TIAA Bank 1-Year CD Rates: A Comprehensive Guide For Savers

Are you looking for a secure way to grow your savings with predictable returns? A 1-year Certificate of Deposit (CD) from TIAA Bank might be the perfect solution for you. TIAA Bank is renowned for offering competitive CD rates, making it an attractive option for individuals seeking stability and growth in their financial portfolios. In this article, we will explore everything you need to know about TIAA Bank’s 1-year CD rates, including how they work, their benefits, and why they might be the right choice for your financial goals.

Choosing the right financial product can significantly impact your savings journey. Certificates of Deposit (CDs) are a popular choice among savers because they provide a fixed interest rate over a specified term, ensuring a predictable return on investment. TIAA Bank, a trusted financial institution with a long history of excellence, offers some of the most competitive 1-year CD rates in the market. Whether you are a seasoned investor or a first-time saver, understanding TIAA Bank’s offerings can help you make informed decisions about your money.

In this comprehensive guide, we will delve into the specifics of TIAA Bank’s 1-year CD rates, how they compare to other financial products, and what you need to consider before opening a CD. By the end of this article, you will have a clear understanding of whether TIAA Bank’s 1-year CD is the right fit for your financial strategy.

Read also:Lucy Heartfilia The Beloved Fairy Tail Mage And Her Magical Journey

Table of Contents

- What is a Certificate of Deposit (CD)?

- Why Choose TIAA Bank for Your CD?

- Current 1-Year CD Rates at TIAA Bank

- Benefits of Investing in a 1-Year CD

- How to Open a 1-Year CD at TIAA Bank

- TIAA Bank CD Rates vs. Other Banks

- Understanding the Risks of CDs

- Tips for Maximizing Your CD Returns

- Frequently Asked Questions About TIAA Bank CDs

- Conclusion: Is a TIAA Bank 1-Year CD Right for You?

What is a Certificate of Deposit (CD)?

A Certificate of Deposit (CD) is a type of savings account offered by banks and credit unions that provides a fixed interest rate over a specified term. Unlike traditional savings accounts, CDs require you to deposit a lump sum of money and agree not to withdraw it until the term ends. In return, you receive a higher interest rate compared to regular savings accounts.

CDs are an excellent choice for individuals who want to grow their savings without exposing their money to market volatility. They are considered low-risk investments because they are insured by the Federal Deposit Insurance Corporation (FDIC) up to $250,000. This makes CDs a popular option for conservative investors or those saving for short-term goals.

How CDs Work

When you open a CD, you choose a term length, which can range from a few months to several years. During this period, your money earns interest at a fixed rate. At the end of the term, known as the maturity date, you can withdraw your initial deposit along with the accrued interest or renew the CD for another term.

Why Choose TIAA Bank for Your CD?

TIAA Bank stands out as a reliable financial institution with a strong reputation for offering competitive CD rates. Here are some reasons why you might consider opening a 1-year CD with TIAA Bank:

- Competitive Rates: TIAA Bank consistently offers some of the highest CD rates in the industry, ensuring that your money grows faster.

- FDIC Insurance: Your deposits are protected by the FDIC, providing peace of mind that your savings are secure.

- No Monthly Fees: Unlike some banks, TIAA Bank does not charge monthly maintenance fees on its CDs.

- Flexible Options: TIAA Bank offers a variety of CD terms, allowing you to choose the one that best fits your financial goals.

Current 1-Year CD Rates at TIAA Bank

As of the latest update, TIAA Bank offers a 1-year CD rate of X% APY (Annual Percentage Yield). This rate is subject to change based on market conditions, so it’s essential to check TIAA Bank’s website or contact their customer service for the most up-to-date information.

Factors Affecting CD Rates

Several factors influence CD rates, including:

Read also:Discover The Enchanting World Of Simons Cat A Timeless Tale Of Humor And Heart

- Federal Reserve Policies: Changes in interest rates by the Federal Reserve can impact CD rates.

- Market Conditions: Economic trends and inflation rates also play a role in determining CD rates.

- Bank Competition: Banks often adjust their rates to remain competitive in the market.

Benefits of Investing in a 1-Year CD

Investing in a 1-year CD offers several advantages, especially for individuals looking for stability and predictable returns:

- Fixed Interest Rates: CDs provide a guaranteed return on your investment, making it easier to plan for the future.

- Low Risk: CDs are one of the safest investment options, as they are insured by the FDIC.

- Short-Term Commitment: A 1-year CD allows you to lock in your money for a short period, providing flexibility for future financial decisions.

How to Open a 1-Year CD at TIAA Bank

Opening a 1-year CD at TIAA Bank is a straightforward process. Follow these steps to get started:

- Visit the TIAA Bank Website: Navigate to the CD section to explore available options.

- Select the 1-Year CD: Choose the 1-year term and review the terms and conditions.

- Fund Your CD: Deposit the minimum required amount to open the CD.

- Confirm Your Details: Provide any necessary personal information to complete the application.

TIAA Bank CD Rates vs. Other Banks

When comparing TIAA Bank’s 1-year CD rates to other banks, it’s essential to consider factors such as interest rates, fees, and terms. Below is a comparison of TIAA Bank’s rates with two other leading banks:

| Bank | 1-Year CD Rate | Minimum Deposit | FDIC Insured |

|---|---|---|---|

| TIAA Bank | X% | $1,000 | Yes |

| Bank A | Y% | $2,500 | Yes |

| Bank B | Z% | $500 | Yes |

Understanding the Risks of CDs

While CDs are considered low-risk investments, they are not entirely risk-free. Here are some potential risks to consider:

- Early Withdrawal Penalties: Withdrawing your money before the maturity date can result in significant penalties.

