Understanding CD Rates At TIAA Bank: A Comprehensive Guide

When it comes to securing your financial future, Certificates of Deposit (CDs) are one of the safest and most reliable investment options available. TIAA Bank, a trusted financial institution, offers competitive CD rates that can help you grow your savings effectively. In this article, we will explore everything you need to know about TIAA Bank's CD rates, from how they work to why they are an excellent choice for your investment portfolio.

CDs are a popular choice for individuals looking for low-risk investments with predictable returns. TIAA Bank stands out in this space due to its reputation for offering competitive CD rates and flexible terms. Whether you're a seasoned investor or just starting, understanding the nuances of CD rates at TIAA Bank can help you make informed financial decisions.

In this comprehensive guide, we will break down the key aspects of TIAA Bank's CD offerings, including their rates, terms, benefits, and how they compare to other financial institutions. By the end of this article, you'll have all the information you need to determine if TIAA Bank's CDs are the right choice for your financial goals.

Read also:Understanding Trs Advanced Spray A Comprehensive Guide For Optimal Use

Table of Contents

- What Are Certificates of Deposit (CDs)?

- An Overview of TIAA Bank

- Understanding CD Rates at TIAA Bank

- Benefits of Choosing TIAA Bank's CDs

- How TIAA Bank's CD Rates Compare to Competitors

- Types of CDs Offered by TIAA Bank

- Eligibility and Requirements for Opening a CD

- Risks and Considerations When Investing in CDs

- Tips for Maximizing Returns on Your CD Investments

- Conclusion: Why TIAA Bank's CDs Are Worth Considering

What Are Certificates of Deposit (CDs)?

Certificates of Deposit (CDs) are time-bound savings accounts offered by banks and credit unions. When you open a CD, you agree to deposit a fixed amount of money for a specific period, known as the term. In return, the bank pays you interest at a predetermined rate. CDs are popular because they offer higher interest rates than traditional savings accounts while being low-risk investments.

Key Features of CDs

- Fixed Interest Rates: CD rates are locked in for the duration of the term, ensuring predictable returns.

- Term Lengths: Terms can range from a few months to several years, depending on the bank and your preferences.

- Early Withdrawal Penalties: Withdrawing funds before the term ends typically incurs a penalty.

- Federal Insurance: CDs at FDIC-insured banks like TIAA Bank are protected up to $250,000.

Why Choose CDs for Your Savings?

CDs are an excellent choice for individuals who want to grow their savings without exposing themselves to the volatility of the stock market. They provide a guaranteed return on investment, making them ideal for short-term financial goals or as part of a diversified investment strategy.

An Overview of TIAA Bank

TIAA Bank is a well-established financial institution with a long history of providing reliable banking services. Originally founded in 1918 as the Teachers Insurance and Annuity Association, TIAA Bank has evolved into a trusted name in the financial industry. The bank is known for its competitive CD rates, excellent customer service, and commitment to helping individuals achieve their financial goals.

TIAA Bank's Reputation

TIAA Bank has earned a reputation for being a trustworthy and authoritative financial institution. It is a member of the FDIC, ensuring that your deposits are safe and secure. The bank's expertise in offering financial products like CDs has made it a go-to choice for individuals seeking stability and growth in their savings.

Why TIAA Bank Stands Out

- Competitive CD Rates: TIAA Bank consistently offers some of the highest CD rates in the market.

- Flexible Terms: Whether you're looking for short-term or long-term CDs, TIAA Bank has options to suit your needs.

- Customer Support: TIAA Bank provides exceptional customer service, ensuring that your questions and concerns are addressed promptly.

Understanding CD Rates at TIAA Bank

CD rates at TIAA Bank are influenced by several factors, including the term length, the amount deposited, and current market conditions. The bank offers competitive rates that are often higher than the national average, making it an attractive option for savers.

How CD Rates Work at TIAA Bank

When you open a CD at TIAA Bank, you lock in a specific interest rate for the duration of the term. The longer the term, the higher the interest rate typically is. For example, a 5-year CD will generally offer a higher rate than a 1-year CD. This structure incentivizes individuals to commit their funds for longer periods.

Read also:Vijay Varma The Actors Journey

Current CD Rates at TIAA Bank

- 1-Year CD: 4.50% APY

- 3-Year CD: 4.75% APY

- 5-Year CD: 5.00% APY

Note: These rates are subject to change based on market conditions and the bank's policies.

