Voyage FCU Credit Card: Unlocking Financial Freedom And Travel Rewards

Are you looking for a credit card that offers exceptional travel benefits while helping you manage your finances responsibly? Voyage FCU Credit Card might be the perfect solution for you. Whether you’re an avid traveler, a frequent shopper, or someone who wants to build credit, this card provides a unique blend of features designed to meet your needs. In this comprehensive guide, we’ll explore everything you need to know about the Voyage FCU Credit Card, from its benefits to its application process and how it can enhance your financial journey.

Choosing the right credit card is a critical decision that can impact your financial health and lifestyle. The Voyage FCU Credit Card stands out in the crowded credit card market due to its travel-focused rewards, low fees, and user-friendly features. This article will provide you with expert insights, actionable tips, and detailed information to help you make an informed decision about whether this card is right for you.

Throughout this guide, we’ll cover the card’s features, eligibility requirements, application process, and tips for maximizing its benefits. By the end, you’ll have a clear understanding of how the Voyage FCU Credit Card can fit into your financial strategy and help you achieve your goals.

Read also:Understanding The Public Txdpsscheduler Platform A Comprehensive Guide

Table of Contents

- Introduction to Voyage FCU Credit Card

- Key Features and Benefits

- Eligibility and Application Process

- How to Maximize Your Rewards

- Fees and Interest Rates

- Comparing Voyage FCU with Other Cards

- Tips for Responsible Credit Card Usage

- Travel Benefits and Perks

- Customer Support and Security

- Conclusion and Next Steps

Introduction to Voyage FCU Credit Card

The Voyage FCU Credit Card is a product offered by Voyage Financial Credit Union (FCU), a trusted financial institution known for its commitment to providing members with affordable and flexible financial solutions. This credit card is designed to cater to individuals who value convenience, rewards, and financial stability. Whether you’re planning your next vacation or managing everyday expenses, this card offers a range of benefits tailored to enhance your financial experience.

Voyage FCU has built a reputation for its customer-centric approach and transparent policies. As a member-owned institution, it prioritizes the needs of its users, ensuring that the credit card aligns with their financial goals. This focus on trust and reliability makes the Voyage FCU Credit Card a popular choice among consumers seeking a dependable financial tool.

Why Choose Voyage FCU?

- Member-Centric Approach: Voyage FCU is dedicated to serving its members with personalized financial solutions.

- Low Fees: The credit card comes with minimal fees, making it an affordable option for users.

- Travel-Focused Rewards: Earn points on purchases that can be redeemed for travel-related expenses.

- Secure Transactions: Advanced security features protect your financial data and transactions.

Key Features and Benefits

The Voyage FCU Credit Card is packed with features that make it an attractive option for a wide range of users. Below, we’ll delve into the key benefits and explain how they can enhance your financial journey.

Reward Points Program

One of the standout features of the Voyage FCU Credit Card is its reward points program. Cardholders earn points for every dollar spent, which can be redeemed for travel-related expenses such as flights, hotel stays, and car rentals. This program is particularly beneficial for frequent travelers who want to save on their trips while enjoying the convenience of a credit card.

- Earn 1 point for every $1 spent on eligible purchases.

- Redeem points for travel rewards, gift cards, or statement credits.

- No expiration on points as long as the account remains active.

Low Interest Rates

Unlike many other credit cards on the market, the Voyage FCU Credit Card offers competitive interest rates. This makes it an excellent choice for users who carry a balance from month to month. The low APR ensures that you won’t be burdened with excessive interest charges, allowing you to manage your finances more effectively.

No Annual Fee

Many credit cards come with annual fees that can add up over time. The Voyage FCU Credit Card, however, has no annual fee, making it a cost-effective option for users who want to avoid unnecessary expenses.

Read also:Who Is Alex Trumble Married To A Comprehensive Guide To His Personal Life And Career

Eligibility and Application Process

Before applying for the Voyage FCU Credit Card, it’s important to understand the eligibility requirements and the application process. This ensures that you meet the necessary criteria and can complete the application smoothly.

Eligibility Criteria

To qualify for the Voyage FCU Credit Card, applicants must meet the following requirements:

- Be at least 18 years old.

