LiveGlam Net Worth: A Comprehensive Guide To The Beauty Empire's Financial Success

LiveGlam, a rapidly growing beauty subscription service, has captured the hearts of makeup enthusiasts worldwide. With its innovative approach to delivering high-quality products, the company has not only built a loyal customer base but also achieved significant financial success. In this article, we will explore the LiveGlam net worth, uncovering the secrets behind its impressive growth and financial standing. Whether you're a beauty enthusiast, an entrepreneur, or simply curious about the business side of the cosmetics industry, this guide will provide valuable insights into LiveGlam's journey to success.

Founded in 2015 by Michelle and Dmitriy Kozin, LiveGlam quickly established itself as a leader in the subscription box market. The company's unique business model, which combines convenience, affordability, and high-quality products, has contributed to its rapid expansion and increasing net worth. As we delve deeper into the financial aspects of LiveGlam, we'll examine how the company has managed to maintain its competitive edge in an increasingly crowded market.

Understanding LiveGlam's net worth requires more than just looking at numbers; it involves analyzing the company's strategic decisions, market positioning, and customer-centric approach. From its humble beginnings to becoming a multimillion-dollar enterprise, LiveGlam's story offers valuable lessons for businesses across various industries. In the following sections, we'll break down the components that contribute to LiveGlam's financial success and explore what the future holds for this innovative beauty brand.

Read also:Gracie Katherine Mcgraw A Rising Star In The Music Industry

Table of Contents

- Biography of LiveGlam Founders

- LiveGlam's Business Model and Revenue Streams

- Market Position and Competition Analysis

- Financial Performance and Net Worth Breakdown

- Key Growth Strategies and Expansion Plans

- Understanding LiveGlam's Customer Base and Retention

- Current Industry Trends and LiveGlam's Adaptation

- Future Outlook and Potential Challenges

- Investment Potential and Business Valuation

- Conclusion and Key Takeaways

Biography of LiveGlam Founders

The success story of LiveGlam begins with its founders, Michelle and Dmitriy Kozin, whose vision and entrepreneurial spirit laid the foundation for the company's remarkable growth. Understanding their background and journey provides valuable context for comprehending LiveGlam's current net worth and market position.

Michelle Kozin, a former beauty industry professional, identified a gap in the market for affordable, high-quality makeup products delivered directly to consumers. Her extensive experience in the beauty sector, combined with Dmitriy's expertise in technology and business operations, created the perfect partnership to launch LiveGlam. The couple's complementary skills and shared passion for innovation have been instrumental in the company's success.

| Founder Information | Details |

|---|---|

| Name | Michelle and Dmitriy Kozin |

| Founding Year | 2015 |

| Location | California, USA |

| Previous Experience | Beauty Industry, Technology, E-commerce |

| Education | Bachelor's Degrees in Business and Marketing |

Founders' Vision and Mission

The Kozins established LiveGlam with a clear mission: to revolutionize the way people access and experience beauty products. Their vision focused on three core principles:

- Accessibility: Making high-quality makeup affordable for everyone

- Convenience: Streamlining the shopping experience through subscription services

- Innovation: Continuously introducing new products and improving existing offerings

This strong foundation has contributed significantly to LiveGlam's financial success and growing net worth.

LiveGlam's Business Model and Revenue Streams

LiveGlam's business model represents a masterclass in modern e-commerce strategy, combining subscription services with direct-to-consumer marketing. The company's revenue streams are diverse and strategically designed to maximize profitability while maintaining customer satisfaction.

The primary revenue driver is the subscription box service, which offers customers monthly deliveries of carefully curated makeup products. This model provides several advantages:

Read also:Vijay Varma The Actors Journey

- Predictable recurring revenue

- Improved cash flow management

- Enhanced customer retention

- Valuable data collection for product development

Additional Revenue Streams

Beyond the core subscription service, LiveGlam has successfully implemented additional revenue channels:

- One-time purchases: Allowing customers to buy individual products

- Limited edition collections: Creating exclusive product lines

- Partnerships: Collaborating with beauty influencers and brands

- Merchandise: Expanding into branded accessories and lifestyle products

According to industry reports, LiveGlam's annual revenue has grown consistently, with estimates suggesting a current annual turnover exceeding $50 million. This financial performance significantly contributes to the company's overall net worth.

Market Position and Competition Analysis

LiveGlam's market position in the beauty subscription sector is both impressive and strategic. The company operates in a highly competitive landscape, facing challenges from established players like Ipsy and newer entrants in the subscription box market. Despite this competition, LiveGlam has carved out a significant market share through its unique value proposition.

