Bookkeeper360 Review: Comprehensive Insights Into A Modern Bookkeeping Solution

In today’s fast-paced business environment, managing finances efficiently is crucial for success. Bookkeeper360 has emerged as a popular choice for businesses seeking reliable bookkeeping services. This review will explore the features, benefits, and potential drawbacks of Bookkeeper360, helping you determine if it’s the right solution for your financial management needs. Whether you’re a small business owner or part of a growing enterprise, understanding the tools available to streamline your bookkeeping processes is essential. Bookkeeper360 offers a range of services designed to simplify accounting tasks, but how does it stack up against competitors?

Choosing the right bookkeeping service can be overwhelming, especially with so many options on the market. Bookkeeper360 positions itself as a comprehensive solution tailored to businesses of all sizes. From cloud-based accounting to dedicated support teams, this platform promises to handle your financial needs with precision and expertise. But what exactly does Bookkeeper360 offer, and is it worth the investment? This article will provide an in-depth analysis to help you make an informed decision.

Throughout this review, we’ll examine the platform’s features, pricing, customer feedback, and overall performance. By the end of this article, you’ll have a clear understanding of whether Bookkeeper360 aligns with your business goals and financial management requirements. Let’s dive into the details to uncover the strengths and weaknesses of this bookkeeping solution.

Read also:Laura Celia Valk The Rising Star In The World Of Acting

Table of Contents

- Overview of Bookkeeper360

- Key Features of Bookkeeper360

- Pricing Plans and Packages

- Customer Experience and Support

- Integration with Accounting Software

- Pros and Cons of Using Bookkeeper360

- Comparison with Competitors

- Customer Testimonials and Reviews

- Conclusion and Final Thoughts

Overview of Bookkeeper360

Bookkeeper360 is a cloud-based bookkeeping service designed to cater to the financial management needs of businesses across various industries. Founded with the goal of simplifying accounting processes, the platform offers a combination of technology and human expertise to ensure accurate and efficient financial record-keeping. Its services are particularly beneficial for small and medium-sized enterprises (SMEs) that lack the resources to maintain an in-house accounting team.

At its core, Bookkeeper360 focuses on automating repetitive tasks, reducing errors, and providing real-time insights into a business’s financial health. The platform integrates seamlessly with popular accounting software like QuickBooks and Xero, allowing users to streamline their workflows. Additionally, Bookkeeper360 offers dedicated account managers who work closely with clients to address their unique financial challenges.

One of the standout aspects of Bookkeeper360 is its commitment to transparency. Clients receive detailed reports and updates on their financial status, enabling them to make informed decisions. This level of clarity and accountability sets Bookkeeper360 apart from many other bookkeeping services in the market.

Key Features of Bookkeeper360

Bookkeeper360 offers a wide range of features designed to simplify financial management for businesses. Below, we’ll explore some of the most notable features that make this platform a popular choice among entrepreneurs and business owners.

Cloud-Based Accounting

One of the primary advantages of Bookkeeper360 is its cloud-based infrastructure. This feature allows users to access their financial data from anywhere, at any time, using any internet-enabled device. Cloud-based accounting eliminates the need for manual data entry and ensures that all records are up-to-date and accurate.

Dedicated Account Managers

Bookkeeper360 assigns a dedicated account manager to each client. These professionals act as a single point of contact, ensuring that all financial queries and concerns are addressed promptly. The account managers also provide personalized advice to help businesses optimize their financial processes.

Read also:Discovering Bridgeport Wv A Hidden Gem In West Virginia

Real-Time Financial Reporting

With Bookkeeper360, users can generate real-time financial reports that provide insights into their business’s performance. These reports include key metrics such as cash flow, profit and loss statements, and balance sheets. Access to real-time data empowers business owners to make strategic decisions quickly.

Automation of Repetitive Tasks

Bookkeeper360 automates repetitive tasks such as invoicing, expense tracking, and payroll processing. This automation not only saves time but also reduces the risk of human error, ensuring that financial records are accurate and reliable.

Pricing Plans and Packages

Bookkeeper360 offers a variety of pricing plans to accommodate businesses of different sizes and needs. The platform’s pricing structure is designed to be flexible, allowing clients to choose a plan that aligns with their budget and requirements.

Basic Plan

The Basic Plan is ideal for startups and small businesses with minimal bookkeeping needs. It includes essential features such as cloud-based accounting, automated invoicing, and monthly financial reports. This plan is competitively priced, making it an attractive option for businesses with limited resources.

