New York State Income Tax: A Comprehensive Guide For Taxpayers

Understanding New York State (NYS) income tax is crucial for anyone living or working in the state. This tax plays a vital role in funding essential public services such as education, healthcare, and infrastructure. For taxpayers, staying informed about NYS income tax rates, deductions, and filing requirements ensures compliance and helps optimize financial planning. Whether you are a resident, non-resident, or part-year resident, navigating the complexities of state taxes can be challenging. This article aims to provide a detailed guide on everything you need to know about NYS income tax, from rates and brackets to credits and filing deadlines.

Taxation is one of the most significant financial responsibilities for individuals and businesses alike. In New York State, the income tax system is progressive, meaning that higher income earners are taxed at higher rates. This structure is designed to ensure fairness while generating revenue for the state. However, understanding how these rates apply to your income, what deductions you qualify for, and how to file correctly can be overwhelming. This guide will break down the key components of NYS income tax to help you navigate it with confidence.

For those who are new to New York or unfamiliar with its tax system, this article will serve as a reliable resource. By the end of this guide, you will have a clear understanding of how NYS income tax works, how it affects your finances, and what steps you can take to manage it effectively. Whether you're filing your taxes for the first time or looking to optimize your tax strategy, this article has you covered.

Read also:Vxe R1 Pro Software Web The Ultimate Guide To Elevating Your Digital Experience

Table of Contents

- Overview of New York State Income Tax

- NYS Income Tax Rates and Brackets

- Who Must File NYS Income Tax?

- Deductions and Credits Available in NYS

- How to File Your NYS Income Tax Return

- Common Mistakes to Avoid When Filing

- Tax Obligations for Non-Residents and Part-Year Residents

- Recent Changes to NYS Income Tax Laws

- Helpful Resources for NYS Taxpayers

- Conclusion and Call to Action

Overview of New York State Income Tax

New York State income tax is a direct tax levied on the income earned by individuals and businesses within the state. It is administered by the New York State Department of Taxation and Finance and serves as a primary source of revenue for the state government. The funds collected through income tax are used to support public services such as schools, hospitals, transportation systems, and public safety initiatives.

The NYS income tax system operates on a progressive structure, meaning that tax rates increase as income levels rise. This system is designed to ensure that individuals with higher incomes contribute a larger share of their earnings to state revenue. Unlike federal income tax, which applies uniformly across the United States, state income taxes vary by jurisdiction. Therefore, understanding the specifics of NYS income tax is essential for compliance and financial planning.

For taxpayers, NYS income tax is separate from federal income tax and requires its own filing process. While some states do not impose income tax, New York is one of the states with a comprehensive tax system. This makes it crucial for residents and non-residents earning income in New York to familiarize themselves with the state's tax laws and regulations.

NYS Income Tax Rates and Brackets

The tax rates for New York State income tax are divided into brackets based on taxable income. For the tax year 2023, the rates range from 4% to 8.82%, depending on the taxpayer's income level and filing status. Below is a breakdown of the tax brackets for single filers, married couples filing jointly, and heads of households:

- Single Filers:

- 4% on income up to $8,500

- 4.5% on income between $8,501 and $11,700

- 5.25% on income between $11,701 and $13,900

- 5.9% on income between $13,901 and $21,400

- 6.33% on income between $21,401 and $80,650

- 6.85% on income between $80,651 and $215,400

- 9.65% on income between $215,401 and $1,077,550

- 10.3% on income exceeding $1,077,550

- Married Filing Jointly:

- 4% on income up to $17,150

- 4.5% on income between $17,151 and $23,600

- 5.25% on income between $23,601 and $27,900

- 5.9% on income between $27,901 and $43,000

- 6.33% on income between $43,001 and $161,550

- 6.85% on income between $161,551 and $323,200

- 9.65% on income between $323,201 and $2,155,350

- 10.3% on income exceeding $2,155,350

These tax brackets are subject to change annually, so it's important to stay updated on the latest rates. Additionally, New York City residents are subject to an additional city income tax, which ranges from 2.907% to 3.876%, depending on income levels.

Who Must File NYS Income Tax?

Not everyone who earns income in New York State is required to file a state income tax return. The filing requirements depend on factors such as income level, filing status, and residency status. Below are the general guidelines:

Read also:Ultimate Guide To Choosing The Perfect Vinyl Tarps For Any Purpose

- Residents: Individuals who are full-year residents of New York State must file a return if their gross income exceeds the standard deduction for their filing status.

- Non-Residents: Non-residents who earn income from New York sources, such as wages or business income, may be required to file if their income exceeds certain thresholds.

- Part-Year Residents: Individuals who move into or out of New York during the tax year must file a return if they meet the income thresholds for either residents or non-residents.

It's important to note that even if you are not required to file, you may still benefit from filing to claim refunds or credits. Consulting a tax professional can help clarify your filing obligations.

How to File Your NYS Income Tax Return

Filing your NYS income tax return can be done online or by mail. The New York State Department of Taxation and Finance provides an online filing system called "NY State of Health" for convenience. Here are the steps to file your return:

