Kabbage Funding Requirements: A Comprehensive Guide For Small Business Owners

Are you a small business owner looking for funding options to grow your business? Kabbage Funding Requirements might be the solution you need. In today's competitive business landscape, securing the right funding can make all the difference in scaling your operations, managing cash flow, or even surviving unexpected challenges. Kabbage, a well-known name in the world of small business financing, offers flexible funding options tailored to meet the needs of entrepreneurs. However, understanding Kabbage funding requirements is crucial to ensure you qualify for their services and make the most of the financial support they provide.

Funding is not just about securing money; it's about finding the right financial partner who understands your business needs. Kabbage has earned a reputation for providing accessible and transparent funding solutions. However, like any financial service, it comes with specific requirements that applicants must meet. In this article, we will delve into everything you need to know about Kabbage funding requirements, including eligibility criteria, application processes, and tips to improve your chances of approval.

Whether you're a startup or an established business, understanding the intricacies of Kabbage funding can save you time and effort. This guide will not only break down the requirements but also provide actionable insights to help you prepare your application. By the end of this article, you'll have a clear roadmap to navigate the Kabbage funding process and secure the financial resources your business needs to thrive.

Read also:Underwater Welder Salary In Canada Comprehensive Guide To Earnings And Opportunities

Table of Contents

- What is Kabbage and How Does It Work?

- Kabbage Funding Requirements: Eligibility Criteria

- Key Business Requirements for Kabbage Funding

- Essential Financial Documents You Need to Prepare

- How Your Credit Score Affects Kabbage Funding Approval

- Step-by-Step Guide to the Kabbage Application Process

- Tips to Improve Your Chances of Kabbage Funding Approval

- Alternative Funding Options if Kabbage Isn't Right for You

- Benefits and Drawbacks of Kabbage Funding

- Conclusion: Is Kabbage Funding Right for Your Business?

What is Kabbage and How Does It Work?

Kabbage is a financial technology company that specializes in providing small business loans and lines of credit. Founded in 2009, Kabbage has become a trusted name in the small business funding industry, offering flexible and accessible financing solutions to entrepreneurs across various industries. Unlike traditional banks, Kabbage leverages technology and data analytics to streamline the funding process, making it easier for small businesses to access the capital they need.

How does Kabbage work? The platform uses an automated system to evaluate the financial health and performance of your business. This includes analyzing data from your bank accounts, accounting software, and other financial platforms. By doing so, Kabbage can quickly assess your eligibility and provide funding decisions in a matter of minutes. Once approved, businesses can access their funds almost immediately, allowing them to address urgent financial needs or invest in growth opportunities.

