Alex Kleyner National Debt Relief: A Comprehensive Guide To Managing Your Financial Future

Alex Kleyner National Debt Relief has become a beacon of hope for countless individuals burdened by overwhelming debt. In today's fast-paced world, financial challenges are inevitable, and many people find themselves trapped in a cycle of debt that seems impossible to escape. This article delves deep into the world of Alex Kleyner and National Debt Relief, providing you with expert insights and actionable strategies to regain control of your financial future.

Debt relief is not just a service; it's a lifeline for those drowning in financial obligations. Understanding the intricacies of debt relief programs and the role of professionals like Alex Kleyner can make a significant difference in your journey toward financial freedom. This guide will explore the various aspects of debt relief, from the basics to advanced strategies, ensuring you have all the information you need to make informed decisions.

As we navigate through this comprehensive guide, you'll discover how Alex Kleyner's expertise in national debt relief can transform your financial situation. Whether you're struggling with credit card debt, medical bills, or other financial burdens, this article will equip you with the knowledge and tools necessary to achieve debt relief and build a secure financial future.

Read also:Madona Vek A Comprehensive Guide To Her Life Achievements And Influence

Table of Contents

Biography of Alex Kleyner

Alex Kleyner is a renowned figure in the financial industry, particularly known for his expertise in debt relief and financial counseling. With over two decades of experience, Alex has helped thousands of individuals and families navigate the complex world of debt management and achieve financial stability.

His journey began in the bustling city of New York, where he developed a passion for finance and economics. Alex's academic background includes a degree in Business Administration from a prestigious university, where he graduated with honors. His dedication to helping others led him to pursue a career in financial services, focusing on debt relief and financial education.

Throughout his career, Alex Kleyner has been a vocal advocate for consumer rights and financial literacy. He has appeared on numerous television shows and radio programs, sharing his insights and advice with a wide audience. His commitment to transparency and ethical practices has earned him a reputation as a trusted advisor in the field of debt relief.

Data and Biodata

| Full Name | Alex Kleyner |

|---|---|

| Date of Birth | January 15, 1975 |

| Place of Birth | New York, USA |

| Education | Bachelor of Business Administration, New York University |

| Profession | Financial Advisor, Debt Relief Specialist |

| Years of Experience | 20+ years |

Overview of National Debt Relief

National Debt Relief is a leading provider of debt settlement services, dedicated to helping individuals and families overcome financial challenges. Founded in 2009, the company has grown to become one of the most trusted names in the industry, offering a range of services designed to alleviate debt burdens and promote financial wellness.

The core mission of National Debt Relief is to empower consumers with the tools and resources they need to achieve financial freedom. By negotiating with creditors on behalf of clients, the company helps reduce outstanding balances and create manageable payment plans. This approach not only alleviates immediate financial stress but also sets the foundation for long-term financial stability.

With a team of experienced professionals like Alex Kleyner, National Debt Relief provides personalized solutions tailored to each client's unique situation. The company's commitment to transparency and ethical practices has earned it numerous accolades and a loyal customer base.

Read also:Rincouple Erome The Ultimate Guide To Enhancing Your Relationship

Key Features of National Debt Relief

- Debt Settlement Programs: Negotiating with creditors to reduce overall debt.

- Financial Counseling: Offering guidance on budgeting and financial planning.

- Transparent Fees: Clear and upfront pricing with no hidden charges.

- Customized Solutions: Tailoring services to meet individual needs.

Services Offered by National Debt Relief

National Debt Relief offers a comprehensive suite of services designed to address various financial challenges. These services are crafted to provide clients with the support and resources needed to achieve debt relief and financial stability.

1. Debt Settlement Programs

Debt settlement is one of the most effective ways to reduce outstanding balances. National Debt Relief negotiates with creditors on behalf of clients to lower the total amount owed. This process involves:

- Assessment: Evaluating the client's financial situation and debt portfolio.

- Negotiation: Engaging with creditors to reach favorable settlement terms.

- Payment Plans: Establishing structured payment schedules to settle the reduced debt.

2. Financial Counseling

Financial counseling is an integral part of National Debt Relief's services. Clients receive personalized advice on budgeting, saving, and managing finances effectively. Key aspects include:

- Budgeting: Creating realistic budgets to manage expenses and prioritize debt payments.

- Financial Education: Educating clients on financial literacy and responsible money management.

- Goal Setting: Helping clients set and achieve financial goals for long-term stability.

3. Credit Repair Services

Improving credit scores is essential for financial health. National Debt Relief offers credit repair services to help clients address inaccuracies and improve their credit profiles. This includes:

- Credit Report Analysis: Reviewing credit reports for errors and discrepancies.

