TIAA Savings Rate: A Comprehensive Guide To Maximizing Your Retirement Savings

Planning for retirement is one of the most important financial decisions you will ever make, and understanding the TIAA savings rate is crucial to ensuring a secure future. TIAA, or Teachers Insurance and Annuity Association, is a leading provider of retirement services, particularly for those in the academic, medical, and research fields. The TIAA savings rate refers to the percentage of your income that you contribute to your TIAA retirement account, and optimizing this rate can significantly impact your financial well-being in retirement. In this guide, we’ll explore everything you need to know about the TIAA savings rate, including how it works, how to maximize your contributions, and why it’s essential for your long-term financial health.

For many individuals, retirement planning can feel overwhelming. However, with the right strategies and tools, you can take control of your financial future. TIAA offers a range of retirement savings options, including traditional and Roth accounts, that allow you to grow your savings tax-efficiently. Understanding how the TIAA savings rate fits into your overall retirement strategy is key to making informed decisions. In this article, we will break down the intricacies of the TIAA savings rate and provide actionable tips to help you make the most of your retirement savings.

Whether you’re just starting your career or nearing retirement, it’s never too early or too late to evaluate your savings rate. The TIAA savings rate is not just a number—it’s a reflection of your commitment to securing your financial future. By the end of this article, you’ll have a clear understanding of how to optimize your contributions, take advantage of employer matching, and make informed decisions about your retirement savings. Let’s dive into the details and explore how you can maximize your TIAA savings rate.

Read also:Zeolite Spray Trs The Ultimate Guide To Detoxification And Health Benefits

Table of Contents

- What is the TIAA Savings Rate?

- How Does the TIAA Savings Rate Work?

- Benefits of Maximizing TIAA Contributions

- Employer Matching and TIAA Savings

- TIAA Savings Rate vs. Other Retirement Plans

- How to Calculate Your Optimal Savings Rate

- Common Mistakes to Avoid

- Tips for Maximizing Your TIAA Savings

- Statistics and Trends in Retirement Savings

- Conclusion and Next Steps

What is the TIAA Savings Rate?

The TIAA savings rate is the percentage of your income that you contribute to your TIAA retirement account. This rate is a critical component of your retirement planning, as it determines how much money you are setting aside for your future. TIAA offers a variety of retirement plans, including 403(b) plans, IRAs, and annuities, each with its own contribution limits and tax advantages.

Contributions to your TIAA account are typically made on a pre-tax basis, meaning they reduce your taxable income for the year. This tax-deferred growth allows your savings to compound over time, potentially resulting in significant growth by the time you retire. The TIAA savings rate is flexible, allowing you to adjust your contributions as your financial situation changes.

TIAA Contribution Limits

TIAA accounts have annual contribution limits set by the IRS. For 2023, the maximum contribution limit for a 403(b) plan is $22,500, with an additional $7,500 catch-up contribution allowed for individuals aged 50 and older. Understanding these limits is essential for optimizing your TIAA savings rate and ensuring you are contributing as much as possible within legal boundaries.

How Does the TIAA Savings Rate Work?

The TIAA savings rate works by deducting a specified percentage of your income from each paycheck and depositing it into your TIAA retirement account. This automated process ensures that you consistently contribute to your retirement savings without having to think about it. Your contributions are invested in a range of options, including mutual funds, annuities, and fixed-income products, depending on your risk tolerance and retirement goals.

Investment Options and Growth

- Mutual Funds: Diversified portfolios that offer growth potential.

- Annuities: Provide guaranteed income in retirement.

- Fixed-Income Products: Offer stability and predictable returns.

The growth of your TIAA account depends on your investment choices and the performance of the markets. By selecting a mix of investments that align with your risk tolerance and time horizon, you can maximize the growth of your retirement savings.

Benefits of Maximizing TIAA Contributions

Maximizing your TIAA contributions offers several benefits, including tax advantages, employer matching, and long-term financial security. By contributing the maximum allowable amount, you can take full advantage of the tax-deferred growth and compound interest that TIAA accounts provide.

