Colt 90 Day Finance: A Comprehensive Guide To Managing Your Finances Effectively

Are you looking for a reliable and flexible financing option to manage your expenses over a 90-day period? Colt 90 Day Finance might be the perfect solution for you. This innovative financial tool is designed to help individuals and businesses manage their cash flow efficiently without the stress of long-term commitments. Whether you're planning a major purchase, covering unexpected expenses, or simply want to optimize your budget, Colt 90 Day Finance offers a tailored approach to meet your needs.

With the increasing demand for short-term financing solutions, Colt 90 Day Finance has gained popularity due to its simplicity, transparency, and customer-centric approach. In this article, we will explore everything you need to know about Colt 90 Day Finance, including how it works, its benefits, eligibility criteria, and tips to make the most of this financial tool. By the end of this guide, you'll have a clear understanding of whether Colt 90 Day Finance is the right choice for your financial goals.

Short-term financing options like Colt 90 Day Finance are becoming increasingly relevant in today's fast-paced world. Whether you're an individual managing personal expenses or a business owner looking to streamline operations, understanding the ins and outs of this financial product can help you make informed decisions. Let's dive deeper into the details and explore how Colt 90 Day Finance can transform your financial strategy.

Read also:Fantana Body The Ultimate Guide To Achieving A Healthy And Sculpted Physique

Table of Contents

- What is Colt 90 Day Finance?

- How Does Colt 90 Day Finance Work?

- Benefits of Colt 90 Day Finance

- Eligibility and Application Process

- Costs and Fees Associated with Colt 90 Day Finance

- Tips for Using Colt 90 Day Finance Effectively

- Comparison with Other Financing Options

- Customer Reviews and Testimonials

- Common Misconceptions About Colt 90 Day Finance

- Conclusion

What is Colt 90 Day Finance?

Colt 90 Day Finance is a short-term financing solution designed to provide individuals and businesses with the flexibility to manage their expenses over a 90-day period. Unlike traditional loans, which often come with long repayment terms and strict conditions, Colt 90 Day Finance offers a more adaptable and customer-friendly approach. This financial product is ideal for those who need quick access to funds without the burden of long-term debt.

One of the key features of Colt 90 Day Finance is its simplicity. The application process is straightforward, and approvals are typically quick, making it an attractive option for those who need immediate financial assistance. Whether you're looking to cover personal expenses, invest in a business opportunity, or manage unexpected costs, Colt 90 Day Finance provides a practical solution.

Colt 90 Day Finance is particularly beneficial for businesses that experience seasonal fluctuations in cash flow. By providing a short-term funding option, it allows businesses to maintain operational stability during lean periods. Additionally, individuals can use this financial tool to manage large purchases, medical expenses, or other short-term financial needs without compromising their long-term financial health.

How Does Colt 90 Day Finance Work?

Understanding how Colt 90 Day Finance works is essential to making the most of this financial tool. The process begins with an application, which can typically be completed online or through a financial institution offering this service. The application requires basic personal and financial information, such as income details, employment status, and the purpose of the loan.

Once the application is submitted, the lender evaluates the applicant's financial profile to determine eligibility. Approval times are generally fast, often within a few hours to a couple of days, depending on the lender. Upon approval, the funds are disbursed directly to the borrower's account, providing immediate access to the required amount.

Repayment terms for Colt 90 Day Finance are structured to align with the borrower's financial capabilities. Typically, the repayment period is divided into three monthly installments, with the first payment due 30 days after the disbursement of funds. This structure allows borrowers to manage their cash flow effectively while ensuring timely repayment.

Read also:Noah Bridges Net Worth A Comprehensive Guide To His Earnings And Career

Eligibility and Application Process

To qualify for Colt 90 Day Finance, applicants must meet certain eligibility criteria. These criteria may vary slightly depending on the lender but generally include factors such as age, income level, credit score, and employment status. Most lenders require applicants to be at least 18 years old and have a stable source of income.

The application process is designed to be user-friendly and efficient. Applicants are required to provide documentation such as proof of identity, income statements, and bank account details. Some lenders may also conduct a soft credit check to assess the applicant's creditworthiness. Once all the necessary information is submitted, the lender reviews the application and communicates the decision promptly.

Benefits of Colt 90 Day Finance

Colt 90 Day Finance offers several advantages that make it an attractive option for both individuals and businesses. One of the primary benefits is its flexibility. Unlike traditional loans, which often come with rigid repayment schedules, Colt 90 Day Finance allows borrowers to tailor their repayment plan to suit their financial situation.