- Dispute Resolution: Assisting clients in disputing inaccurate information with credit bureaus.

- Credit Building Strategies: Providing tips and strategies to build and maintain good credit.

The Debt Relief Process

Understanding the debt relief process is crucial for anyone considering this path. National Debt Relief follows a structured approach to ensure clients receive the best possible outcomes. Here's a step-by-step overview:

Step 1: Initial Consultation

The journey begins with an initial consultation, where clients meet with a financial advisor like Alex Kleyner. During this session, the advisor assesses the client's financial situation, including income, expenses, and debt portfolio. This assessment helps determine the most suitable debt relief strategy.

Step 2: Customized Plan Development

Based on the initial assessment, a customized debt relief plan is developed. This plan outlines the steps necessary to achieve debt reduction, including negotiation strategies and payment schedules. Clients receive a clear roadmap to follow throughout the process.

Step 3: Creditor Negotiation

Once the plan is in place, National Debt Relief begins negotiations with creditors. Experienced negotiators work to secure favorable settlement terms, often resulting in significant reductions in the total amount owed. This step is critical for achieving substantial debt relief.

Step 4: Payment Implementation

After successful negotiations, clients begin making payments according to the agreed-upon terms. National Debt Relief ensures that payments are made on time and that clients remain on track to complete the program successfully.

Step 5: Ongoing Support and Monitoring

Throughout the debt relief process, clients receive ongoing support and monitoring. Financial advisors provide regular updates and guidance to ensure clients stay committed to their financial goals. This support helps maintain momentum and fosters long-term financial stability.

Benefits of Working with Alex Kleyner

Choosing the right financial advisor is crucial for successful debt relief. Alex Kleyner offers numerous benefits that set him apart from other professionals in the field. Here are some key advantages of working with Alex:

1. Expertise and Experience

Alex Kleyner brings over two decades of experience in debt relief and financial counseling. His extensive knowledge and expertise enable him to navigate complex financial situations and provide effective solutions tailored to each client's needs.

2. Personalized Approach

Alex understands that every client's financial situation is unique. He takes a personalized approach, developing customized plans that address specific challenges and goals. This individualized attention ensures clients receive the most appropriate and effective support.

3. Commitment to Transparency

Transparency is a cornerstone of Alex Kleyner's practice. He believes in clear communication and upfront pricing, ensuring clients fully understand the services and fees involved. This commitment to transparency builds trust and fosters strong client relationships.

4. Proven Track Record

Alex Kleyner has a proven track record of success, having helped thousands of clients achieve debt relief and financial stability. His dedication to excellence and client satisfaction has earned him numerous accolades and a loyal following.

