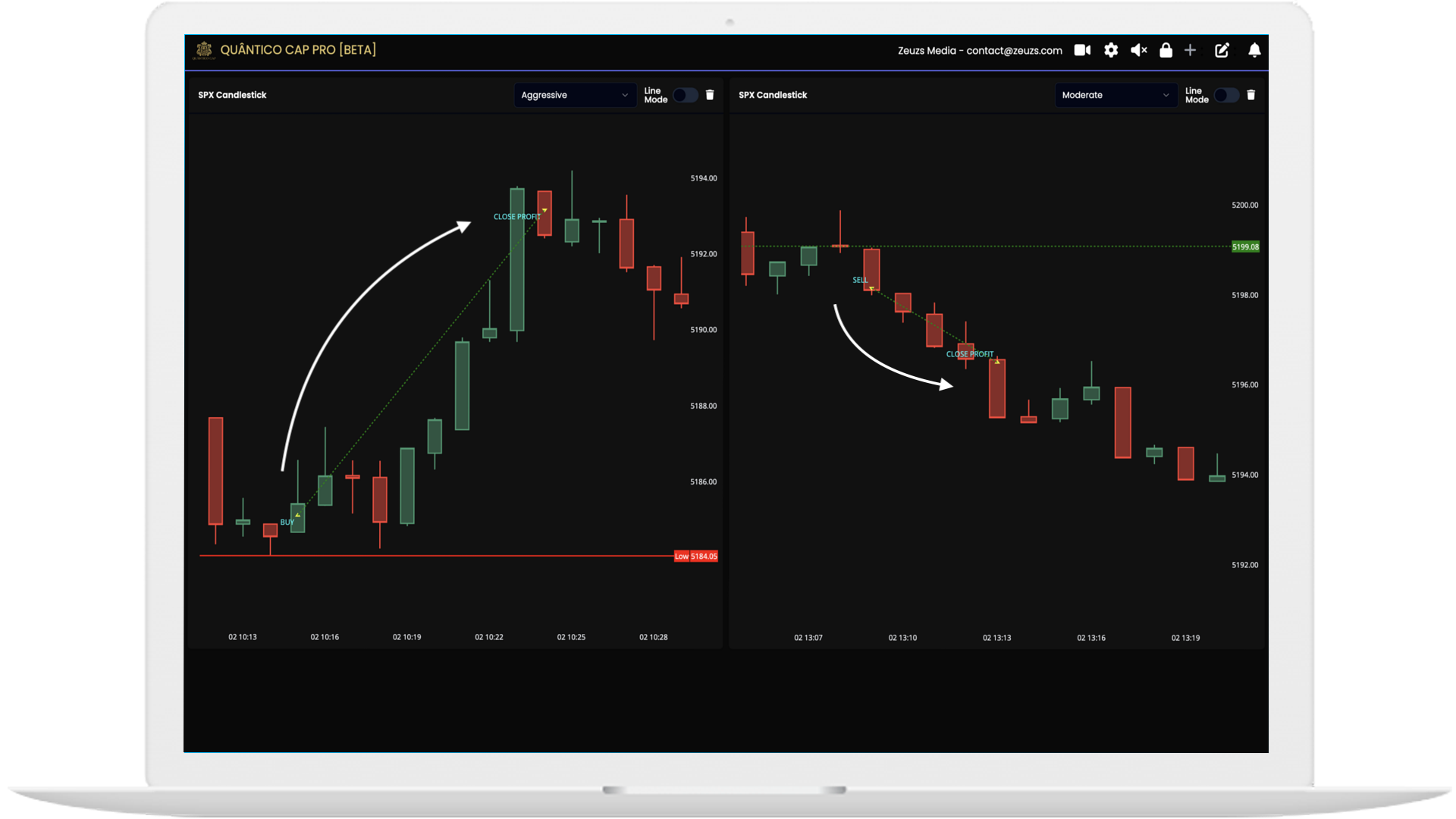

Real-Time Data and Tools on FintechZoom

FintechZoom offers a suite of tools designed to help investors stay ahead of market trends. From real-time stock price updates to expert analyses, the platform provides everything investors need to make informed decisions.

Key Tools on FintechZoom

- Stock screeners for identifying opportunities.

- Customizable alerts for price movements.

- Historical data for backtesting strategies.

Economic Indicators Influencing the S&P 500

The performance of the S&P 500 is influenced by a variety of economic indicators, such as GDP growth, unemployment rates, and interest rates. Understanding these indicators can help investors anticipate market movements and adjust their strategies accordingly.

Important Economic Indicators

- GDP growth rate.

- Unemployment rate.

- Federal Reserve interest rate decisions.

Long-Term Performance of the S&P 500

Over the long term, the S&P 500 has delivered impressive returns. Historically, the index has averaged an annual return of around 10%. This makes it an attractive option for investors seeking long-term growth.

Factors Contributing to Long-Term Growth

- Strong performance of technology companies.

- Resilience during economic downturns.

- Regular rebalancing to reflect market trends.

Conclusion and Call to Action

The S&P 500 is a cornerstone of the U.S. stock market, offering investors a diversified and reliable way to grow their wealth. Platforms like FintechZoom enhance investor knowledge by providing real-time data, expert analyses, and actionable insights. Whether you are a passive investor or an active trader, understanding the S&P 500 is essential for success in the financial markets.

We encourage you to explore the tools and resources available on FintechZoom to enhance your investment strategy. Share your thoughts in the comments below, and don't forget to check out our other articles for more insights into the world of finance.

Tyler, The Creator Mom Name: A Deep Dive Into His Family Background

When Does George O'Malley Die: A Detailed Breakdown Of His Storyline

Anna Torv Husband: Everything You Need To Know About Her Personal Life

Paramount sued for 500 million over 1968 'Romeo & Juliet' nude scene

The Best Nasdaq Indicator and System Master Nasdaq and SP500