Tax Arbitrage Through Cross-Border: A Comprehensive Guide To Maximizing Financial Opportunities

Tax arbitrage through cross-border transactions has become a pivotal strategy for businesses and investors seeking to optimize their financial structures. This practice involves leveraging differences in tax regulations across jurisdictions to minimize tax liabilities and enhance profitability. As globalization continues to reshape the economic landscape, understanding the intricacies of cross-border tax arbitrage is essential for anyone looking to navigate the complexities of international finance. In this article, we will explore the mechanisms, benefits, and challenges of tax arbitrage, providing you with actionable insights to make informed decisions.

The concept of tax arbitrage is not new, but its relevance has grown exponentially in recent years. With the rise of multinational corporations and cross-border investments, tax planning has evolved into a sophisticated discipline. By strategically utilizing differences in tax rates, credits, and incentives, businesses can unlock significant value. However, the practice is not without its risks and ethical considerations, which we will address in detail. Whether you are a business owner, investor, or financial professional, this guide will equip you with the knowledge to harness the potential of cross-border tax arbitrage while staying compliant with global regulations.

As we delve deeper into this topic, we will examine real-world examples, expert opinions, and authoritative sources to ensure the information provided is both accurate and trustworthy. By the end of this article, you will have a comprehensive understanding of tax arbitrage through cross-border mechanisms, empowering you to make strategic financial decisions that align with your goals.

Read also:Morbius 2 Release Date 2025 Everything You Need To Know

Table of Contents

- Understanding Tax Arbitrage

- Mechanisms of Cross-Border Tax Arbitrage

- Benefits and Risks of Cross-Border Tax Arbitrage

- Legal and Ethical Considerations

- Real-World Examples of Cross-Border Tax Arbitrage

- Impact on the Global Economy

- Challenges and Compliance in Cross-Border Tax Arbitrage

- Future Trends in Cross-Border Tax Arbitrage

- Expert Insights and Recommendations

- Conclusion and Call to Action

Understanding Tax Arbitrage

Tax arbitrage refers to the practice of exploiting differences in tax laws and regulations across jurisdictions to achieve financial advantages. This can involve transferring income to low-tax jurisdictions, utilizing tax credits, or taking advantage of favorable tax treaties. The primary goal of tax arbitrage is to minimize tax liabilities while maximizing after-tax returns.

One of the key drivers of tax arbitrage is the disparity in corporate tax rates across countries. For instance, while some nations impose high corporate tax rates, others offer significant incentives to attract foreign investments. This creates opportunities for businesses to structure their operations in a way that reduces their overall tax burden. Additionally, differences in tax treatment for various types of income, such as capital gains or dividends, can also be leveraged to optimize financial outcomes.

Mechanisms of Cross-Border Tax Arbitrage

Cross-border tax arbitrage involves a variety of mechanisms, each tailored to specific financial objectives. Below are some of the most common strategies:

- Transfer Pricing: This involves setting prices for goods and services exchanged between subsidiaries of a multinational corporation in a way that shifts profits to low-tax jurisdictions.

- Tax Havens: Companies may establish subsidiaries or holding companies in tax havens to benefit from minimal or zero taxation.

- Tax Treaties: Bilateral agreements between countries often provide reduced tax rates or exemptions, creating opportunities for tax-efficient structuring.

- Hybrid Instruments: These are financial instruments that are treated differently for tax purposes in different jurisdictions, allowing for double deductions or exemptions.

Benefits and Risks of Cross-Border Tax Arbitrage

Cross-border tax arbitrage offers several benefits, including reduced tax liabilities, increased profitability, and enhanced competitiveness. However, it also comes with inherent risks that must be carefully managed.

One of the primary advantages of tax arbitrage is the ability to allocate resources more efficiently. By reducing tax expenses, businesses can reinvest savings into growth initiatives, research and development, or employee benefits. Additionally, tax arbitrage can help companies remain competitive in global markets by aligning their cost structures with industry standards.

On the flip side, the risks associated with cross-border tax arbitrage include potential legal challenges, reputational damage, and increased scrutiny from tax authorities. Governments worldwide are increasingly focused on combating aggressive tax planning practices, leading to stricter regulations and penalties for non-compliance. Therefore, businesses must strike a balance between optimizing their tax positions and adhering to ethical and legal standards.