Read also:Unlocking The Mysteries Of Angel Number 1122 Meaning Significance And Guidance

Additionally, many employers offer matching contributions to TIAA accounts, which can significantly boost your retirement savings. For example, if your employer matches 50% of your contributions up to 6% of your salary, contributing at least 6% ensures you receive the full match, effectively doubling your savings rate.

Employer Matching and TIAA Savings

Employer matching is a powerful tool for increasing your TIAA savings rate. Many organizations that offer TIAA retirement plans provide matching contributions as part of their employee benefits package. Understanding how employer matching works and taking full advantage of it can significantly enhance your retirement savings.

How Employer Matching Works

Employer matching typically involves your employer contributing a certain percentage of your salary to your TIAA account, based on your contributions. For example, if your employer offers a 50% match on contributions up to 6% of your salary, and you earn $50,000 per year, contributing 6% ($3,000) would result in an additional $1,500 from your employer.

This matching contribution is essentially free money and can significantly accelerate the growth of your retirement savings. To maximize this benefit, it’s important to contribute at least enough to receive the full employer match.

TIAA Savings Rate vs. Other Retirement Plans

While TIAA offers a robust retirement savings platform, it’s important to compare it with other retirement plans to ensure you’re making the best choice for your financial future. Plans like 401(k)s, IRAs, and Roth IRAs each have their own advantages and limitations.

Comparison with 401(k) Plans

Both TIAA and 401(k) plans offer tax-deferred growth and employer matching, but TIAA is specifically designed for nonprofit and educational institutions. This specialization allows TIAA to offer unique investment options and services tailored to the needs of its members.

How to Calculate Your Optimal Savings Rate

Calculating your optimal TIAA savings rate involves evaluating your current financial situation, retirement goals, and future expenses. A general rule of thumb is to aim for a savings rate of at least 15% of your income, including employer contributions. However, this rate may vary depending on your age, income, and retirement objectives.

Steps to Calculate Your Savings Rate

- Determine your annual income and expenses.

- Estimate your retirement expenses and desired lifestyle.

- Use retirement calculators to project your savings growth.

- Adjust your contributions to align with your goals.

Common Mistakes to Avoid

When managing your TIAA savings rate, it’s important to avoid common pitfalls that can hinder your retirement savings. These include failing to take advantage of employer matching, underestimating retirement expenses, and not adjusting your contributions as your income grows.

Tips for Maximizing Your TIAA Savings

To maximize your TIAA savings, consider the following tips:

- Contribute enough to receive the full employer match.

- Review and adjust your investment allocations regularly.

- Increase your contributions whenever you receive a raise.

- Take advantage of catch-up contributions if you’re over 50.

Statistics and Trends in Retirement Savings

According to a 2023 study by the Employee Benefit Research Institute, only 42% of workers are confident about their ability to retire comfortably. This highlights the importance of maximizing your TIAA savings rate and taking proactive steps to secure your financial future.

Conclusion and Next Steps

In conclusion, understanding and optimizing your TIAA savings rate is essential for achieving a secure and comfortable retirement. By taking full advantage of employer matching, selecting appropriate investment options, and regularly reviewing your contributions, you can maximize your retirement savings and ensure a brighter financial future.

We encourage you to take action today by evaluating your current TIAA savings rate and making adjustments as needed. Share this article with friends and colleagues who may benefit from learning more about TIAA savings, and explore additional resources on retirement planning to further enhance your knowledge.

