Chase Mortgage: A Comprehensive Guide To Securing Your Dream Home

Are you considering applying for a Chase mortgage to purchase your dream home? You're not alone. Thousands of homebuyers turn to Chase Bank each year for its competitive mortgage rates, flexible loan options, and exceptional customer service. Whether you're a first-time homebuyer or looking to refinance your current mortgage, understanding the ins and outs of Chase mortgage products is crucial to making informed financial decisions.

Chase Mortgage is one of the largest mortgage lenders in the United States, offering a wide range of home loan products designed to meet various financial needs and circumstances. From conventional fixed-rate mortgages to government-backed loans, Chase provides solutions for different types of borrowers. This comprehensive guide will walk you through everything you need to know about Chase mortgage options, application process, and important considerations before making such a significant financial commitment.

In today's competitive housing market, securing the right mortgage can make all the difference in achieving your homeownership goals. With Chase's extensive network of loan officers and online resources, you can access professional guidance throughout your home-buying journey. This article will explore the various aspects of Chase mortgage products, eligibility requirements, application procedures, and valuable tips to help you navigate the mortgage process successfully.

Read also:Unlocking The Mysteries Of Angel Number 1122 Meaning Significance And Guidance

Table of Contents

- Understanding Chase Mortgage Options

- Eligibility Requirements for Chase Mortgages

- The Chase Mortgage Application Process

- Chase Mortgage Interest Rates and Fees

- Chase Mortgage Loan Officers: Your Guides to Homeownership

- Chase Mortgage Customer Service and Support

- Refinancing Options with Chase Mortgage

- Government-Backed Loan Programs

- Chase Homebuyer Assistance Programs

- Financial Planning and Mortgage Management

Understanding Chase Mortgage Options

Chase offers a comprehensive suite of mortgage products designed to accommodate various financial situations and home-buying goals. The bank's primary mortgage options include fixed-rate mortgages, adjustable-rate mortgages (ARMs), jumbo loans, and government-backed loans. Each product serves different purposes and caters to specific borrower needs.

Fixed-Rate Mortgages

Fixed-rate mortgages remain the most popular choice among homebuyers due to their stability and predictability. Chase offers fixed-rate terms of 15, 20, and 30 years, allowing borrowers to choose the repayment period that best suits their financial situation. These loans feature:

- Consistent monthly payments throughout the loan term

- Interest rates that remain unchanged regardless of market fluctuations

- Predictable long-term budgeting for homeowners

Adjustable-Rate Mortgages (ARMs)

Chase's ARMs typically feature an initial fixed-rate period followed by periodic adjustments. Common ARM options include:

- 5/1 ARM: Fixed rate for five years, then annual adjustments

- 7/1 ARM: Fixed rate for seven years, then annual adjustments

- 10/1 ARM: Fixed rate for ten years, then annual adjustments

Eligibility Requirements for Chase Mortgages

Securing a mortgage from Chase requires meeting specific eligibility criteria that help determine your creditworthiness and ability to repay the loan. These requirements typically include:

- Minimum credit score of 620 for conventional loans

- Debt-to-income ratio below 43%

- Stable employment history of at least two years

- Minimum down payment requirements varying by loan type

Credit Score Requirements

Your credit score plays a crucial role in mortgage approval and interest rate determination. Chase generally follows these credit score guidelines:

- Conventional loans: 620 minimum

- FHA loans: 580 minimum

- VA loans: No minimum, but higher scores improve terms

The Chase Mortgage Application Process

Applying for a Chase mortgage involves several key steps that ensure a thorough evaluation of your financial situation and home-buying readiness:

Read also:Kayja Rose Unveiling The Rising Star And Her Impact On Modern Entertainment

