Best Credit Cards For First-Time Users: A Comprehensive Guide

Are you considering getting your first credit card? If so, you're not alone. Many people take this step as a way to build credit, manage expenses, or enjoy financial perks. However, choosing the right credit card for the first time can be overwhelming, especially with so many options available in the market. Understanding the basics of credit cards, how they work, and which ones are best suited for beginners is essential to making an informed decision.

In this article, we will explore everything you need to know about credit cards for first-time users. From understanding the benefits of having a credit card to choosing the right one, we’ll cover all aspects to ensure you’re well-prepared. Whether you're looking to build credit, earn rewards, or simply learn how to manage your finances responsibly, this guide will provide you with the tools and knowledge you need.

By the end of this article, you’ll have a clear understanding of the factors to consider when selecting a credit card, the best options available for beginners, and tips for using your card responsibly. Let’s dive in and explore the world of credit cards for first-time users.

Read also:In Which Episode Does Escanor Die Unveiling The Tragic Fate Of The Lions Sin

Table of Contents

- Understanding Credit Cards

- Benefits of a First Credit Card

- Key Features to Look for in a Credit Card

- Top Credit Cards for First-Time Users

- How to Apply for a Credit Card

- Tips for Responsible Credit Card Use

- Common Mistakes to Avoid

- Building Credit with Your First Card

- Credit Card Terminology Explained

- Conclusion

Understanding Credit Cards

Credit cards are financial tools that allow you to borrow money from a bank or financial institution to make purchases. They come with a pre-approved credit limit, which is the maximum amount you can spend using the card. Each month, you receive a statement detailing your transactions and the minimum payment due. Paying off your balance in full each month helps you avoid interest charges.

For first-time users, credit cards can be a powerful tool for building credit history. Your credit score is influenced by how responsibly you use your credit card, including factors like payment history, credit utilization, and length of credit history. A good credit score can open doors to better financial opportunities, such as lower interest rates on loans and mortgages.

Types of Credit Cards

There are several types of credit cards available, each catering to different needs:

- Secured Credit Cards: Require a security deposit, making them ideal for beginners or those with no credit history.

- Student Credit Cards: Designed for college students with limited credit history.

- Rewards Credit Cards: Offer cashback, points, or miles for every purchase.

- Low-Interest Credit Cards: Feature lower APRs, making them suitable for carrying a balance.

Benefits of a First Credit Card

Using a credit card for the first time comes with several advantages, especially if you use it responsibly. Below are some of the key benefits:

1. Building Credit History

One of the most significant benefits of having a credit card is the ability to build credit history. Your credit score plays a crucial role in your financial life, affecting your ability to secure loans, rent an apartment, or even get a job. By making timely payments and keeping your credit utilization low, you can establish a strong credit profile.

2. Financial Flexibility

Credit cards provide financial flexibility, allowing you to make purchases even when you don’t have immediate access to cash. They are particularly useful for emergencies or large purchases that you can pay off over time.

Read also:Thom Bierdz Husband Who Is He

3. Rewards and Perks

Many credit cards offer rewards programs, such as cashback, travel points, or discounts on purchases. These perks can add significant value, especially if you use your card for everyday expenses like groceries and gas.

Key Features to Look for in a Credit Card

When choosing a credit card for the first time, it’s important to consider several key features that align with your financial needs and goals. Here are some factors to keep in mind:

1. Low or No Annual Fee

Many credit cards charge an annual fee, but as a first-time user, it’s best to opt for a card with no annual fee. This ensures you don’t incur unnecessary costs while building your credit history.

2. Low Interest Rates (APR)

The Annual Percentage Rate (APR) is the interest rate charged on any unpaid balance. Look for a card with a low APR, especially if you think you might carry a balance from month to month.

3. Introductory Offers

Some credit cards offer introductory perks, such as 0% APR for a certain period or bonus rewards for signing up. These offers can be beneficial if used wisely.