Discovering The World's Whitest Person: Unveiling The Secrets Of Albinism

Exploring Canadian Tire Walker Road Windsor Ontario: Your Ultimate Guide

Prenatal Vitamins UK: A Comprehensive Guide For Expecting Mothers

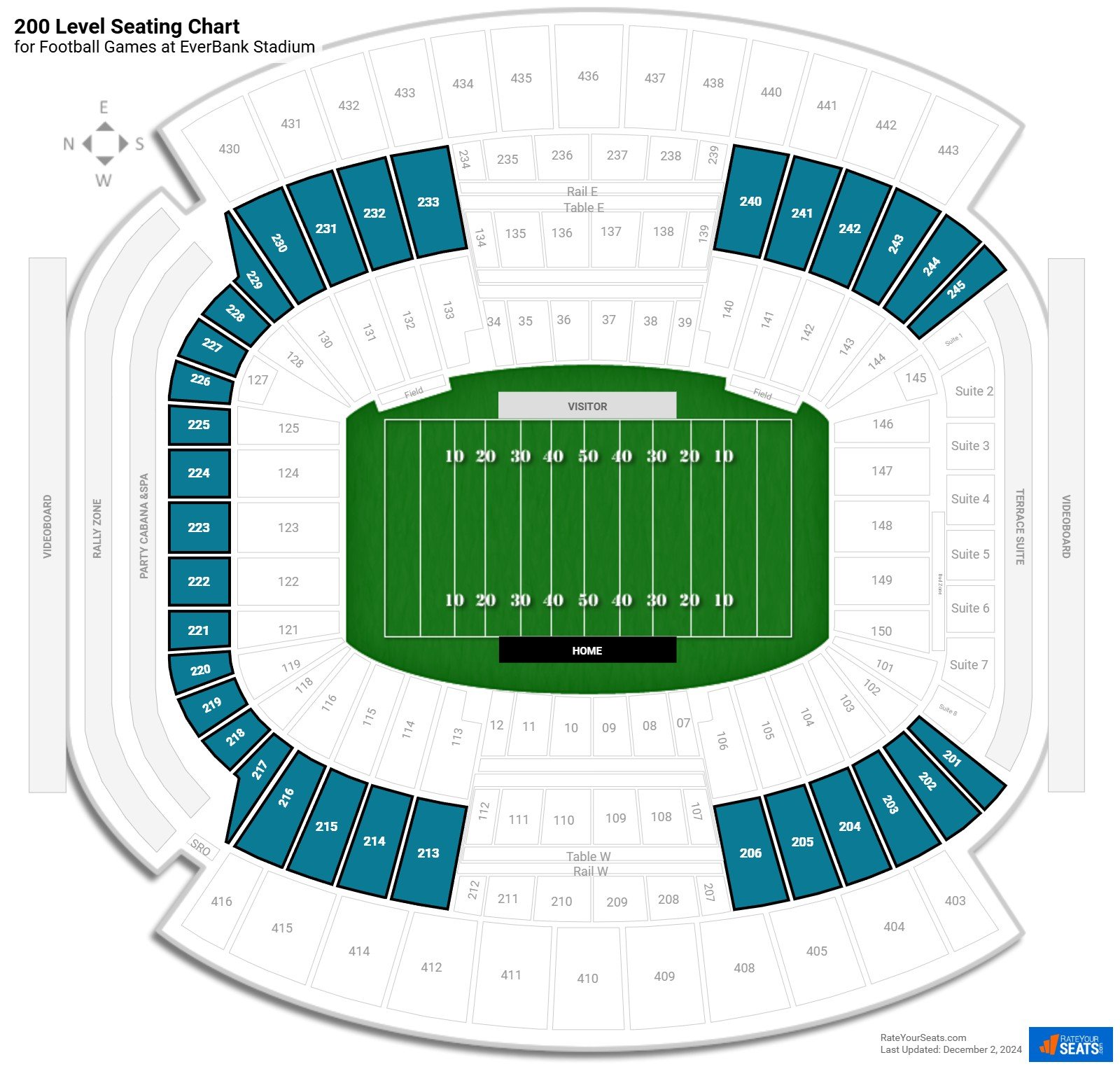

TIAA Bank Field 200 Level

Crypto markets head lower in anticipation of Wednesday’s FOMC rate hike