Standard Plan

The Standard Plan is suitable for growing businesses that require more comprehensive bookkeeping services. In addition to the features offered in the Basic Plan, this package includes dedicated account management, expense tracking, and payroll processing. The Standard Plan is priced slightly higher but offers significant value for businesses seeking a more hands-on approach.

Premium Plan

The Premium Plan is designed for large enterprises with complex financial needs. It includes all the features of the Standard Plan, along with advanced reporting tools, tax preparation assistance, and 24/7 customer support. While this plan is the most expensive, it provides unparalleled support and functionality for businesses that demand the highest level of service.

Customer Experience and Support

Customer experience is a critical factor when evaluating any service, and Bookkeeper360 excels in this area. The platform is known for its responsive and knowledgeable support team, which is available to assist clients with any issues or questions they may have.

Bookkeeper360 offers multiple channels of support, including phone, email, and live chat. Clients can also schedule consultations with their dedicated account managers to discuss specific financial concerns. This level of accessibility ensures that businesses receive the support they need to manage their finances effectively.

Additionally, Bookkeeper360 provides educational resources such as webinars, tutorials, and blog articles to help clients improve their financial literacy. These resources are particularly beneficial for small business owners who may not have prior experience with bookkeeping.

Integration with Accounting Software

One of the key strengths of Bookkeeper360 is its ability to integrate seamlessly with popular accounting software. This integration ensures that businesses can continue using their preferred tools while benefiting from Bookkeeper360’s advanced features.

Bookkeeper360 supports integrations with platforms such as QuickBooks, Xero, and FreshBooks. These integrations allow for automatic syncing of financial data, eliminating the need for manual updates. As a result, businesses can maintain accurate records without the hassle of transferring information between systems.

Furthermore, the platform’s API capabilities enable custom integrations for businesses with unique requirements. This flexibility ensures that Bookkeeper360 can adapt to the specific needs of each client, regardless of their industry or size.

Pros and Cons of Using Bookkeeper360

Like any service, Bookkeeper360 has its strengths and weaknesses. Below, we’ll outline the key advantages and disadvantages of using this platform.

Pros

- Cloud-based infrastructure for easy access and real-time updates

- Dedicated account managers for personalized support

- Automation of repetitive tasks to save time and reduce errors

- Integration with popular accounting software

- Transparent pricing and flexible plans

Cons

- Premium Plan may be expensive for small businesses

- Limited customization options for certain features

- Some users report occasional delays in customer support response times

Comparison with Competitors

When evaluating Bookkeeper360, it’s important to consider how it compares to other bookkeeping services in the market. Competitors such as Bench and Pilot offer similar features, but there are key differences that set Bookkeeper360 apart.

For example, Bench focuses primarily on automated bookkeeping and lacks the dedicated account managers that Bookkeeper360 provides. While Bench is a cost-effective option, it may not offer the same level of personalized support. On the other hand, Pilot offers advanced reporting tools but comes with a higher price tag, making it less accessible for small businesses.

Bookkeeper360 strikes a balance between affordability and functionality, making it a versatile choice for businesses of all sizes. Its combination of automation, human expertise, and integration capabilities positions it as a strong contender in the bookkeeping industry.

Customer Testimonials and Reviews

Customer feedback is a valuable indicator of a service’s quality, and Bookkeeper360 has received overwhelmingly positive reviews from its users. Many clients praise the platform for its ease of use, reliability, and exceptional customer support.

One satisfied customer, a small business owner, shared that Bookkeeper360 helped them save time and reduce stress by automating their bookkeeping tasks. Another user highlighted the platform’s real-time reporting feature, which enabled them to make data-driven decisions for their business.

While the majority of reviews are positive, some users have noted areas for improvement, such as faster response times for support inquiries. Overall, however, Bookkeeper360 has established a strong reputation for delivering high-quality bookkeeping services.

Conclusion and Final Thoughts

In conclusion, Bookkeeper360 is a robust and reliable bookkeeping solution that caters to businesses of all sizes. Its cloud-based infrastructure, automation capabilities, and dedicated support team make it an excellent choice for entrepreneurs seeking to streamline their financial processes.

While the platform has a few drawbacks, such as its higher-priced Premium Plan and occasional delays in support, its overall performance and value make it a worthwhile investment. By offering a combination of technology and human expertise, Bookkeeper360 addresses the unique needs of modern businesses in a competitive market.