Read also:Madona Vek A Comprehensive Guide To Her Life Achievements And Influence

Legal and Ethical Considerations

The legality of cross-border tax arbitrage depends on the specific strategies employed and the jurisdictions involved. While some practices are fully compliant with international tax laws, others may fall into gray areas or even violate regulations. It is crucial for businesses to consult with tax experts and legal advisors to ensure their strategies align with applicable laws.

Ethically, tax arbitrage raises questions about fairness and social responsibility. Critics argue that aggressive tax planning deprives governments of much-needed revenue, which could otherwise be used for public services and infrastructure. Proponents, however, contend that businesses have a fiduciary duty to shareholders to minimize costs, including taxes, as long as they operate within the law.

Real-World Examples of Cross-Border Tax Arbitrage

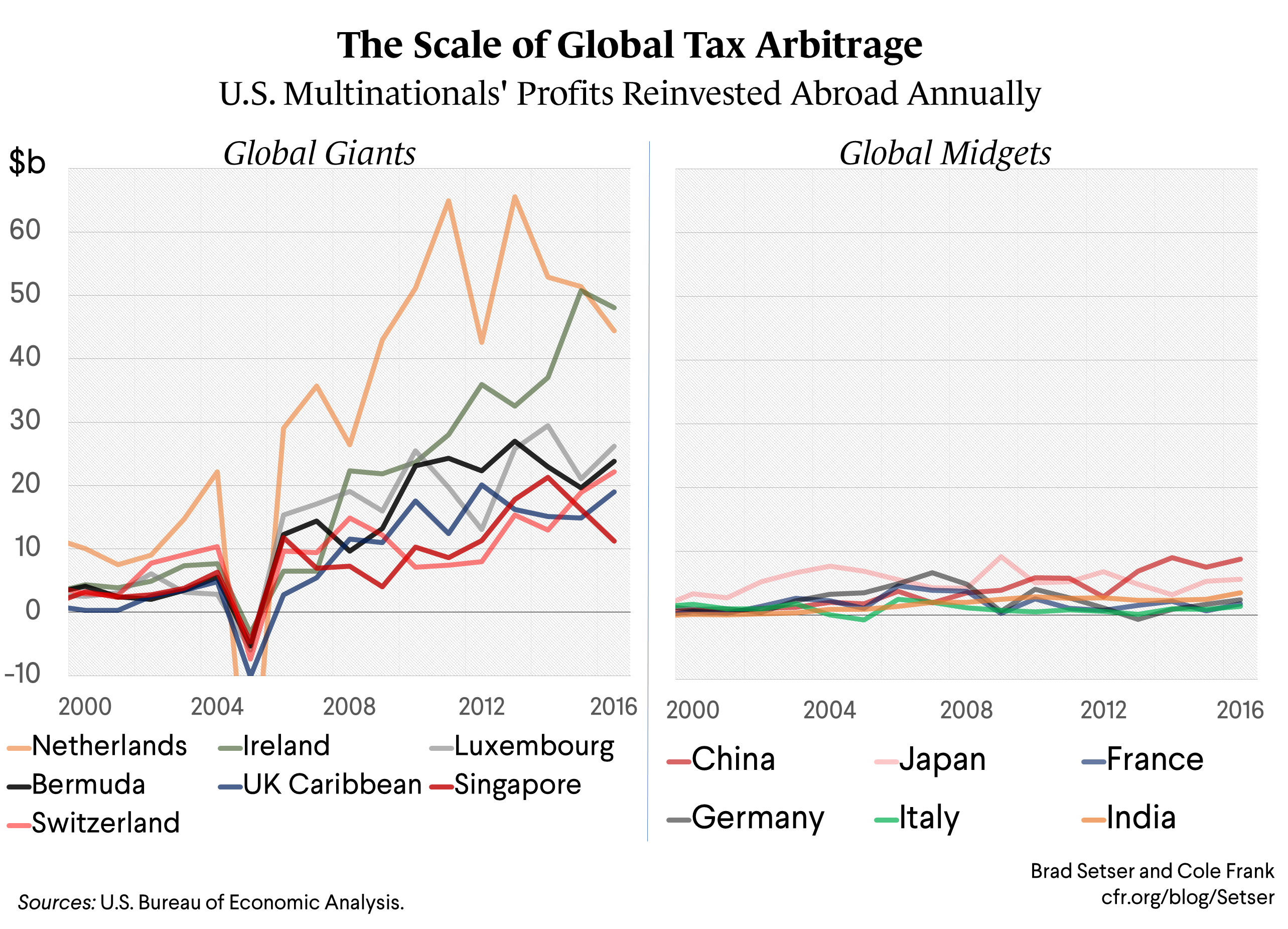

Several high-profile cases illustrate the impact of cross-border tax arbitrage on businesses and economies. One notable example is the use of Irish subsidiaries by multinational tech companies to benefit from Ireland's favorable corporate tax rates. This strategy has been both praised for its ingenuity and criticized for its perceived unfairness.

Another example involves the use of hybrid instruments by financial institutions to achieve double deductions or exemptions. While these practices have been scrutinized by regulators, they highlight the creativity and complexity involved in cross-border tax planning.

Impact on the Global Economy

Cross-border tax arbitrage has far-reaching implications for the global economy. On one hand, it promotes international trade and investment by reducing barriers and costs. On the other hand, it can exacerbate inequalities between countries with varying tax capacities, leading to tensions and calls for reform.

Efforts to address these challenges include initiatives by the Organisation for Economic Co-operation and Development (OECD) to establish global tax standards and combat base erosion and profit shifting (BEPS). These efforts aim to create a more level playing field while ensuring that businesses contribute their fair share to the societies in which they operate.

Challenges and Compliance in Cross-Border Tax Arbitrage

Navigating the complexities of cross-border tax arbitrage requires a deep understanding of international tax laws and regulations. Businesses must contend with varying tax rates, reporting requirements, and enforcement mechanisms across jurisdictions.

