TIAA CD Rates: A Comprehensive Guide To Maximizing Your Savings

Are you looking for a secure and reliable way to grow your savings? TIAA CD rates offer a fantastic opportunity for individuals seeking stability and competitive returns on their investments. Certificates of Deposit (CDs) from TIAA are designed to provide peace of mind while ensuring your money grows steadily over time. Whether you're a seasoned investor or just starting your financial journey, understanding TIAA CD rates can help you make informed decisions about your savings.

When it comes to choosing the right financial product, it's essential to consider factors like interest rates, terms, and the institution's reputation. TIAA, a trusted name in the financial industry, has been serving customers for over a century. Their CD offerings are known for competitive rates and a commitment to customer satisfaction. In this article, we will delve into the details of TIAA CD rates, explore their benefits, and provide actionable insights to help you make the most of your savings.

Before diving into the specifics, it's important to note that TIAA CDs are particularly relevant for individuals who prioritize safety and predictability in their investments. Whether you're saving for retirement, a major purchase, or simply building an emergency fund, TIAA CDs can be an excellent addition to your financial portfolio. Let’s explore everything you need to know about TIAA CD rates and how they can benefit you.

Read also:Squidward Tentacles Voice The Iconic Sound Behind The Character

Table of Contents

- What is TIAA and Why Choose Their CDs?

- Understanding TIAA CD Rates

- Types of CDs Offered by TIAA

- Benefits of TIAA CDs

- How to Open a TIAA CD Account

- Key Factors to Consider Before Investing

- Comparing TIAA CD Rates with Other Banks

- Tips for Maximizing Returns on Your CD

- Risks and Limitations of TIAA CDs

- Conclusion and Next Steps

What is TIAA and Why Choose Their CDs?

TIAA, or Teachers Insurance and Annuity Association, is a financial services organization that has been providing investment and retirement services since 1918. Originally established to serve educators, TIAA has expanded its offerings to cater to a wide range of individuals, including professionals, retirees, and institutions. Known for its commitment to financial security and customer-centric approach, TIAA has earned a reputation as a trusted provider of financial products.

One of TIAA’s standout offerings is its Certificates of Deposit (CDs). These financial instruments allow individuals to deposit a fixed amount of money for a predetermined period, earning interest at a guaranteed rate. TIAA CDs are particularly appealing because they combine competitive interest rates with the security of FDIC insurance, ensuring that your investment is protected up to the applicable limits.

Why Choose TIAA CDs?

- Competitive Rates: TIAA CD rates are often higher than those offered by traditional banks, making them an attractive option for savers.

- Security: TIAA CDs are FDIC-insured, providing peace of mind that your money is safe.

- Flexibility: With various terms available, you can choose a CD that aligns with your financial goals.

- Expert Guidance: TIAA’s team of financial advisors can help you tailor your investment strategy to meet your needs.

Understanding TIAA CD Rates

TIAA CD rates are influenced by several factors, including the Federal Reserve’s monetary policy, market conditions, and the term of the CD. Understanding how these rates work is crucial for maximizing your returns and making informed investment decisions.

CD rates are typically expressed as an Annual Percentage Yield (APY), which represents the total amount of interest you will earn over a year, including compounding. TIAA offers a range of CD terms, from short-term options like 6 months to long-term options like 5 years. Generally, longer-term CDs offer higher interest rates, but they also require you to lock in your money for an extended period.

Factors Affecting TIAA CD Rates

- Term Length: Longer terms usually come with higher rates, but they also limit your access to funds.

- Market Conditions: Economic factors, such as inflation and interest rate trends, can impact CD rates.

- Deposit Amount: Some institutions offer tiered rates based on the size of your deposit.

Types of CDs Offered by TIAA

TIAA provides a variety of CD options to cater to different financial needs and goals. Understanding the types of CDs available can help you choose the right product for your situation.

1. Traditional CDs

Traditional CDs are the most common type of certificate of deposit. With this option, you deposit a fixed amount of money for a specific term and earn interest at a guaranteed rate. Early withdrawal penalties may apply if you access your funds before the maturity date.

Read also:Thom Bierdz Husband Who Is He

2. Jumbo CDs

Jumbo CDs are designed for individuals who want to invest larger sums of money. These CDs typically require a minimum deposit of $100,000 or more and often come with higher interest rates than traditional CDs.

3. IRA CDs

IRA CDs combine the benefits of a traditional CD with the tax advantages of an Individual Retirement Account (IRA). These CDs are ideal for individuals looking to grow their retirement savings in a secure and predictable manner.