Another significant advantage is the speed of approval and disbursement. In many cases, funds are available within 24 to 48 hours of application approval, making it an ideal solution for urgent financial needs. Additionally, the short-term nature of the loan reduces the overall interest burden, making it a cost-effective option for those who need temporary financial support.

Colt 90 Day Finance also promotes financial discipline by encouraging borrowers to repay the loan within a short period. This helps individuals and businesses avoid the pitfalls of long-term debt and maintain a healthy credit score. Furthermore, the transparency of the terms and conditions ensures that borrowers are fully aware of their financial obligations, fostering trust and confidence in the lending process.

Costs and Fees Associated with Colt 90 Day Finance

While Colt 90 Day Finance offers numerous benefits, it's important to understand the associated costs and fees. The primary cost is the interest rate, which is typically higher than traditional loans due to the short-term nature of the financing. However, the total interest paid is often lower because the repayment period is shorter.

In addition to interest, borrowers may incur other fees, such as application fees, processing fees, and late payment penalties. It's crucial to review the terms and conditions carefully to understand all potential costs. Some lenders may offer promotional rates or discounts for early repayment, so it's worth exploring these options to minimize expenses.

Transparent communication about costs and fees is a hallmark of reputable lenders offering Colt 90 Day Finance. Borrowers should always ask for a detailed breakdown of all charges before committing to the loan. This ensures there are no hidden surprises and allows for accurate financial planning.

Tips for Using Colt 90 Day Finance Effectively

To maximize the benefits of Colt 90 Day Finance, it's essential to use it wisely. One of the most important tips is to borrow only what you need. While it may be tempting to take out a larger loan, doing so can lead to unnecessary financial strain. Carefully assess your financial requirements and borrow accordingly.

Another tip is to create a repayment plan before taking out the loan. This involves calculating your monthly installments and ensuring they fit within your budget. Setting aside a portion of your income for loan repayment can help you avoid missed payments and late fees.

Finally, always prioritize timely repayments. Missing a payment can result in penalties and negatively impact your credit score. If you encounter financial difficulties, contact your lender immediately to discuss possible solutions, such as restructuring the repayment schedule.

Comparison with Other Financing Options

When considering Colt 90 Day Finance, it's helpful to compare it with other financing options to determine the best fit for your needs. Traditional personal loans, for example, often come with longer repayment terms and lower interest rates. However, the application process can be more time-consuming, and approval may require a higher credit score.

On the other hand, credit cards offer flexibility and convenience but typically come with higher interest rates, especially for cash advances. Additionally, credit card debt can accumulate quickly if not managed properly, leading to long-term financial challenges.

Colt 90 Day Finance strikes a balance between these options by offering a short-term solution with manageable repayment terms. Its simplicity and transparency make it an appealing choice for those who need immediate financial assistance without the complexities of traditional loans or the high costs associated with credit cards.

Customer Reviews and Testimonials

Hearing from others who have used Colt 90 Day Finance can provide valuable insights into its effectiveness. Many customers appreciate the quick approval process and the flexibility it offers. One user shared, "I needed funds urgently to cover an unexpected medical expense, and Colt 90 Day Finance came through for me. The application was straightforward, and I received the money within a day."

Another customer highlighted the importance of timely repayments, stating, "I was initially concerned about the interest rate, but since the loan term is short, the total cost was manageable. I made sure to pay on time to avoid any additional fees, and it worked out perfectly for my situation."

While most reviews are positive, some users have noted the importance of understanding all associated costs before committing. Reading customer testimonials can help you make an informed decision and set realistic expectations for your experience with Colt 90 Day Finance.

Common Misconceptions About Colt 90 Day Finance

There are several misconceptions about Colt 90 Day Finance that can lead to confusion. One common myth is that it's only suitable for businesses. While it's true that businesses can benefit from this financial tool, individuals can also use it to manage personal expenses effectively.

Another misconception is that Colt 90 Day Finance is equivalent to payday loans. While both are short-term financing options, Colt 90 Day Finance is typically more regulated and offers better terms. Payday loans often come with exorbitant interest rates and fees, making them a less favorable choice for most borrowers.

Finally, some people believe that applying for Colt 90 Day Finance will negatively impact their credit score. In reality, responsible use and timely repayments can actually improve your credit score by demonstrating financial responsibility. It's important to separate fact from fiction to make the best decision for your financial needs.

Conclusion

Colt 90 Day Finance is a versatile and practical solution for managing short-term financial needs. Its flexibility, speed, and transparency make it an attractive option for both individuals and businesses. By understanding how it works, its benefits, and associated costs, you can make an informed decision about whether it's the right choice for you.