- Have a valid Social Security Number (SSN) or Taxpayer Identification Number (TIN).

- Be a member of Voyage FCU or eligible to join.

- Demonstrate a stable source of income.

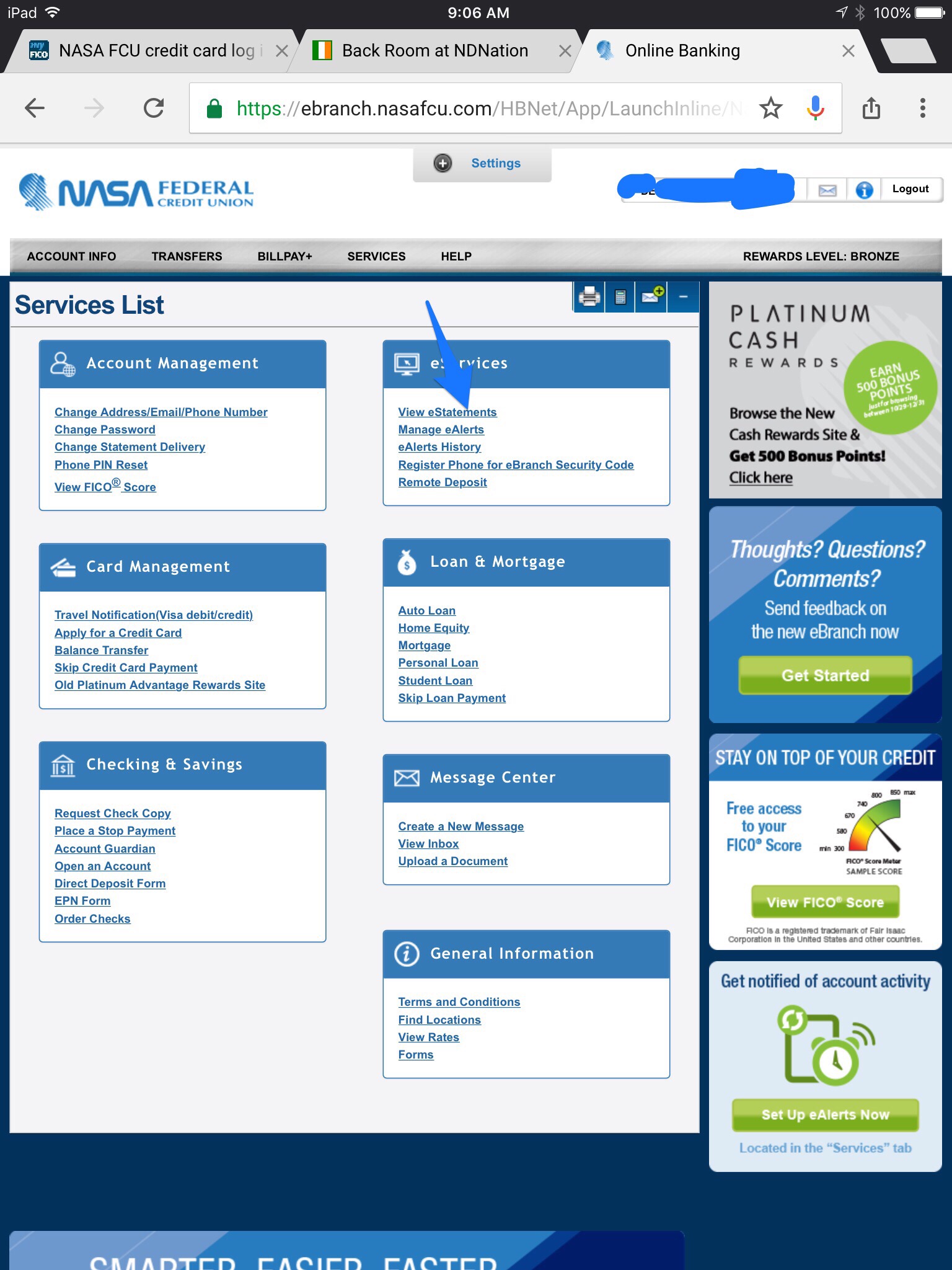

How to Apply

The application process for the Voyage FCU Credit Card is straightforward and can be completed online or in person. Here’s a step-by-step guide:

- Visit the official Voyage FCU website or your nearest branch.