4. No-Penalty CDs

No-penalty CDs allow you to withdraw your money before the maturity date without incurring a penalty. While these CDs typically offer lower interest rates than traditional CDs, they provide greater flexibility for those who may need access to their funds.

Benefits of TIAA CDs

Investing in TIAA CDs offers several advantages that make them an attractive option for savers and investors alike. Below are some of the key benefits:

1. Guaranteed Returns

TIAA CDs provide a fixed interest rate, ensuring that you know exactly how much your investment will grow over the term. This predictability makes CDs an excellent choice for risk-averse investors.

2. FDIC Insurance

TIAA CDs are backed by the Federal Deposit Insurance Corporation (FDIC), which protects your deposits up to $250,000 per account. This insurance provides an additional layer of security for your investment.

3. Competitive Rates

TIAA is known for offering competitive CD rates compared to traditional banks. This makes their CDs a smart choice for individuals looking to maximize their savings.

4. Flexibility

With a variety of terms and CD types available, TIAA allows you to customize your investment to suit your financial goals and timeline.

How to Open a TIAA CD Account

Opening a TIAA CD account is a straightforward process that can be completed online or through a financial advisor. Below are the steps to get started:

Step 1: Research and Compare Rates

Before opening a CD, it’s essential to compare TIAA CD rates with other financial institutions to ensure you’re getting the best deal. Consider factors like term length, interest rates, and penalties for early withdrawal.

Step 2: Gather Required Information

You’ll need to provide personal information, such as your name, address, Social Security number, and initial deposit amount, to open a CD account.

Step 3: Choose Your CD Type and Term

Select the type of CD and term length that aligns with your financial goals. For example, if you’re saving for a short-term goal, a 12-month CD might be ideal, while a 5-year CD could be better for long-term savings.

Step 4: Fund Your Account

Once you’ve selected your CD, transfer the required deposit amount to fund your account. TIAA typically requires a minimum deposit to open a CD.

Step 5: Monitor Your Investment

After opening your CD, keep track of its performance and maturity date. You’ll have the option to renew the CD or withdraw your funds once it matures.

Key Factors to Consider Before Investing

While TIAA CDs offer numerous benefits, it’s important to consider certain factors before making an investment. These considerations will help you make an informed decision and avoid potential pitfalls.

1. Early Withdrawal Penalties

Most CDs impose penalties for withdrawing funds before the maturity date. These penalties can significantly reduce your returns, so it’s crucial to ensure you won’t need access to your money during the term.

2. Inflation Risk

CDs with fixed interest rates may not keep pace with inflation, especially during periods of high inflation. This could erode the purchasing power of your savings over time.

3. Liquidity Constraints

CDs are less liquid than other investment options, such as savings accounts or money market accounts. If you anticipate needing access to your funds, consider a no-penalty CD or a shorter-term option.

4. Opportunity Cost

By locking your money in a CD, you may miss out on higher returns from other investment opportunities, such as stocks or bonds. Evaluate your risk tolerance and financial goals before committing to a CD.

Comparing TIAA CD Rates with Other Banks

When choosing a CD, it’s essential to compare TIAA CD rates with those offered by other financial institutions. While TIAA is known for its competitive rates, other banks and credit unions may offer better deals depending on market conditions and promotions.

Key Considerations for Comparison

- Interest Rates: Compare APYs across different institutions to ensure you’re getting the best return on your investment.

- Terms and Conditions: Review the terms, including early withdrawal penalties and minimum deposit requirements.

- Reputation: Consider the institution’s reputation and customer reviews to ensure reliability and trustworthiness.

- Additional Benefits: Some banks may offer perks like sign-up bonuses or loyalty rewards for opening a CD.

Tips for Maximizing Returns on Your CD

While TIAA CDs are a low-risk investment, there are strategies you can use to maximize your returns and make the most of your savings.

1. Ladder Your CDs

CD laddering involves investing in multiple CDs with different term lengths. For example, you could open CDs with terms of 1, 2, 3, 4, and 5 years. As each CD matures, you can reinvest the funds into a new 5-year CD, allowing you to take advantage of higher rates while maintaining liquidity.

2. Monitor Market Trends

Keep an eye on interest rate trends and economic conditions. If rates are expected to rise, consider shorter-term CDs to take advantage of future increases. Conversely, if rates are falling, lock in a longer-term CD to secure a higher rate.

3. Take Advantage of Promotions

Some banks and credit unions offer promotional rates for new customers. These promotions can provide an opportunity to earn higher returns on your CD investment.

4. Consider Tax Implications

Interest earned on CDs is subject to federal and state taxes. To minimize your tax burden, consider holding your CDs in tax-advantaged accounts, such as IRAs.