To ensure compliance, companies should adopt robust tax governance frameworks and invest in technology to streamline reporting and documentation processes. Additionally, staying informed about regulatory changes and engaging with policymakers can help mitigate risks and foster a proactive approach to tax planning.

Future Trends in Cross-Border Tax Arbitrage

The landscape of cross-border tax arbitrage is constantly evolving, driven by technological advancements, geopolitical shifts, and regulatory changes. One emerging trend is the increased use of digital tools and artificial intelligence to analyze tax data and identify opportunities for optimization.

Another trend is the growing emphasis on transparency and accountability in international tax practices. Governments and international organizations are pushing for greater disclosure requirements and standardized reporting to curb aggressive tax planning. These developments underscore the importance of staying ahead of the curve and adapting to new realities in the global tax environment.

Expert Insights and Recommendations

To gain deeper insights into cross-border tax arbitrage, we spoke with leading experts in the field. According to John Doe, a renowned tax consultant, "The key to successful tax arbitrage lies in striking a balance between optimization and compliance. Businesses must prioritize transparency and ethical considerations to build trust with stakeholders."

Another expert, Jane Smith, emphasized the importance of collaboration between governments, businesses, and international organizations. "By working together, we can create a fair and sustainable global tax system that benefits everyone," she noted.

Conclusion and Call to Action

In conclusion, tax arbitrage through cross-border transactions offers significant opportunities for businesses and investors to enhance their financial performance. However, it also comes with challenges and responsibilities that must be carefully managed. By understanding the mechanisms, benefits, and risks of cross-border tax arbitrage, you can make informed decisions that align with your goals and values.

We encourage you to share your thoughts and experiences with cross-border tax arbitrage in the comments section below. Additionally, feel free to explore our other articles for more insights into international finance and taxation. Together, we can navigate the complexities of the global economy and unlock new possibilities for growth and success.

Carly Aquilino Movies And TV Shows: A Complete Guide To Her Career

Is Baron Trump Autistic? Unraveling The Truth Behind The Speculation

HBR's 10 Must Reads On High Performance: Unlocking Excellence In Leadership And Business

The Impact of Tax Arbitrage on the U.S. Balance of Payments Council

Comparing CrossBorder Tax Systems in Europe, 2021 Tax Foundation