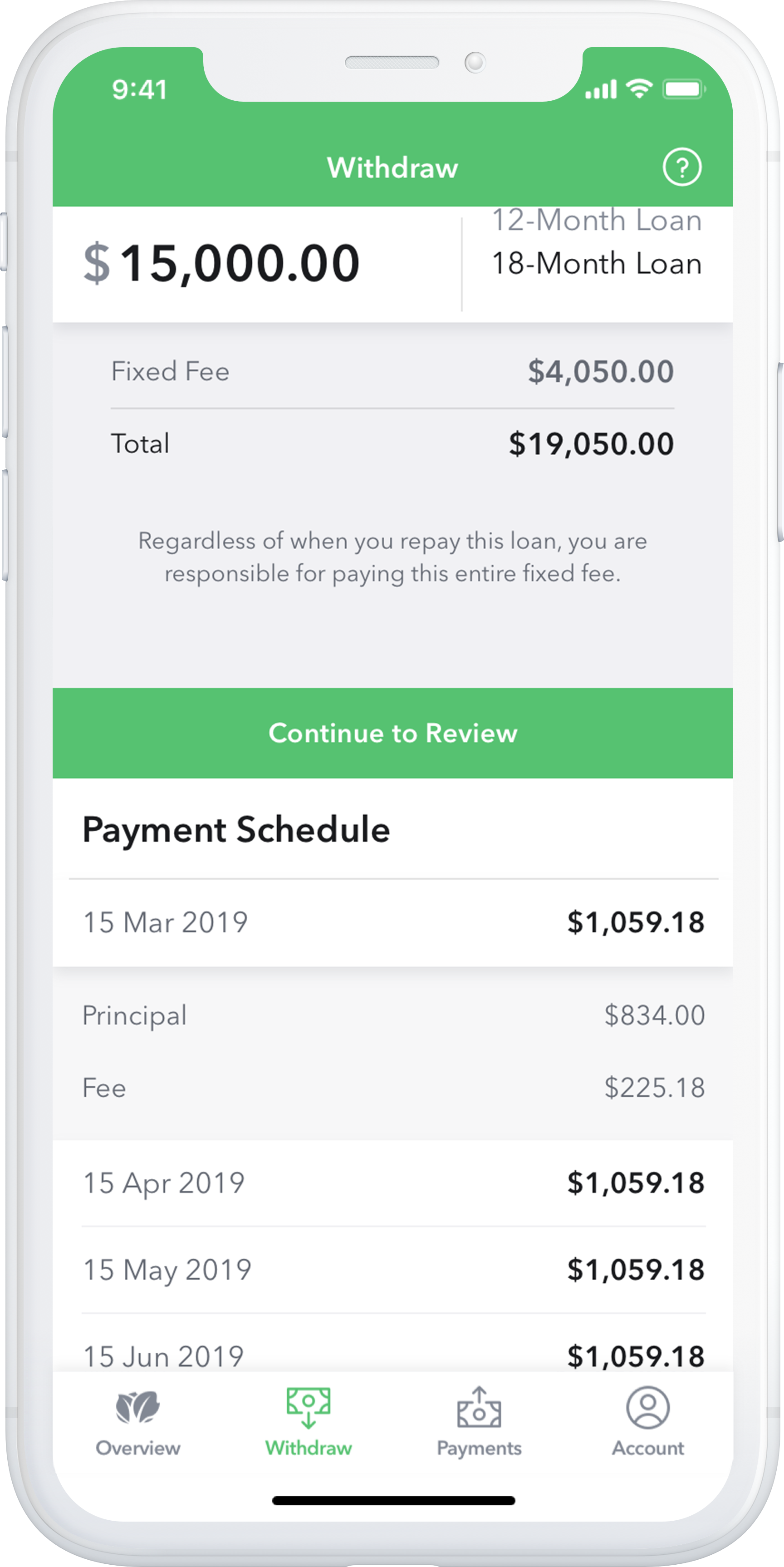

One of the standout features of Kabbage is its flexibility. Borrowers can choose from various funding amounts and repayment terms, ensuring that the financing aligns with their specific needs. Additionally, Kabbage offers a line of credit, which allows businesses to draw funds as needed, similar to a credit card. This flexibility, combined with a user-friendly application process, makes Kabbage an attractive option for small business owners seeking funding.

Kabbage Funding Requirements: Eligibility Criteria

Before diving into the application process, it's essential to understand the eligibility criteria for Kabbage funding. Meeting these requirements is the first step toward securing financing for your business. Kabbage has designed its eligibility criteria to ensure that only qualified businesses receive funding, reducing the risk for both the lender and the borrower.

Basic Eligibility Requirements

- Your business must have been operational for at least 12 months.

- You must generate at least $50,000 in annual revenue or $4,200 per month over the last three months.

- Your business must operate in an eligible industry (Kabbage does not fund certain industries like gambling or adult entertainment).

- You must have a valid business bank account in the U.S. or Canada.

Additional Considerations

Beyond the basic requirements, Kabbage also evaluates other factors, such as your business's financial performance, credit history, and overall stability. While these factors are not strict eligibility criteria, they play a significant role in determining your approval and funding amount.

Key Business Requirements for Kabbage Funding

Securing Kabbage funding is not just about meeting the eligibility criteria; your business must also fulfill specific requirements to qualify. These requirements ensure that Kabbage can assess your business's financial health and repayment capacity accurately.

Read also:In Which Episode Does Escanor Die Unveiling The Tragic Fate Of The Lions Sin

Revenue Requirements

One of the most critical business requirements is your revenue. Kabbage requires businesses to generate at least $50,000 in annual revenue or $4,200 per month over the last three months. This requirement ensures that your business has a steady income stream to support loan repayments.

Business Age

Kabbage also requires businesses to have been operational for at least 12 months. This criterion helps Kabbage assess the stability and longevity of your business. Startups or businesses that have been operating for less than a year may not qualify for funding.

Industry Restrictions

Not all industries are eligible for Kabbage funding. Certain industries, such as gambling, adult entertainment, and speculative trading, are excluded from the platform. This restriction helps Kabbage mitigate risks associated with high-risk industries.

Essential Financial Documents You Need to Prepare

When applying for Kabbage funding, having the right financial documents is crucial. These documents provide Kabbage with the necessary information to evaluate your business's financial health and determine your eligibility for funding.

Bank Statements

Kabbage requires access to your business bank statements for the last six months. These statements help Kabbage analyze your cash flow, revenue, and overall financial performance. Ensure that your bank statements are up-to-date and accurately reflect your business's financial activity.

Tax Returns

While not always mandatory, providing your business tax returns can strengthen your application. Tax returns offer additional insights into your business's financial health and profitability, which can improve your chances of approval.

Accounting Records

If your business uses accounting software like QuickBooks or Xero, Kabbage may request access to these records. This data helps Kabbage verify your revenue and expenses, providing a more comprehensive view of your business's financial performance.

How Your Credit Score Affects Kabbage Funding Approval

While Kabbage places significant emphasis on your business's financial performance, your personal and business credit scores also play a role in the approval process. Understanding how your credit score impacts your application can help you prepare and improve your chances of success.

