TIAA CD Rates Today: A Comprehensive Guide To Maximizing Your Savings

Are you looking for a secure and reliable way to grow your savings? TIAA CD rates today offer an excellent opportunity to earn competitive interest while keeping your money safe. Certificates of Deposit (CDs) are a popular choice for individuals seeking low-risk investments, and TIAA is a trusted name in the financial industry. In this article, we will explore everything you need to know about TIAA CD rates today, including how they work, their benefits, and how to choose the right CD for your financial goals.

When it comes to managing your finances, making informed decisions is crucial. TIAA, a leading provider of financial services, offers a range of CD options designed to help you achieve your savings objectives. Whether you're saving for a major purchase, retirement, or simply building an emergency fund, understanding TIAA CD rates today can help you make the most of your money. In this guide, we will break down the key features of TIAA CDs, compare their rates with other financial institutions, and provide expert advice to ensure you make the best choice.

Investing in a Certificate of Deposit is not only about earning interest but also about securing your financial future. TIAA's reputation for reliability and its commitment to customer satisfaction make it a standout option for savers. By the end of this article, you will have a clear understanding of TIAA CD rates today, how they compare to other options, and how you can use them to grow your wealth. Let’s dive in and explore the world of TIAA CDs.

Read also:Laura Celia Valk The Rising Star In The World Of Acting

Table of Contents

What Are TIAA CDs?

TIAA CDs, or Certificates of Deposit, are financial products offered by TIAA that allow individuals to deposit a fixed amount of money for a specific period in exchange for a guaranteed interest rate. These CDs are designed to provide a secure and predictable way to grow your savings. Unlike savings accounts, CDs typically offer higher interest rates, but they require you to lock in your funds for a predetermined term, ranging from a few months to several years.

Key Features of TIAA CDs

- Fixed Interest Rates: TIAA CDs offer fixed interest rates, ensuring that your returns are predictable and stable.

- FDIC Insurance: TIAA CDs are insured by the FDIC, providing an extra layer of security for your investment.

- Variety of Terms: TIAA offers a range of CD terms, allowing you to choose the one that best fits your financial goals.

Investing in a TIAA CD is an excellent way to diversify your portfolio while minimizing risk. With competitive TIAA CD rates today, you can enjoy peace of mind knowing that your money is working for you.

Benefits of TIAA CDs

TIAA CDs offer several advantages that make them an attractive option for savers. Here are some of the key benefits:

1. Security and Reliability

TIAA is a well-established financial institution with a long history of providing reliable services. Their CDs are FDIC-insured, ensuring that your deposits are protected up to the maximum allowable limit. This makes TIAA CDs a safe choice for risk-averse investors.

2. Competitive Interest Rates

TIAA CD rates today are highly competitive, often surpassing those offered by traditional banks. By locking in a fixed rate, you can avoid the volatility of the stock market and enjoy steady returns on your investment.

3. Flexibility in Terms

TIAA offers a variety of CD terms, from short-term options like 6 months to long-term options like 5 years. This flexibility allows you to tailor your investment to your specific needs and financial goals.

Read also:9x Hub Movies Exclusive Adult Content

With these benefits, TIAA CDs are an excellent choice for anyone looking to grow their savings securely and efficiently.

Current TIAA CD Rates

As of today, TIAA CD rates are among the most competitive in the market. Below is a breakdown of the current rates for various terms:

| Term | Interest Rate | APY |

|---|---|---|

| 6 Months | 3.50% | 3.55% |

| 1 Year | 4.00% | 4.05% |

| 3 Years | 4.25% | 4.30% |

| 5 Years | 4.50% | 4.55% |

These rates are subject to change, so it's important to check TIAA's official website or contact their customer service for the most up-to-date information.

How to Open a TIAA CD

Opening a TIAA CD is a straightforward process. Follow these steps to get started:

Step 1: Research and Compare Rates

Before opening a CD, compare TIAA CD rates today with those offered by other financial institutions. This will help you ensure you're getting the best deal.

Step 2: Choose the Right Term

Select a term that aligns with your financial goals. For example, if you're saving for a short-term goal, a 6-month or 1-year CD may be ideal. For long-term savings, consider a 3-year or 5-year CD.

