TIAA Bank 1 Year CD: A Comprehensive Guide To Secure And Profitable Investments

Are you looking for a secure way to grow your savings over the next year? TIAA Bank’s 1-Year Certificate of Deposit (CD) might be the perfect solution for you. With competitive interest rates and the assurance of FDIC insurance, TIAA Bank offers a reliable option for individuals seeking stability and growth. Whether you're a seasoned investor or someone just starting to explore financial products, understanding the benefits and features of a 1-Year CD can help you make informed decisions about your money.

Certificates of Deposit, commonly referred to as CDs, are time-bound deposit accounts that provide a fixed interest rate over a specified term. TIAA Bank, a trusted financial institution, has gained a reputation for offering competitive CD rates while ensuring the safety of your funds. In today’s uncertain economic climate, the appeal of a 1-Year CD lies in its simplicity and predictability, making it an attractive option for both short-term financial goals and long-term savings strategies.

In this article, we will explore everything you need to know about TIAA Bank’s 1-Year CD, including its features, benefits, and how it compares to other investment options. By the end of this guide, you will have a clear understanding of whether this product aligns with your financial goals and how you can maximize its potential. Let’s dive in and uncover the details of this secure and profitable investment opportunity.

Read also:Kayja Rose Unveiling The Rising Star And Her Impact On Modern Entertainment

Table of Contents

- What is a Certificate of Deposit (CD)?

- An Overview of TIAA Bank

- Key Features of TIAA Bank’s 1-Year CD

- Benefits of Investing in a 1-Year CD

- How TIAA Bank’s CD Compares to Other CDs

- Eligibility and Requirements for Opening a CD

- Risks and Considerations to Keep in Mind

- How to Open a TIAA Bank 1-Year CD

- Tips for Maximizing Your CD Investment

- Conclusion and Call to Action

What is a Certificate of Deposit (CD)?

A Certificate of Deposit, or CD, is a type of savings account offered by banks and credit unions. It allows individuals to deposit a fixed amount of money for a predetermined period, known as the term, in exchange for a fixed interest rate. CDs are popular among investors because they offer higher interest rates compared to traditional savings accounts, while still providing the security of FDIC insurance.

How CDs Work

When you open a CD, you agree to leave your money in the account for the specified term, which can range from a few months to several years. In return, the bank pays you interest at regular intervals. Once the term ends, also known as the maturity date, you can withdraw your initial deposit along with the accrued interest. However, withdrawing funds before the maturity date typically incurs a penalty.

Why Choose a CD?

- Predictable Returns: CDs offer fixed interest rates, ensuring you know exactly how much you'll earn over the term.

- Low Risk: CDs are insured by the FDIC, making them one of the safest investment options available.

- Flexibility: With various terms available, you can choose a CD that aligns with your financial goals and timeline.

An Overview of TIAA Bank

TIAA Bank, formerly known as EverBank, is a division of TIAA, a leading financial services organization. Established in 1909, TIAA has a long history of providing financial solutions to individuals, businesses, and institutions. TIAA Bank specializes in offering a wide range of banking products, including savings accounts, checking accounts, and CDs, with a focus on competitive rates and customer satisfaction.

TIAA Bank’s Reputation

TIAA Bank is known for its commitment to financial stability and transparency. As a member of the FDIC, it ensures that all deposits, including CDs, are insured up to $250,000 per depositor. This level of security, combined with its competitive interest rates, makes TIAA Bank a trusted choice for investors seeking reliable financial products.

Why Choose TIAA Bank for Your CD?

- Competitive Rates: TIAA Bank consistently offers some of the highest CD rates in the market.

- Customer Support: Their dedicated support team is available to assist with any questions or concerns.

- Online Accessibility: TIAA Bank provides a user-friendly online platform for managing your accounts.

Key Features of TIAA Bank’s 1-Year CD

TIAA Bank’s 1-Year CD is designed to provide a balance of security, growth, and flexibility. Below are the key features that make it stand out:

Competitive Interest Rates

TIAA Bank offers one of the highest annual percentage yields (APYs) for 1-Year CDs. This ensures that your money grows significantly over the term, outpacing inflation and traditional savings accounts.

Read also:Ira Khan Birthday Date Everything You Need To Know About The Rising Star

FDIC Insurance

All TIAA Bank CDs are fully insured by the FDIC, providing peace of mind that your investment is protected up to $250,000.

Flexible Funding Options

You can fund your CD through a variety of methods, including transfers from an existing bank account or direct deposits.