Personal Credit Score

Kabbage typically requires a minimum personal credit score of 550. While this is not a strict cutoff, a higher credit score can increase your chances of approval and secure better terms. Your personal credit score reflects your financial responsibility and repayment history, which are critical factors for lenders.

Business Credit Score

In addition to your personal credit score, Kabbage may also consider your business credit score. A strong business credit score demonstrates your business's ability to manage debt and meet financial obligations, making you a more attractive candidate for funding.

Improving Your Credit Score

If your credit score is below the recommended threshold, consider taking steps to improve it before applying. Paying down existing debt, resolving any errors on your credit report, and maintaining a low credit utilization ratio can positively impact your score.

Step-by-Step Guide to the Kabbage Application Process

Applying for Kabbage funding is a straightforward process, but understanding the steps involved can help you prepare and navigate the application more effectively. Here's a step-by-step guide to help you through the process:

Step 1: Create an Account

Start by creating an account on the Kabbage website. You'll need to provide basic information about yourself and your business, including your business name, industry, and contact details.

Step 2: Connect Your Financial Accounts

Once your account is set up, Kabbage will ask you to connect your business bank account and accounting software. This step allows Kabbage to analyze your financial data and assess your eligibility for funding.

Step 3: Review Your Funding Options

After evaluating your financial data, Kabbage will present you with funding options tailored to your business's needs. You can choose the amount and repayment terms that best suit your requirements.

Step 4: Submit Your Application

Once you've selected your funding option, submit your application. Kabbage will review your application and provide a decision within minutes. If approved, you can access your funds almost immediately.

Tips to Improve Your Chances of Kabbage Funding Approval

Securing Kabbage funding is not guaranteed, but there are several strategies you can employ to improve your chances of approval. Here are some tips to help you prepare and strengthen your application:

Boost Your Revenue

If your business is close to meeting Kabbage's revenue requirements, consider implementing strategies to increase your income. This could include expanding your product or service offerings, improving marketing efforts, or optimizing your pricing strategy.

Improve Your Credit Score

As mentioned earlier, a higher credit score can enhance your application. Take proactive steps to improve your credit score by paying down debt, resolving errors, and maintaining a low credit utilization ratio.

Ensure Accurate Financial Records

Providing accurate and up-to-date financial records is crucial. Ensure that your bank statements, tax returns, and accounting records are error-free and reflect your business's true financial performance.

Alternative Funding Options if Kabbage Isn't Right for You

While Kabbage is an excellent option for many small businesses, it may not be the right fit for everyone. Fortunately, there are several alternative funding options available to consider:

Small Business Administration (SBA) Loans

SBA loans are government-backed loans that offer favorable terms and low interest rates. These loans are ideal for businesses that need larger funding amounts and are willing to go through a more rigorous application process.

Business Credit Cards

Business credit cards provide a flexible funding option, allowing you to access funds as needed. They are particularly useful for managing short-term expenses and improving cash flow.

Invoice Financing

If your business struggles with cash flow due to unpaid invoices, invoice financing can provide immediate access to funds. This option allows you to borrow against your outstanding invoices, ensuring you have the capital you need to operate smoothly.

Benefits and Drawbacks of Kabbage Funding

Like any financial product, Kabbage funding comes with its own set of benefits and drawbacks. Understanding these can help you make an informed decision about whether Kabbage is the right funding option for your business.

Benefits

- Quick and easy application process.

- Flexible funding options tailored to your needs.

- Access to funds almost immediately after approval.

- No hidden fees or long-term commitments.

Drawbacks

- Higher interest rates compared to traditional loans.

- Strict revenue and business age requirements.

- Limited funding options for startups and high-risk industries.

Conclusion: Is Kabbage Funding Right for Your Business?

Kabbage funding offers a flexible and accessible solution for small business owners seeking financial support. By understanding the Kabbage funding requirements and preparing your application accordingly, you can increase your chances of approval and secure the capital your business needs to grow and thrive.

However, it's essential to weigh the benefits and drawbacks of Kabbage funding and consider alternative options if necessary. Whether you choose Kabbage or another funding provider, the key is to find a solution that aligns with your business's unique needs and goals.

If you're ready to take the next step, visit the Kabbage website to learn more about their funding options and start your application today. Don't forget to share your experience or leave a comment below to help other business owners make informed decisions about their funding options.

Liteblue USPS Gov Payroll: A Comprehensive Guide To Managing Your USPS Employee Benefits

Isaiah Thomas Career Earnings: A Comprehensive Look At His NBA Journey

Von Dutch Net Worth: Unveiling The Legacy And Financial Success Of The Iconic Brand

Screenshots Kabbage Newsroom

![Kabbage Funding Amex +3 Small Business Alternatives [2023]](https://alexmedawar.com/wp-content/uploads/2022/11/kabbage-funding-american-express-business-insights.jpeg)

Kabbage Funding Amex +3 Small Business Alternatives [2023]