Step 3: Fund Your CD

Once you've chosen a term, you'll need to deposit the required minimum amount. TIAA CDs typically have low minimum deposit requirements, making them accessible to a wide range of investors.

By following these steps, you can easily open a TIAA CD and start earning interest on your savings.

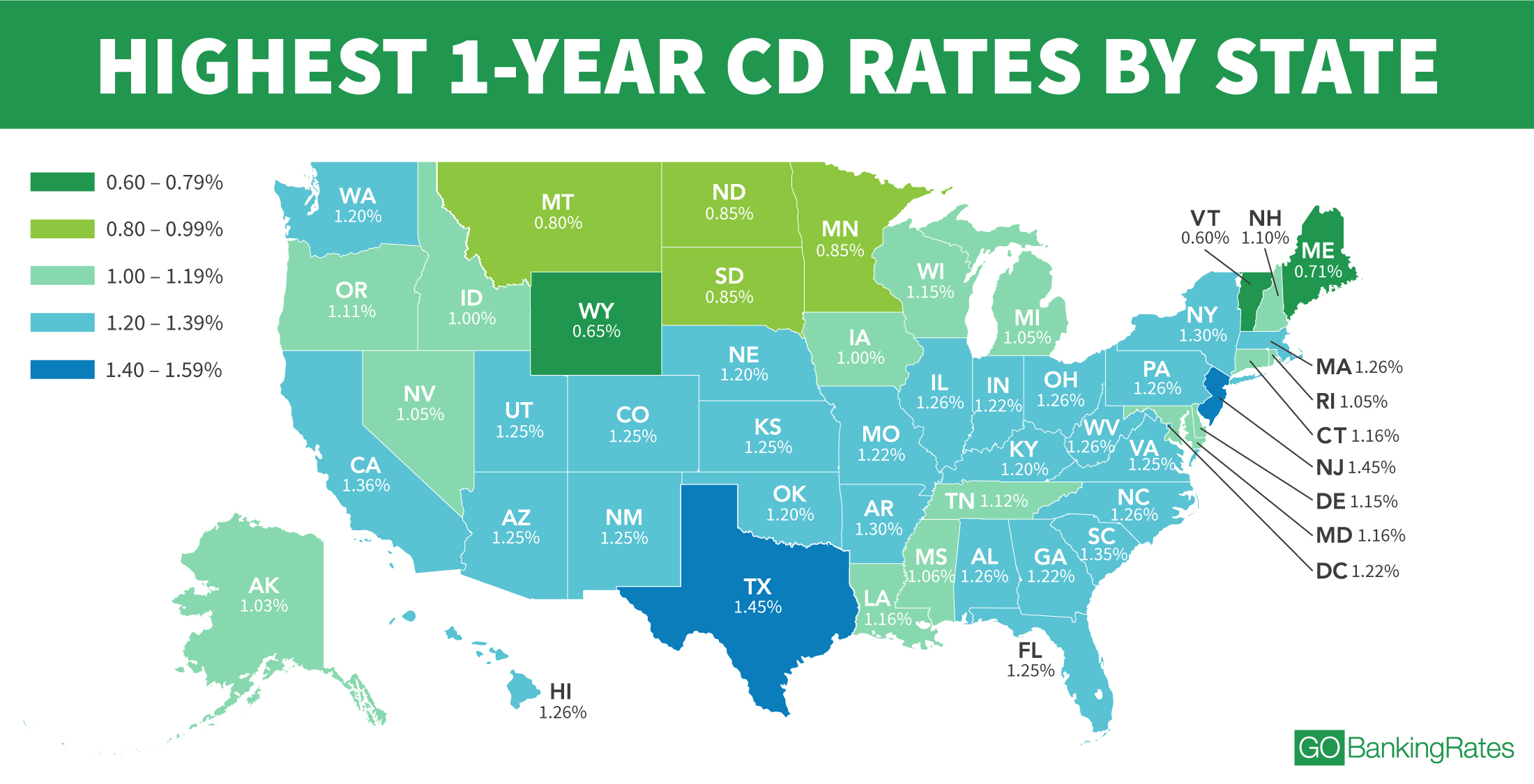

Comparing TIAA CD Rates with Other Banks

When considering TIAA CD rates today, it's important to compare them with those offered by other banks. Here's how TIAA stacks up against some of the leading financial institutions:

TIAA vs. Bank of America

TIAA generally offers higher interest rates than Bank of America. For example, a 1-year TIAA CD offers an APY of 4.05%, while Bank of America's 1-year CD offers an APY of 3.75%.