We encourage you to explore Colt 90 Day Finance further and consider how it can fit into your financial strategy. If you have any questions or experiences to share, feel free to leave a comment below. Additionally, don't hesitate to share this article with others who might benefit from learning about this innovative financing option. For more insights into financial tools and strategies, check out our other articles on the site.

Jean Claude Van Damme Height In Feet: A Comprehensive Guide To The Action Legend's Stature

Does Drew Carey Have Any Children? Exploring The Life Of The Beloved TV Host

Exploring Sheila Ford Hamp Ann Arbor: A Comprehensive Guide

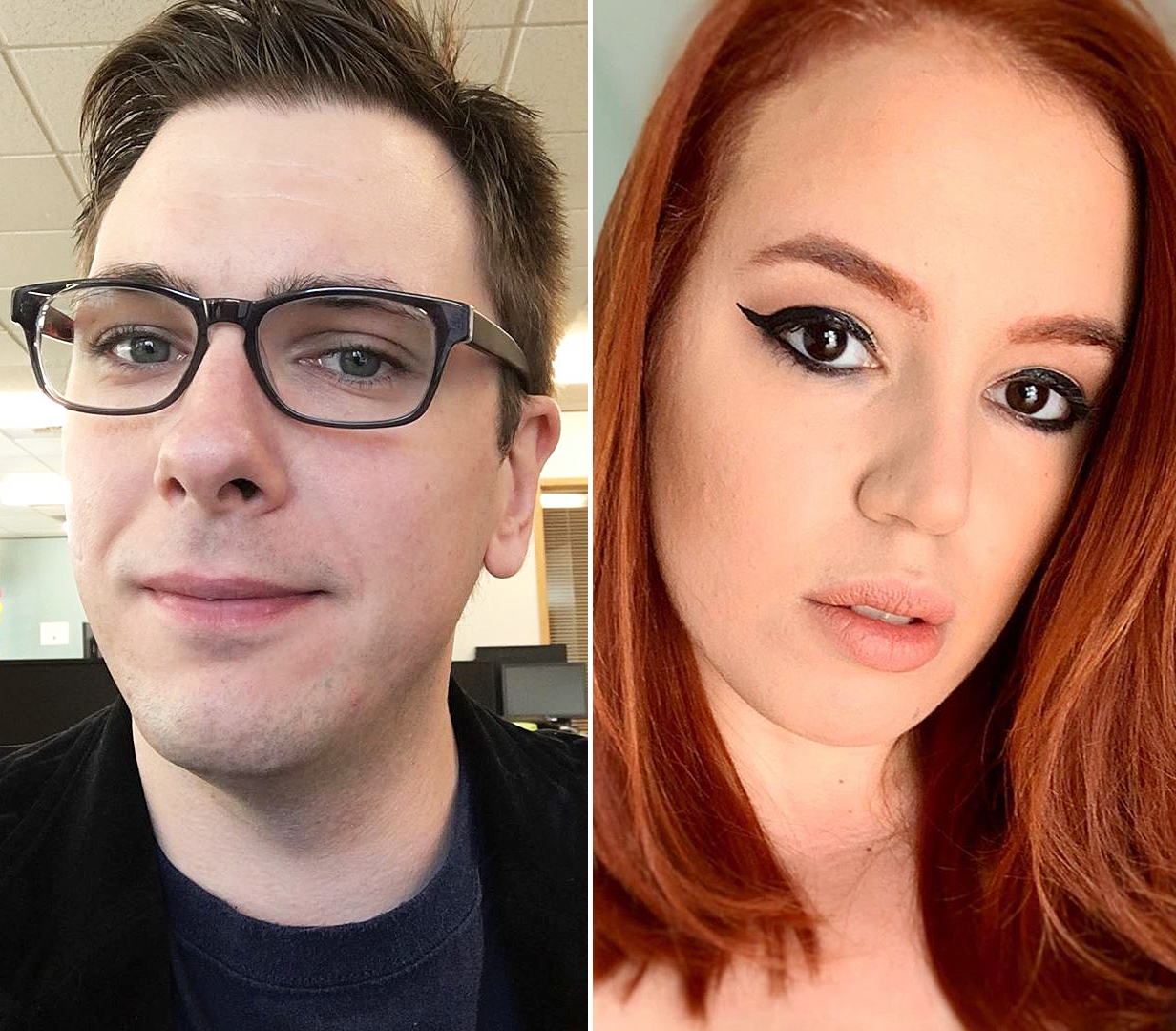

What Happened to Colt Johnson From ‘90 Day Fiance’? WheelchairBound

90 Day Fiance's Colt Johnson Raves Over New Girlfriend Jess Caroline