If you’re considering Bookkeeper360 for your business, we encourage you to explore its features and pricing plans to determine if it aligns with your goals. For further insights, feel free to leave a comment below or share this article with others who may find it helpful. Thank you for reading, and we hope this review has provided you with the information you need to make an informed decision.

Charlie Sheen Net Worth: A Comprehensive Look At His Wealth And Career

David Lee Roth Daughter: Exploring Family, Legacy, And Influence

Dharr Man Net Worth: A Comprehensive Guide To His Wealth, Career, And Achievements

Doro Medium Mobile Phone Pouch Black Review Review Electronics

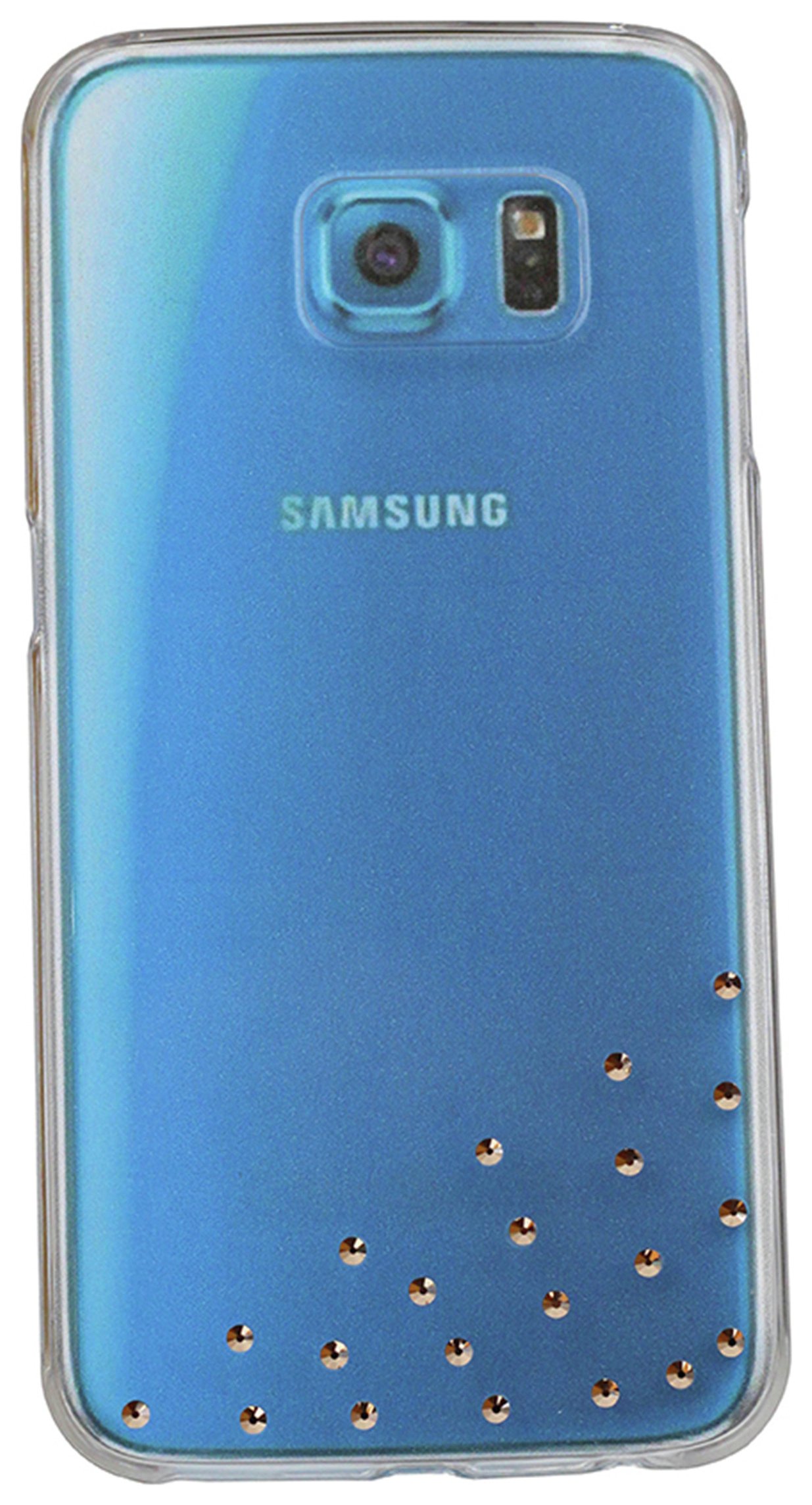

Diamond Jet Set Comet 18 Karat Gold. Review Review Electronics