Factors That Influence CD Rates

- Federal Reserve Policies: Changes in interest rates by the Federal Reserve can impact CD rates.

- Market Demand: High demand for CDs can lead to more competitive rates.

- Bank Competition: TIAA Bank adjusts its rates to remain competitive in the market.

Benefits of Choosing TIAA Bank's CDs

Investing in CDs at TIAA Bank comes with numerous advantages that make them an appealing option for savers and investors alike.

Higher Returns Compared to Savings Accounts

CDs typically offer higher interest rates than traditional savings accounts, allowing your money to grow more effectively over time. TIAA Bank's competitive rates ensure that you maximize your returns.

Safety and Security

As an FDIC-insured institution, TIAA Bank guarantees the safety of your deposits up to $250,000. This protection provides peace of mind, knowing that your investment is secure.

Predictable Earnings

With fixed interest rates, CDs provide a predictable and reliable source of income. This makes them ideal for individuals planning for future expenses, such as a down payment on a home or a child's education.

How TIAA Bank's CD Rates Compare to Competitors

When evaluating CD rates, it's essential to compare them with those offered by other banks and credit unions. TIAA Bank consistently ranks among the top institutions for its competitive rates and favorable terms.

Comparison Table: TIAA Bank vs. Competitors

| Bank | 1-Year CD Rate | 3-Year CD Rate | 5-Year CD Rate |

|---|---|---|---|

| TIAA Bank | 4.50% APY | 4.75% APY | 5.00% APY |

| Bank of America | 3.75% APY | 4.00% APY | 4.25% APY |

| Chase Bank | 3.50% APY | 3.85% APY | 4.10% APY |

As shown in the table above, TIAA Bank offers significantly higher CD rates compared to major competitors like Bank of America and Chase Bank. This makes TIAA Bank a standout choice for individuals seeking the best returns on their investments.

Types of CDs Offered by TIAA Bank

TIAA Bank provides a variety of CD options to cater to different investor needs. Understanding the types of CDs available can help you choose the best option for your financial goals.

Fixed-Rate CDs

Fixed-rate CDs are the most common type of CD offered by TIAA Bank. These CDs lock in a specific interest rate for the entire term, ensuring consistent returns regardless of market fluctuations.

Variable-Rate CDs

Variable-rate CDs have interest rates that can change during the term based on market conditions. While these CDs carry more risk, they can offer higher returns if interest rates rise.

Eligibility and Requirements for Opening a CD

Opening a CD at TIAA Bank is a straightforward process, but there are specific eligibility requirements and steps you need to follow.

Eligibility Criteria

- Minimum Deposit: TIAA Bank typically requires a minimum deposit of $1,000 to open a CD.

- Age Requirement: You must be at least 18 years old to open a CD.

- U.S. Citizenship or Residency: Most CDs are available to U.S. citizens and residents.

Steps to Open a CD

- Visit TIAA Bank's website and navigate to the CD section.

- Select the type of CD and term length that suits your needs.

- Provide the required personal and financial information.

- Fund your CD with the minimum deposit amount.

Risks and Considerations When Investing in CDs

While CDs are considered low-risk investments, there are still some factors to consider before committing your funds.

Early Withdrawal Penalties

Withdrawing funds from a CD before the term ends can result in significant penalties. These penalties often include a portion of the interest earned or even a reduction in the principal amount.

Opportunity Cost

By locking your money in a CD, you may miss out on higher returns from other investment opportunities, such as stocks or mutual funds.

Inflation Risk

If the interest rate on your CD is lower than the inflation rate, your purchasing power may decrease over time.

Tips for Maximizing Returns on Your CD Investments

To make the most of your CD investments, consider the following tips:

- Ladder Your CDs: Invest in multiple CDs with varying term lengths to balance liquidity and returns.

- Monitor Market Trends: Keep an eye on interest rate changes to time your CD investments effectively.

- Reinvest Your Earnings: When your CD matures, reinvest the funds into a new CD to continue earning interest.

Conclusion: Why TIAA Bank's CDs Are Worth Considering

TIAA Bank's CDs offer a compelling combination of competitive rates, flexibility, and security, making them an excellent choice for individuals looking to grow their savings. Whether you're a seasoned investor or a beginner, TIAA Bank's CD offerings can help you achieve your financial goals while minimizing risk.