- Pre-qualification assessment

- Formal application submission

- Documentation collection

- Loan processing and underwriting

- Final approval and closing

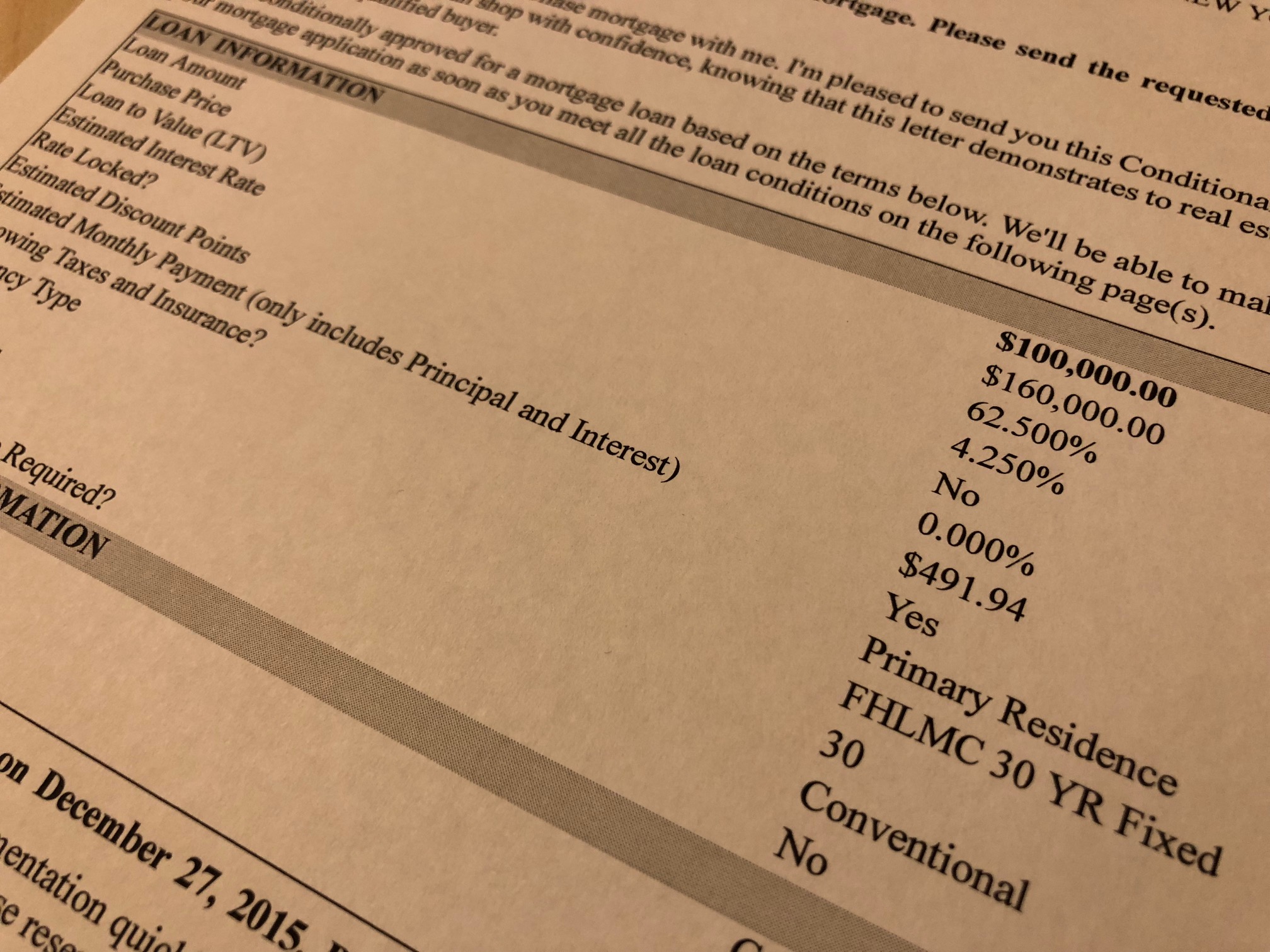

Required Documentation

Chase requires specific documents to verify your financial information:

- Two years of W-2 forms

- Two years of federal tax returns

- Two months of bank statements

- Recent pay stubs

Chase Mortgage Interest Rates and Fees

Understanding mortgage rates and associated fees is crucial when evaluating Chase's loan products. The bank's interest rates typically range from:

- Fixed-rate: 4.5% to 6.5% (varies by market conditions)

- ARMs: 4.0% to 6.0% initial rate

- Jumbo loans: 5.0% to 7.0%

Closing Costs Breakdown

Common closing costs include:

- Origination fees: 0.5% to 1% of loan amount

- Appraisal fees: $300 to $600

- Title insurance: 0.5% to 1% of purchase price

- Recording fees: $25 to $250

Chase Mortgage Loan Officers: Your Guides to Homeownership

Chase employs a nationwide network of experienced mortgage loan officers who provide personalized guidance throughout your home-buying journey. These professionals offer:

- Expert advice on loan options

- Market rate analysis

- Customized financial solutions

- Ongoing support during the application process

Locating Your Local Loan Officer

Chase provides multiple ways to connect with loan officers:

- Branch office visits

- Online scheduling

- Phone consultations

- Virtual meetings

Chase Mortgage Customer Service and Support

Chase maintains a robust customer service infrastructure to support mortgage clients:

- 24/7 online account access

- Dedicated customer support lines

- Mobile banking app features

- Online payment options

Customer Support Channels

Available support options include:

- Phone support: 1-800-CHASE-24

- Live chat functionality

- Email support system

- In-branch assistance

Refinancing Options with Chase Mortgage

Chase offers various refinancing solutions to help homeowners optimize their mortgage terms:

- Rate-and-term refinancing

- Cash-out refinancing

- Streamline refinancing for government-backed loans

Refinancing Benefits

Potential advantages include:

- Lower monthly payments

- Reduced interest rates

- Shorter loan terms

- Debt consolidation opportunities

Government-Backed Loan Programs

Chase participates in several government-backed mortgage programs:

- FHA loans

- VA loans

- USDA loans

FHA Loan Features

FHA loans offer:

- Low down payment requirements

- Flexible credit guidelines

- Competitive interest rates

- Mortgage insurance protection

Chase Homebuyer Assistance Programs

Chase provides various assistance programs for first-time homebuyers:

- Down payment assistance

- Closing cost grants

- Homebuyer education courses

- Special financing options

Chase DreaMaker Program

This program offers:

- 3% down payment option

- Reduced mortgage insurance costs

- Flexible underwriting guidelines

- Competitive interest rates

Financial Planning and Mortgage Management

Successful mortgage management requires careful financial planning:

- Budgeting for housing expenses

- Emergency fund preparation

- Debt management strategies

- Long-term financial goal setting

Mortgage Payment Strategies

Effective payment management includes:

- Automatic payment setup

- Bi-weekly payment options

- Extra principal payments

- Annual budget reviews

Conclusion: Making Informed Mortgage Decisions with Chase

Securing a Chase mortgage represents a significant step toward achieving your homeownership dreams. By understanding the various loan options, eligibility requirements, and application procedures, you can make informed decisions that align with your financial goals. Remember to:

- Compare multiple loan products before committing

- Review all terms and conditions carefully

- Utilize available resources and support systems

- Plan for long-term financial stability

We encourage you to share your experiences with Chase mortgage products in the comments section below. If you found this guide helpful, please consider sharing it with others who might benefit from this information. For more valuable resources on homeownership and financial planning, explore our other articles on mortgage management and personal finance strategies.

Is Mrs. Obama A Man? Unveiling The Truth Behind The Rumors

Lucky Blue Smith Age: Unveiling The Journey Of A Rising Star

Is It True Michelle Obama Is A Man? Debunking The Rumors And Misinformation

Chase mortgage estimator DermotHilary

Chase Mortgage Statement ubicaciondepersonas.cdmx.gob.mx