- Inflation Risk: If inflation outpaces the interest rate on your CD, your purchasing power may decrease over time.

- Opportunity Cost: Locking your money in a CD means you may miss out on higher returns from other investments.

Tips for Maximizing Your CD Returns

To make the most of your 1-year CD investment, consider the following tips:

- Shop Around: Compare rates from multiple banks to ensure you’re getting the best deal.

- Ladder Your CDs: Invest in multiple CDs with different terms to balance liquidity and returns.

- Monitor Rate Changes: Keep an eye on market trends to take advantage of rising rates.

Frequently Asked Questions About TIAA Bank CDs

Q: Are TIAA Bank CDs FDIC-insured?

A: Yes, TIAA Bank CDs are insured by the FDIC up to $250,000.

Q: Can I withdraw my money early from a TIAA Bank CD?

A: Yes, but early withdrawal penalties may apply.

Conclusion: Is a TIAA Bank 1-Year CD Right for You?

TIAA Bank’s 1-year CD rates offer a secure and predictable way to grow your savings. With competitive rates, FDIC insurance, and flexible options, TIAA Bank is an excellent choice for individuals seeking stability in their financial portfolios. By understanding the benefits, risks, and how to maximize your returns, you can make an informed decision about whether a TIAA Bank 1-year CD aligns with your financial goals.

If you’re ready to take the next step, visit TIAA Bank’s website to explore their CD offerings. Don’t forget to share this article with friends and family who might benefit from learning about TIAA Bank’s 1-year CD rates!

Hoco Poco Meaning: Exploring Its Origins, Usage, And Cultural Impact

New Stock Blox Fruits: A Comprehensive Guide To Maximizing Your Gameplay

Muichiro Death: Unraveling The Tragic Fate Of A Demon Slayer Hero

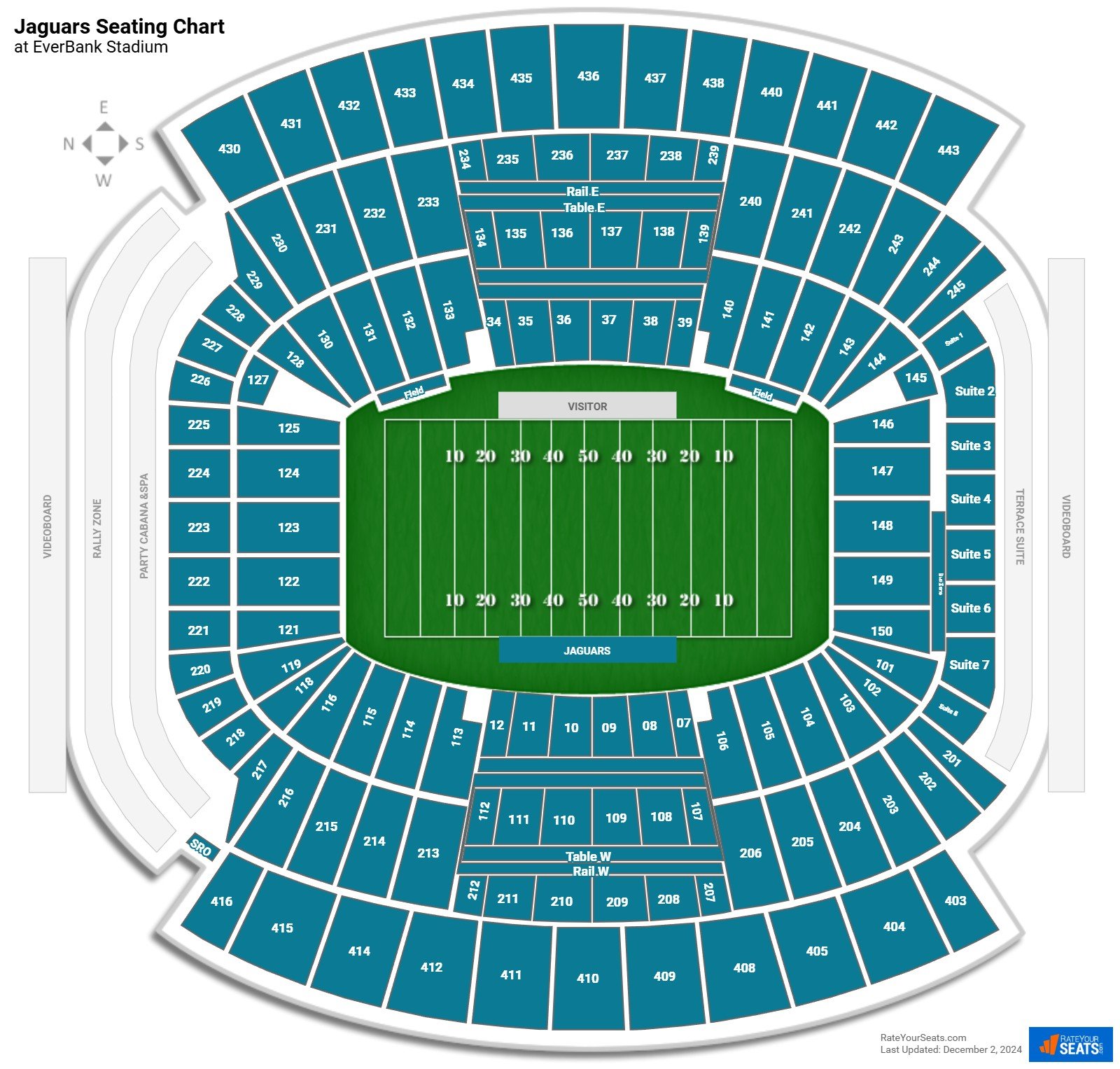

TIAA Bank Field Seating Chart

TIAA Bank CD Rates The Ascent by Motley Fool