No Monthly Fees

TIAA Bank does not charge monthly maintenance fees for its CDs, allowing you to maximize your returns without worrying about hidden costs.

Benefits of Investing in a 1-Year CD

Investing in a 1-Year CD from TIAA Bank offers numerous advantages, especially for individuals looking for a secure and predictable way to grow their savings. Here are some of the key benefits:

Higher Returns Compared to Savings Accounts

While traditional savings accounts offer low interest rates, TIAA Bank’s 1-Year CD provides significantly higher returns, making it an excellent choice for short-term financial goals.

Guaranteed Growth

With a fixed interest rate, you can be confident that your investment will grow as expected, without being affected by market fluctuations.

Short-Term Commitment

A 1-Year CD is ideal for those who want to invest their money without locking it away for an extended period. The short term allows you to access your funds relatively quickly while still benefiting from higher interest rates.

How TIAA Bank’s CD Compares to Other CDs

When choosing a CD, it’s essential to compare the features and benefits of different banks. Below is a comparison of TIAA Bank’s 1-Year CD with other popular CDs in the market:

Interest Rates

TIAA Bank consistently ranks among the top banks for CD rates. While some smaller banks may offer slightly higher rates, they often lack the reputation and security of TIAA Bank.

Terms and Conditions

Unlike some banks that impose strict penalties for early withdrawals, TIAA Bank offers relatively lenient terms, making it easier to manage your funds if unexpected needs arise.

Customer Support

TIAA Bank’s customer service is widely praised for its responsiveness and professionalism, setting it apart from competitors that may have less reliable support systems.

Eligibility and Requirements for Opening a CD

Opening a TIAA Bank 1-Year CD is a straightforward process, but there are a few requirements and eligibility criteria to keep in mind:

Minimum Deposit

TIAA Bank requires a minimum deposit of $1,000 to open a 1-Year CD. This is relatively affordable compared to other banks, which may require higher initial investments.

Age and Residency Requirements

You must be at least 18 years old and a U.S. resident to open a CD with TIAA Bank. Non-residents may need to explore other banking options.

Identification and Documentation

You will need to provide valid identification, such as a driver’s license or passport, and proof of address to verify your identity.

Risks and Considerations to Keep in Mind

While TIAA Bank’s 1-Year CD is a low-risk investment, there are still a few factors to consider before committing your funds:

Early Withdrawal Penalties

Withdrawing funds before the maturity date can result in penalties, which may reduce your overall returns. It’s crucial to ensure that you won’t need access to the money during the term.

Inflation Risk

Although CDs offer fixed interest rates, inflation can erode the purchasing power of your returns over time. This is especially relevant for longer-term CDs.

Limited Liquidity

Unlike savings accounts, CDs lock your money for the specified term, limiting your ability to use the funds for other investments or emergencies.

How to Open a TIAA Bank 1-Year CD

Opening a TIAA Bank 1-Year CD is a simple and straightforward process. Follow these steps to get started:

Step 1: Research and Compare

Before committing, compare TIAA Bank’s CD rates with other banks to ensure you’re getting the best deal.

Step 2: Gather Required Documents

Prepare your identification documents and proof of address to streamline the application process.

Step 3: Fund Your Account

Decide how much you want to invest and transfer the funds from your existing bank account or make a direct deposit.

Step 4: Review Terms and Conditions

Carefully read the terms and conditions, including the interest rate, maturity date, and early withdrawal penalties.

Tips for Maximizing Your CD Investment

To get the most out of your TIAA Bank 1-Year CD, consider the following tips:

Ladder Your CDs

Instead of investing all your money in a single CD, consider creating a CD ladder by spreading your funds across multiple CDs with varying terms. This strategy allows you to benefit from higher rates while maintaining some liquidity.

Reinvest Your Earnings

At the end of the term, reinvest your principal and interest into a new CD to continue growing your savings.

Monitor Market Trends

Keep an eye on interest rate trends to determine the best time to open or renew your CD.

Conclusion and Call to Action

TIAA Bank’s 1-Year CD offers a secure and profitable way to grow your savings over the next year. With competitive interest rates, FDIC insurance, and flexible funding options, it’s an excellent choice for both novice and experienced investors. By understanding the features, benefits, and considerations of this product, you can make informed decisions that align with your financial goals.