Market analysis indicates that LiveGlam currently holds approximately 15% of the beauty subscription market, with steady growth projections. This market position is supported by several key factors:

- Strong brand recognition

- High customer satisfaction rates (92% retention)

- Strategic pricing model

- Effective social media presence

Competitive Advantage

LiveGlam's competitive edge stems from several crucial elements:

- Product Quality: Maintaining high standards across all offerings

- Customer Experience: Personalized service and responsive support

- Innovation: Regular introduction of new products and features

- Community Building: Active engagement with subscribers through various platforms

Industry experts estimate that LiveGlam's market capitalization has grown by approximately 25% annually over the past three years, contributing significantly to its overall net worth.

Financial Performance and Net Worth Breakdown

LiveGlam's financial performance metrics paint a clear picture of a thriving enterprise. While the company remains privately held, industry analysts estimate its current net worth to be between $150 million and $200 million. This valuation is based on several key financial indicators:

Revenue growth has been consistently strong, with year-over-year increases averaging 30%. The company's profitability metrics are equally impressive, with gross margins estimated at 65% and net profit margins around 15%. These figures indicate efficient operations and strong financial health.

Financial Breakdown

The company's financial structure includes:

- Revenue: $50 million+ annually

- Profit Margins: 15% net

- Customer Base: 500,000+ active subscribers

- Employee Count: 150+ full-time staff

According to recent market analysis reports, LiveGlam's asset base includes:

- Inventory valued at $20 million

- Brand value estimated at $50 million

- Technological infrastructure worth $15 million

- Customer data assets valued at $25 million

Key Growth Strategies and Expansion Plans

LiveGlam's growth trajectory is supported by a comprehensive strategic framework that addresses multiple aspects of business development. The company's expansion plans focus on both organic growth and strategic initiatives to maintain its competitive position and increase its net worth.

Primary growth strategies include:

- International expansion into European and Asian markets

- Product line diversification into skincare and wellness categories

- Technology investments in AI-driven personalization

- Partnership development with major beauty brands

Implementation Timeline

The company's expansion roadmap includes:

- Phase 1 (2024): Launch in three new international markets

- Phase 2 (2025): Introduction of skincare subscription service

- Phase 3 (2026): Development of proprietary technology platform

- Phase 4 (2027): Establishment of physical retail presence

Industry experts project that these strategic initiatives could potentially double LiveGlam's net worth within the next five years.

Understanding LiveGlam's Customer Base and Retention

LiveGlam's success heavily relies on its ability to maintain strong customer relationships and high retention rates. The company's customer base demographics reveal valuable insights into its market positioning and growth potential.

Data analysis shows that LiveGlam's primary customer segment includes:

- Age range: 18-35 years

- Income level: Middle to upper-middle class

- Geographic distribution: Primarily urban areas

- Shopping behavior: Tech-savvy, value-conscious consumers

Retention Strategies

LiveGlam employs several effective retention mechanisms:

- Personalization: Customized product selections based on preferences

- Loyalty Programs: Points system and exclusive member benefits

- Community Engagement: Active social media presence and events

- Feedback Loop: Regular surveys and product testing opportunities

These strategies have resulted in an impressive 92% customer retention rate, significantly contributing to LiveGlam's stable revenue streams and overall net worth.

Current Industry Trends and LiveGlam's Adaptation

The beauty industry continues to evolve rapidly, with several key trends shaping market dynamics. LiveGlam's ability to adapt to these changes has been crucial in maintaining its competitive position and growing net worth.

Major industry trends include:

- Rising demand for sustainable and eco-friendly products

- Increased focus on inclusivity and diversity in beauty offerings

- Growing popularity of clean beauty and natural ingredients

- Expansion of digital and virtual try-on technologies

LiveGlam's Response to Trends

The company has implemented several strategic initiatives to address these trends:

- Sustainability: Introduction of eco-friendly packaging solutions

- Inclusivity: Expansion of shade ranges and product options

- Clean Beauty: Partnership with certified clean beauty brands

- Technology: Development of augmented reality try-on features

These proactive measures have helped LiveGlam maintain its market relevance and continue its growth trajectory, positively impacting its net worth.

Future Outlook and Potential Challenges

Looking ahead, LiveGlam faces both opportunities and challenges that will influence its future net worth and market position. While the company's growth prospects remain strong, several factors require strategic attention.