- Fill out the application form with your personal and financial information.

- Submit the form and wait for the approval decision.

- If approved, activate your card and start using it immediately.

How to Maximize Your Rewards

To get the most out of your Voyage FCU Credit Card, it’s essential to adopt strategies that maximize your rewards. Here are some tips to help you make the most of your card:

Use the Card for Everyday Purchases

By using your Voyage FCU Credit Card for everyday expenses such as groceries, gas, and utility bills, you can accumulate reward points quickly. These points can then be redeemed for travel rewards or other benefits.

Pay Your Balance in Full

To avoid interest charges and maintain a healthy credit score, always pay your balance in full each month. This ensures that you’re not losing money on interest and can focus on earning rewards.

Take Advantage of Promotions

Voyage FCU frequently offers promotions and special deals for cardholders. Keep an eye out for these opportunities to earn bonus points or enjoy exclusive discounts.

Fees and Interest Rates

Understanding the fees and interest rates associated with the Voyage FCU Credit Card is crucial for managing your finances effectively. Below, we’ll outline the key costs you need to be aware of:

Interest Rates

The Voyage FCU Credit Card offers a variable APR that is competitive compared to industry standards. The exact rate depends on your creditworthiness and other factors. It’s important to review the terms and conditions to understand how the APR is calculated.

Additional Fees

While the card has no annual fee, there are other fees you should be aware of:

- Foreign transaction fee: 1% of the transaction amount.

- Late payment fee: Up to $39, depending on the circumstances.

- Cash advance fee: 3% of the transaction amount.

Comparing Voyage FCU with Other Cards

When choosing a credit card, it’s important to compare it with other options on the market. Below, we’ll compare the Voyage FCU Credit Card with two popular alternatives:

Voyage FCU vs. Chase Sapphire Preferred

While the Chase Sapphire Preferred offers a higher rewards rate for travel purchases, it comes with an annual fee. The Voyage FCU Credit Card, on the other hand, has no annual fee, making it a more affordable option for budget-conscious users.

Voyage FCU vs. Capital One Venture

The Capital One Venture card offers a higher credit limit and more extensive travel benefits, but it also has a higher annual fee. The Voyage FCU Credit Card is ideal for users who want a balance of affordability and rewards.

Tips for Responsible Credit Card Usage

Using a credit card responsibly is essential for maintaining good financial health. Here are some tips to help you use your Voyage FCU Credit Card wisely:

- Set a Budget: Determine how much you can afford to spend each month and stick to it.

- Monitor Your Statements: Regularly review your statements to catch any errors or fraudulent charges.

- Avoid Cash Advances: Cash advances come with high fees and interest rates, so it’s best to avoid them.

Travel Benefits and Perks

The Voyage FCU Credit Card offers a range of travel-related benefits that make it an excellent choice for frequent travelers. These perks include:

- Travel Insurance: Enjoy peace of mind with built-in travel insurance coverage.

- Global Acceptance: Use your card anywhere Visa is accepted.

- Exclusive Discounts: Access special deals on flights, hotels, and car rentals.

Customer Support and Security

Voyage FCU is committed to providing exceptional customer support and ensuring the security of your financial data. Cardholders can access 24/7 customer service for assistance with any issues. Additionally, the card is equipped with advanced security features such as fraud monitoring and zero-liability protection.

Conclusion and Next Steps

The Voyage FCU Credit Card is a versatile and rewarding financial tool that can help you achieve your financial goals while enjoying travel benefits. With its low fees, competitive interest rates, and robust rewards program, it’s an excellent choice for both new and experienced credit card users.

If you’re ready to take the next step, visit the Voyage FCU website to learn more about the card and begin your application. Don’t forget to share your thoughts in the comments below or explore other articles on our site for more financial tips and insights!

Comfort Inn Battle Creek MI: Your Ultimate Guide To A Comfortable Stay

Advantages Of Tetra Pak Packaging: A Comprehensive Guide

Who Is Madison Cheetow? A Comprehensive Guide To Her Life And Career

Voyage FCU Awarded 1500 in Scholarships at our Annual Meeting — Voyage

NASA FCU credit card log in... myFICO® Forums 4782987