4. Credit Limit

Your credit limit is the maximum amount you can spend on the card. As a beginner, it’s advisable to start with a lower limit to avoid overspending and accumulating debt.

Top Credit Cards for First-Time Users

Here are some of the best credit cards for first-time users, each catering to different needs:

1. Discover it® Student Cash Back

This card is perfect for students, offering cashback rewards and no annual fee. It also provides a bonus match on all cashback earned during the first year.

2. Capital One Journey® Student Rewards

Designed for students, this card offers cashback rewards and increases your credit limit after five consecutive monthly payments on time.

3. Citi® Secured Mastercard®

A secured card that helps build credit history. It requires a security deposit, which also serves as your credit limit.

How to Apply for a Credit Card

Applying for a credit card is a straightforward process, but it’s essential to prepare beforehand. Follow these steps to ensure a smooth application:

1. Check Your Credit Score

Your credit score will determine your eligibility for certain cards. You can check your score for free through services like Credit Karma or your bank.

2. Compare Credit Cards

Research different credit cards and compare their features, fees, and benefits. Choose one that aligns with your financial goals.

3. Gather Required Documents

You’ll need to provide personal information, such as your Social Security number, proof of income, and address, during the application process.

Tips for Responsible Credit Card Use

Using a credit card responsibly is crucial to building a strong credit profile and avoiding debt. Here are some tips to keep in mind:

1. Pay Your Bill on Time

Timely payments are the most significant factor in your credit score. Set up automatic payments to avoid missing deadlines.

2. Keep Credit Utilization Low

Aim to use less than 30% of your available credit limit. This demonstrates responsible credit behavior and positively impacts your score.

3. Avoid Cash Advances

Cash advances often come with high fees and interest rates. Use your credit card for purchases instead.

Common Mistakes to Avoid

First-time credit card users often make mistakes that can harm their credit score or lead to debt. Here are some common pitfalls to avoid:

1. Overspending

It’s easy to get carried away with a credit card, but spending beyond your means can lead to financial trouble.

2. Ignoring the Fine Print

Always read the terms and conditions of your credit card agreement to understand fees, interest rates, and penalties.

3. Missing Payments

Missing even one payment can negatively impact your credit score. Set reminders or automate payments to stay on track.

Building Credit with Your First Card

Building credit takes time and discipline, but your first credit card can be a powerful tool in this process. Here are some strategies to help you build credit effectively:

1. Use Your Card Regularly

Make small, regular purchases on your card and pay them off in full each month. This demonstrates responsible credit use.

2. Monitor Your Credit Report

Check your credit report regularly to ensure there are no errors. You can request a free report from each of the three major credit bureaus annually.

3. Keep Old Accounts Open

The length of your credit history matters. Even if you upgrade to a better card later, consider keeping your first card open to maintain a longer credit history.

Credit Card Terminology Explained

Understanding credit card terminology is essential for making informed decisions. Here are some common terms you should know:

- APR (Annual Percentage Rate): The interest rate charged on unpaid balances.

- Credit Limit: The maximum amount you can spend on your card.

- Grace Period: The time between the end of a billing cycle and the due date when no interest is charged.

- Minimum Payment: The smallest amount you must pay each month to avoid penalties.

Conclusion

Choosing the right credit card for the first time is a significant step toward financial independence and building credit. By understanding the benefits, key features, and responsible usage practices, you can make the most of your credit card while avoiding common pitfalls. Remember to compare options, read the fine print, and use your card wisely to build a strong credit history.

We hope this guide has provided you with valuable insights into credit cards for first-time users. If you found this article helpful, feel free to share it with others who might benefit. For more tips on personal finance and credit management, explore our other articles. Happy credit card journey!