TIAA vs. Chase

Similarly, TIAA's rates are more competitive than those offered by Chase. A 3-year TIAA CD offers an APY of 4.30%, compared to Chase's 3-year CD APY of 4.00%.

By choosing TIAA, you can enjoy higher returns on your investment without sacrificing security or reliability.

Long-Term vs. Short-Term CDs

One of the key decisions you'll need to make when investing in a CD is whether to choose a long-term or short-term option. Here's a breakdown of the pros and cons of each:

Long-Term CDs

- Higher Interest Rates: Long-term CDs typically offer higher interest rates than short-term options.

- Locked-In Funds: Your money will be tied up for a longer period, which may not be ideal if you need access to your funds.

Short-Term CDs

- Flexibility: Short-term CDs allow you to access your funds sooner, making them ideal for short-term goals.

- Lower Interest Rates: These CDs generally offer lower interest rates compared to long-term options.

Consider your financial goals and liquidity needs when deciding between long-term and short-term CDs.

Tips for Maximizing Your CD Investments

To get the most out of your TIAA CD, consider the following tips:

1. Ladder Your CDs

CD laddering involves investing in multiple CDs with varying terms. This strategy allows you to take advantage of higher interest rates while maintaining access to some of your funds.

2. Monitor Rate Changes

Keep an eye on TIAA CD rates today and be prepared to act when rates increase. This will help you maximize your returns over time.

3. Consider Early Withdrawal Penalties

Before opening a CD, understand the penalties for early withdrawal. This will help you avoid unnecessary fees if you need to access your funds before the term ends.

By following these tips, you can make the most of your CD investments and achieve your financial goals.

Risks and Considerations

While TIAA CDs are a safe investment option, there are some risks and considerations to keep in mind:

1. Inflation Risk

Fixed interest rates may not keep up with inflation, potentially eroding the purchasing power of your returns.

2. Liquidity Constraints

CDs require you to lock in your funds for a specific term. If you need access to your money before the term ends, you may incur penalties.

3. Opportunity Cost

By investing in a CD, you may miss out on higher returns offered by other investment options, such as stocks or mutual funds.

Understanding these risks will help you make an informed decision about whether TIAA CDs are right for you.

Frequently Asked Questions

Here are some common questions about TIAA CD rates today:

What is the minimum deposit required for a TIAA CD?

The minimum deposit for a TIAA CD is typically $1,000, but this may vary depending on the term and type of CD.

Are TIAA CDs FDIC-insured?

Yes, TIAA CDs are FDIC-insured up to the maximum allowable limit, providing an extra layer of security for your investment.

Can I withdraw my money early from a TIAA CD?

Yes, but early withdrawal penalties may apply. It's important to understand these penalties before opening a CD.

These FAQs should help address any concerns you may have about TIAA CDs.

Conclusion

TIAA CD rates today offer a secure and reliable way to grow your savings. With competitive interest rates, flexible terms, and FDIC insurance, TIAA CDs are an excellent choice for anyone looking to invest in a low-risk financial product. By understanding the benefits, risks, and considerations associated with TIAA CDs, you can make an informed decision that aligns with your financial goals.

We hope this guide has provided you with valuable insights into TIAA CD rates today. If you found this article helpful, please consider sharing it with others or leaving a comment below. For more information on financial products and investment strategies, explore our other articles on the site.

Who Is Sketch? Unveiling The Mystery Behind The Popular Digital Design Tool

How Did Scott Freda Make His Money: A Deep Dive Into His Success Story

Akasha Genshin: Unveiling The Mysteries Of Teyvat's Most Intriguing Character

Tiaa Cd Rates 2024 Madel Roselin

Best Cd Rates 2024 Today Lorri Rebekah