If you're ready to take the

Silver Elite: Unlocking The Secrets To Success And Recognition

How To Insert A Tampon: A Comprehensive Guide For Comfort And Confidence

Hila Klein IDF: A Comprehensive Insight Into Her Military Journey And Contributions

TIAA Bank CD Rates The Ascent by Motley Fool

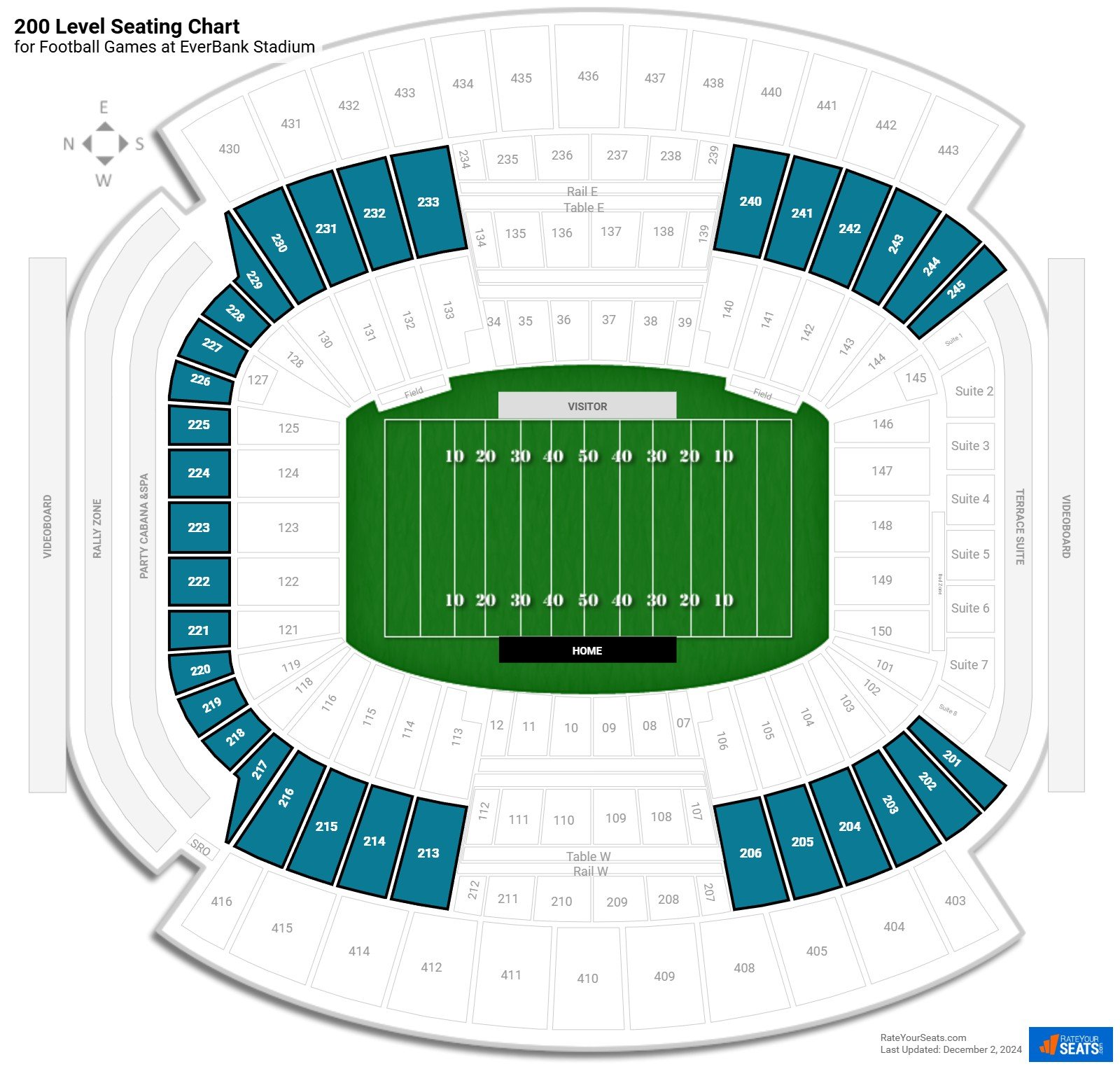

TIAA Bank Field 200 Level