Joan Grande Italian: A Journey Through Her Life, Career, And Legacy

When Did Juice WRLD Pass Away: A Comprehensive Guide To His Life And Legacy

Flynn Rider's Age: Unveiling The Truth Behind The Charming Rogue

Credit card Rewards, Interest Rates & Security Britannica Money

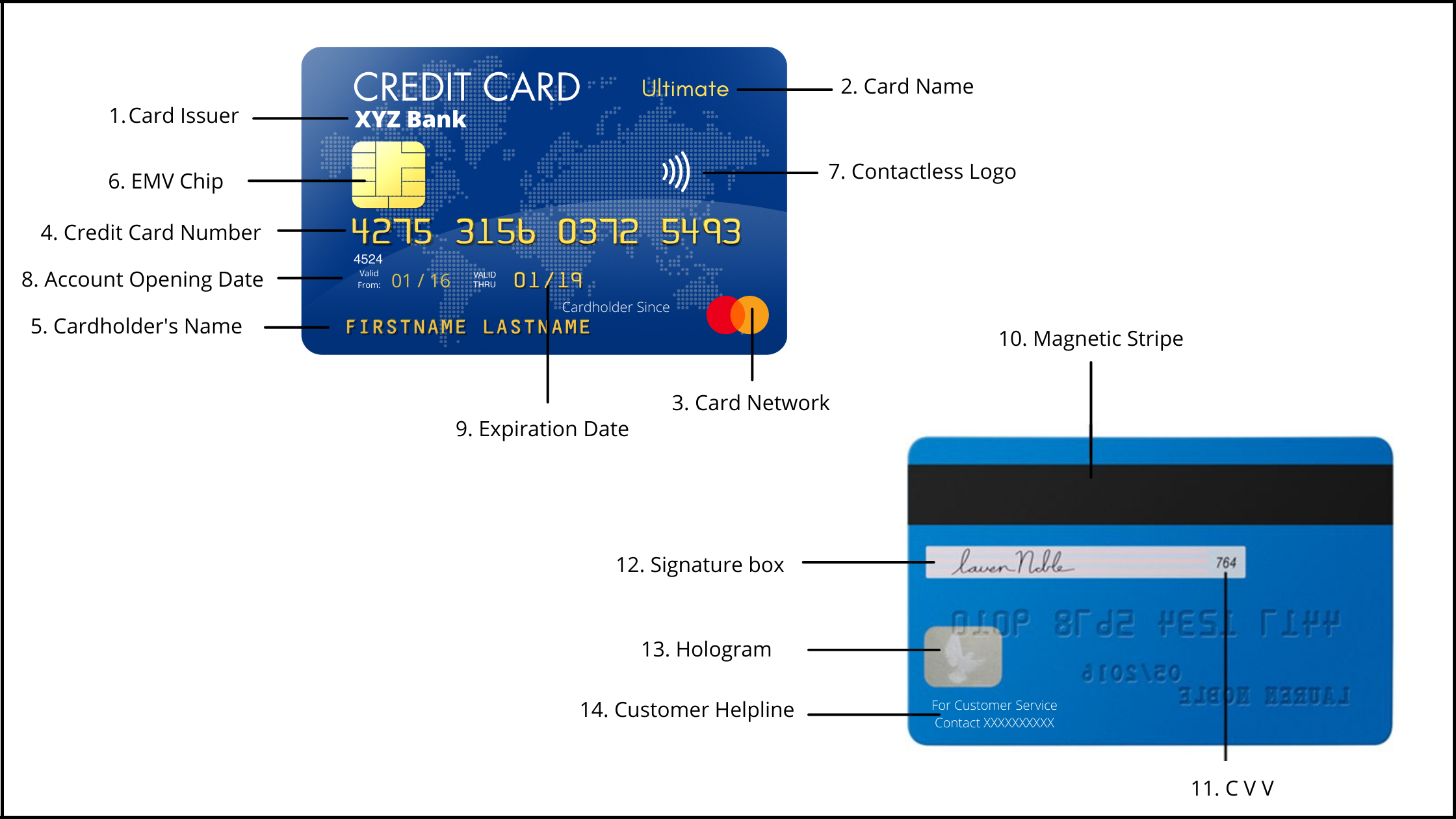

Anatomy of a Credit Card What Do The Symbols/Numbers Mean