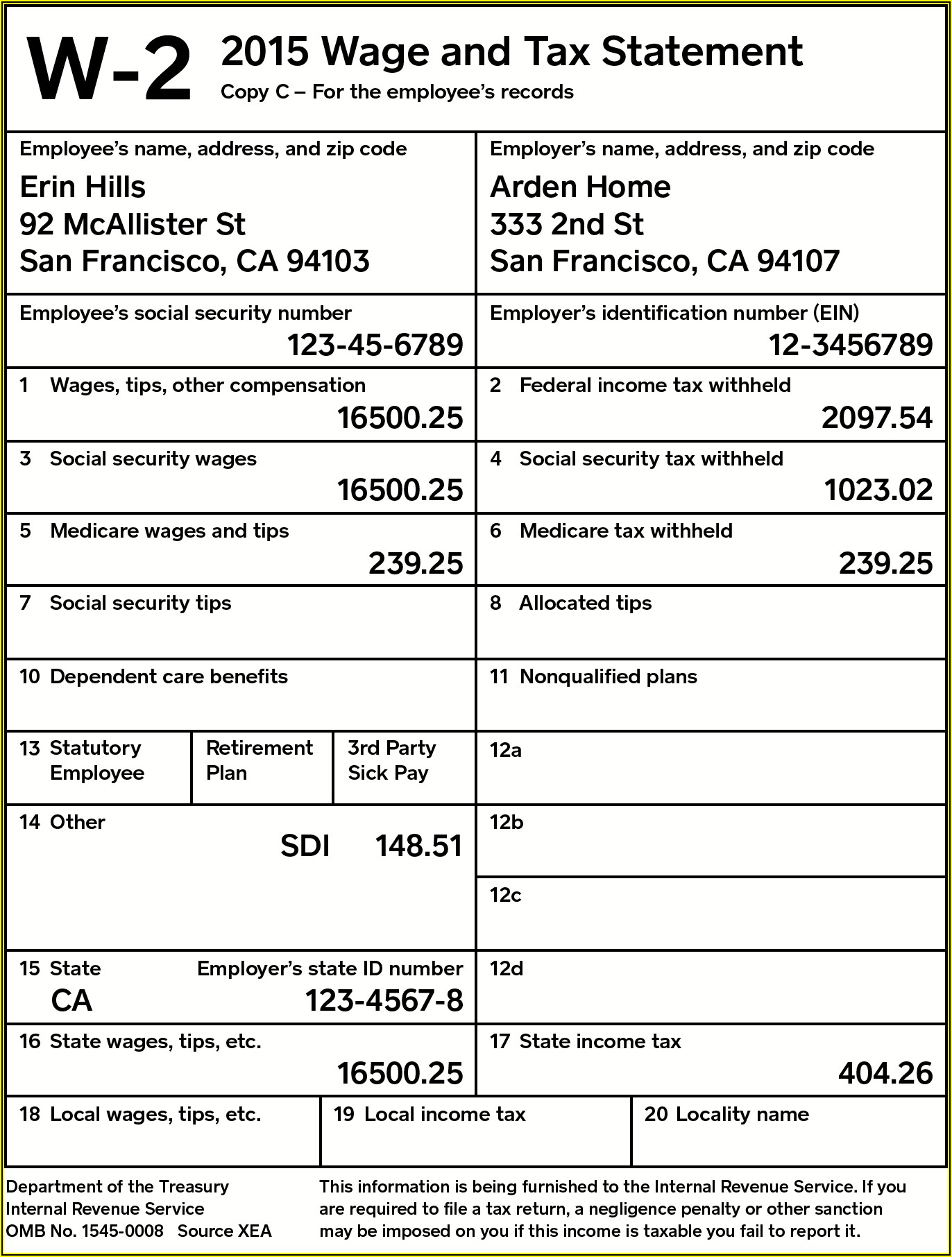

- Gather all necessary documents, including W-2s, 1099s, and receipts for deductions.

- Choose between filing online or by mail, depending on your preference.

- Complete Form IT-201 for residents or Form IT-203 for non-residents.

- Submit your return by the April 15 deadline to avoid penalties.

For those who prefer digital options, e-filing is faster and reduces the risk of errors. Additionally, using tax preparation software can simplify the process.

Deductions and Credits Available in NYS

New York State offers various deductions and credits to help reduce taxable income and lower tax liability. Some of the most common deductions include:

- Standard deduction or itemized deductions

- Retirement contributions

- Educational expenses

In addition to deductions, taxpayers can take advantage of credits such as the Earned Income Tax Credit (EITC) and the Child and Dependent Care Credit. These credits directly reduce the amount of tax owed and can result in significant savings.

Common Mistakes to Avoid When Filing

Filing taxes can be complex, and mistakes can lead to penalties or delays. Some common errors to avoid include:

- Failing to report all sources of income

- Incorrectly calculating deductions or credits

- Missing the filing deadline

Double-checking your return before submission and seeking professional advice can help prevent these issues.

Tax Obligations for Non-Residents and Part-Year Residents

Non-residents and part-year residents of New York State have unique tax obligations. Non-residents are only taxed on income earned within the state, while part-year residents are taxed on all income during the period they resided in New York. Understanding these distinctions is crucial for accurate filing.

Recent Changes to NYS Income Tax Laws

In recent years, New York State has implemented several changes to its tax laws. These include adjustments to tax brackets, increased credits for low-income earners, and modifications to filing deadlines. Staying informed about these changes ensures compliance and maximizes tax benefits.

Helpful Resources for NYS Taxpayers

For additional guidance, taxpayers can access resources such as the New York State Department of Taxation and Finance website, IRS publications, and local tax professionals. These tools provide valuable information and support for navigating NYS income tax.

Conclusion and Call to Action

Understanding New York State income tax is essential for financial planning and compliance. By familiarizing yourself with tax rates, deductions, credits, and filing requirements, you can minimize your tax liability and avoid costly mistakes. If you found this guide helpful, consider sharing it with others who may benefit. For more information, explore additional articles on our website or consult a tax professional for personalized advice.

Claudia Heffner Peltz: A Comprehensive Guide To Her Life, Career, And Influence

Is G-Dragon Gay? Exploring The Rumors, Facts, And Public Perception

Exploring The Iconic Cast Of Two And A Half Men: A Closer Look

2014 Tax Forms Printable Canada prosecution2012

Pa Tax Forms Printable Form Resume Examples MoYoPGNVZB