Risks and Limitations of TIAA CDs

While TIAA CDs are a safe and reliable investment option, they are not without risks and limitations. Understanding these factors will help you make an informed decision and manage your expectations.

1. Interest Rate Risk

If interest rates rise after you’ve locked in your CD, you may miss out on higher returns. This risk is particularly relevant for

Hawaiian Hairstyles: Embrace The Aloha Spirit With Timeless Beauty

Unlocking The Best Marriott Benefits: A Comprehensive Guide To Elevating Your Travel Experience

What Is Chomos: A Comprehensive Guide To Understanding The Concept

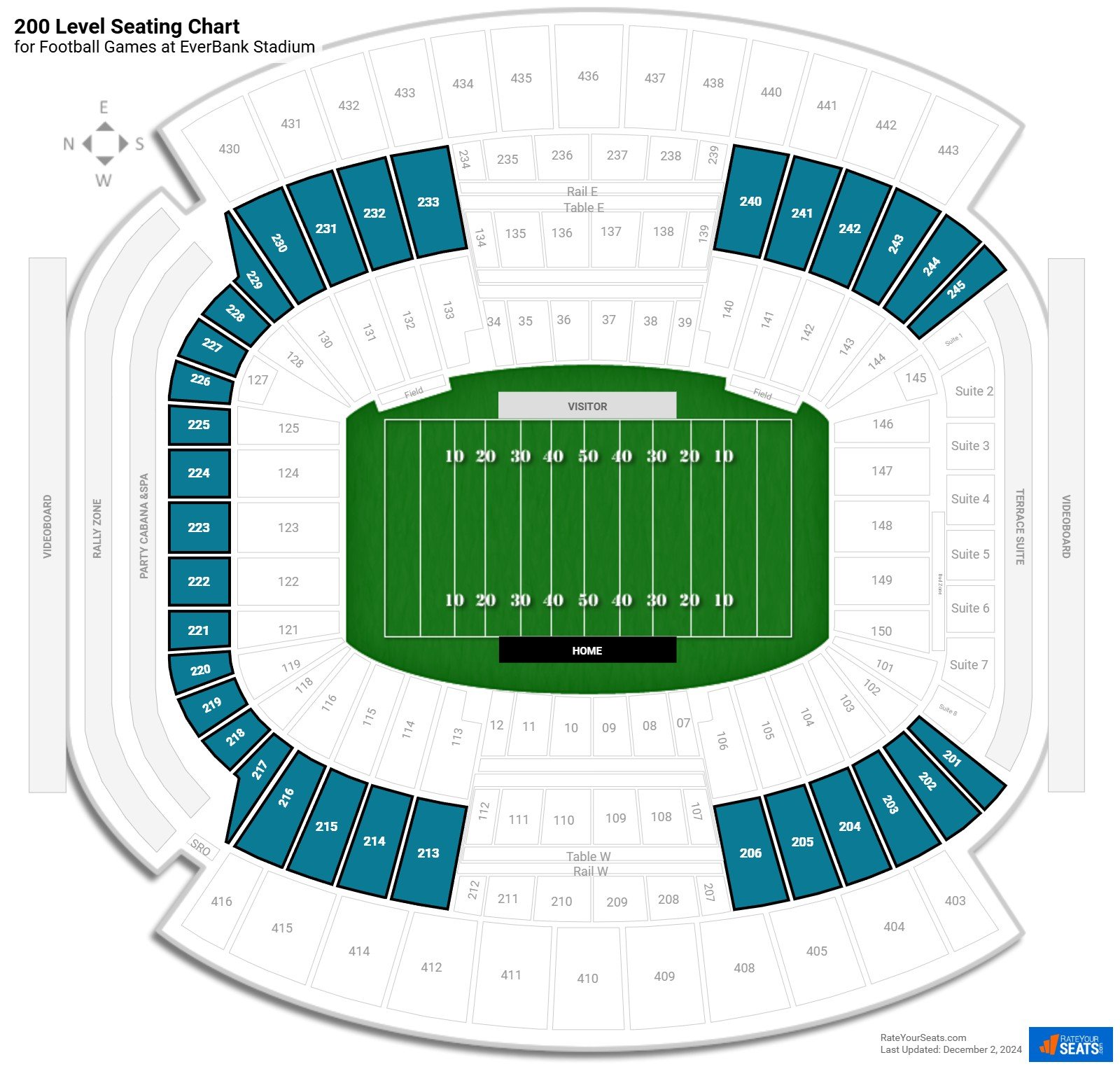

TIAA Bank Field 200 Level

Tiaa Cd Rates 2024 Madel Roselin