If you’re ready to take the next step, visit TIAA Bank’s website to explore their CD offerings and open an account today. Don’t forget to share this article with friends and family who may also benefit from learning about secure investment options. For more financial tips and guides, check out our other articles on investment strategies and banking products.

The Weeknd Net Worth: A Deep Dive Into The R&B Superstar's Financial Empire

Raspberry Pi Remote Access Over Internet SSH Not Working: A Comprehensive Guide

The Weeknd Net Worth: A Comprehensive Look At His Wealth, Career, And Influence

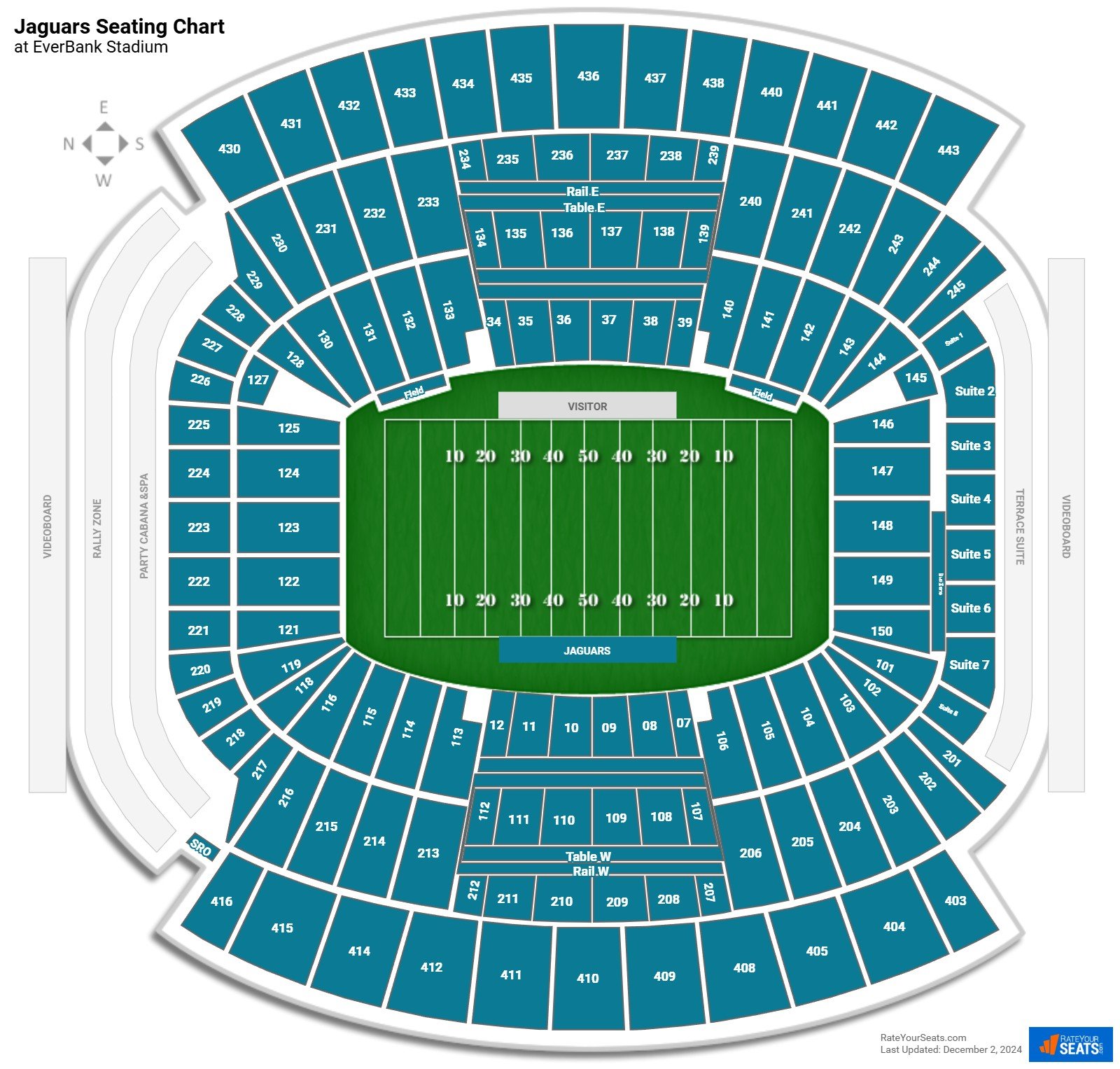

TIAA Bank Field Seating Chart

TIAA Bank CD Rates The Ascent by Motley Fool