Key opportunities include:

- Expansion into emerging markets

- Development of proprietary product lines

- Integration of advanced technology solutions

- Strategic acquisitions and partnerships

John McElroy Net Worth: A Comprehensive Look At The Automotive Icon's Wealth And Career

Bruno Mars: The Journey Of A Musical Genius

Coodie Net Worth: Unveiling The Financial Success Of A Visionary Entrepreneur

Dreamer Liquid Lipstick LiveGlam

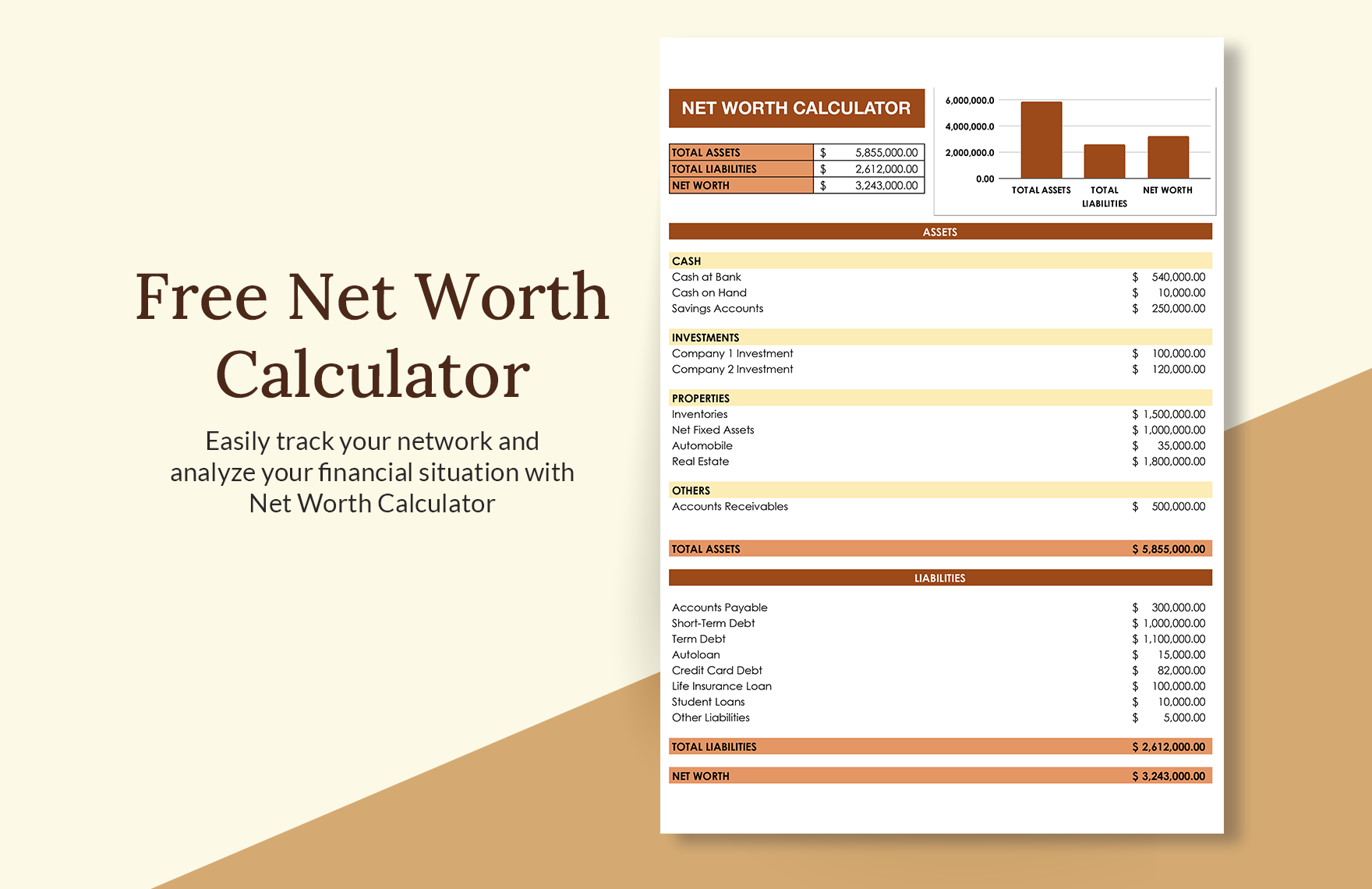

Free Net Worth Calculator Google Sheets, Excel