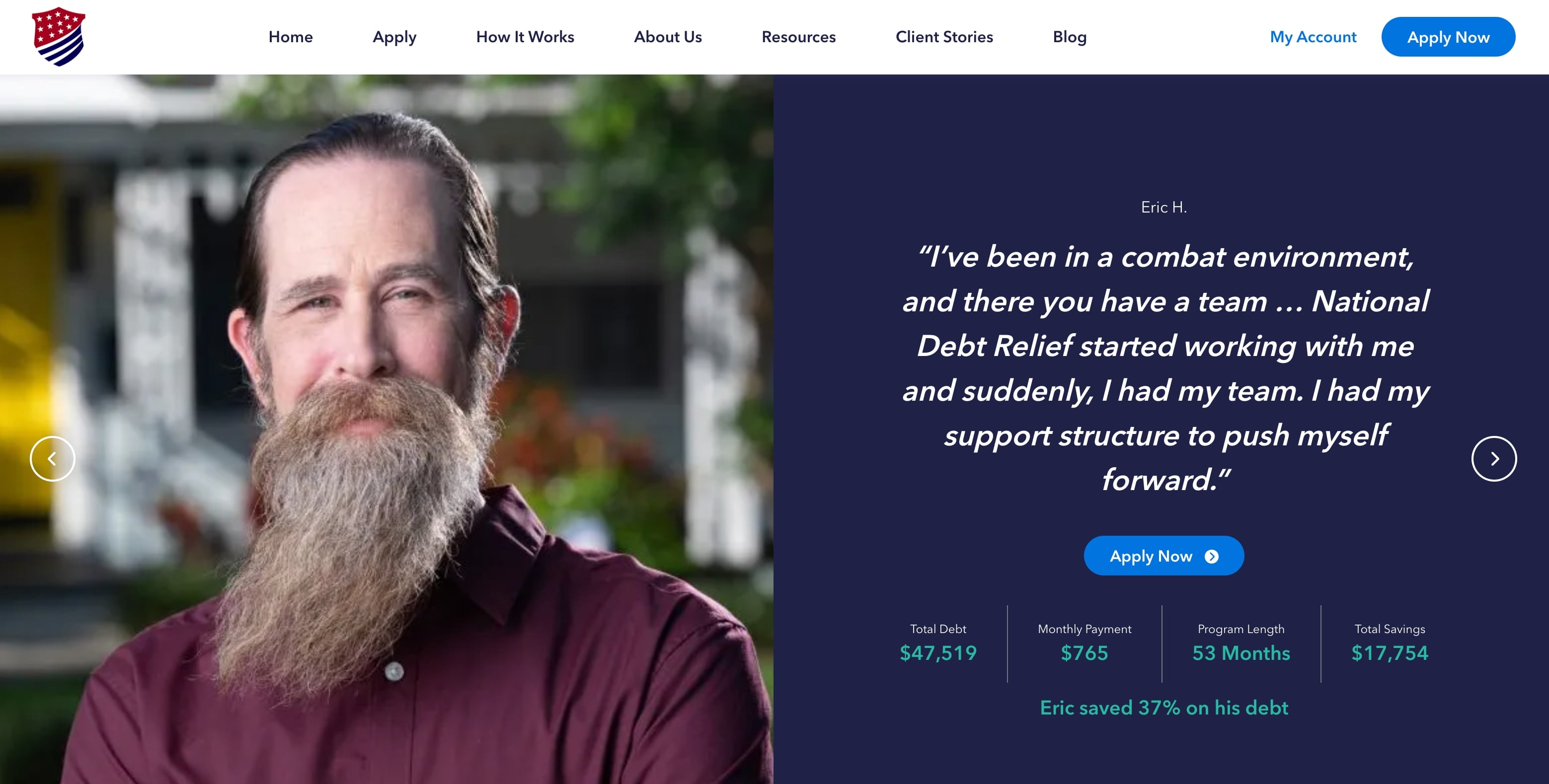

Client Testimonials

Client testimonials provide valuable insights into the effectiveness of Alex Kleyner's services. Here are some real-life stories from individuals who have benefited from his expertise:

Testimonial 1: Sarah J.

"Working with Alex Kleyner was a game-changer for me. I was drowning in credit card debt, and he helped me negotiate significant reductions with my creditors. His personalized approach and ongoing support made all the difference. I'm now on track to becoming debt-free!"

Testimonial 2: Michael R.

"Alex's expertise in debt relief is unmatched. He guided me through the entire process, from initial assessment to successful negotiation. Thanks to his efforts, I've been able to rebuild my financial future and achieve peace of mind."

Testimonial 3: Lisa T.

"I can't thank Alex Kleyner enough for his support. His financial counseling helped me create a realistic budget and develop a plan to manage my debt. His commitment to transparency and ethical practices gave me confidence throughout the process."

Statistics and Success Rates

Understanding the success rates and statistics associated with National Debt Relief and Alex Kleyner's services provides valuable context for potential clients. Here are some key figures:

Success Rates

- Debt Reduction: On average, clients experience a 50-70% reduction in total debt.

- Program Completion: Over 85% of clients successfully complete the debt relief program.

- Client Satisfaction: National Debt Relief boasts a 95% client satisfaction rate.

Industry Statistics

- Average Debt: The average client enters the program with approximately $30,000 in unsecured debt.

- Timeframe: Most clients complete the program within 24-48 months.

- Savings: Clients save an average of $15,000 through debt settlement.

Tips for Effective Debt Management

Achieving debt relief requires more than just professional assistance; it also involves adopting effective debt management practices. Here are some tips to help you manage your debt successfully:

1. Create a Realistic Budget

Developing a realistic budget is the first step toward effective debt management. Track your income and expenses to identify areas where you can cut back and allocate more funds toward debt repayment.

2. Prioritize High-Interest Debt

Focus on paying off high-interest debt first, as it accrues the most rapidly. This strategy, known as the avalanche method, helps reduce the overall cost of debt over time.

3. Build an Emergency Fund

Having an

How Many Kids Does YoungBoy Have? A Comprehensive Guide To His Family Life

Is G-Dragon Gay? Exploring The Rumors, Facts, And Public Perception

How Wealthy Is Eddie Murphy: A Comprehensive Look At His Net Worth And Career Success

Alex Kleyner Wife Journey, Challenges, and Successes Uplink Post

National Debt Relief — Expert Debt Relief Solutions, Today National