Best Credit Card For First Credit Card: A Comprehensive Guide

Are you ready to take the first step towards building your financial future? Choosing the right credit card for your first credit card is a crucial decision that can shape your financial habits and credit score. With so many options available in the market, finding the best credit card for beginners can feel overwhelming. But don’t worry—this guide will walk you through everything you need to know to make an informed decision. Whether you’re a college student, a young professional, or someone new to the world of credit, this article will help you understand the features, benefits, and considerations of selecting the best credit card for your needs.

Building credit is an essential part of financial independence, and your first credit card can be a powerful tool in achieving that. A well-chosen credit card can help you establish a strong credit history, earn rewards, and provide financial flexibility. However, it’s important to choose wisely to avoid pitfalls like high fees or overwhelming debt. In this article, we’ll explore the top credit cards for first-time users, discuss key factors to consider, and provide actionable tips to help you make the best choice.

By the end of this guide, you’ll have a clear understanding of what makes a credit card ideal for beginners, how to use it responsibly, and how to leverage it to build a solid financial foundation. Let’s dive into the world of credit cards and discover the best options for your first credit card.

Read also:How To Schedule A Public Txdp Appointment A Complete Guide

Table of Contents

- What is a First Credit Card?

- Why is a First Credit Card Important?

- Key Factors to Consider When Choosing a First Credit Card

- Top Credit Cards for Beginners

- How to Use Your First Credit Card Responsibly

- Common Mistakes to Avoid with Your First Credit Card

- Building Credit with Your First Credit Card

- Long-Term Benefits of a First Credit Card

- Frequently Asked Questions

- Conclusion

What is a First Credit Card?

A first credit card is typically the initial step for individuals entering the world of credit. It serves as a financial tool that allows users to borrow money from a bank or credit card issuer to make purchases, pay bills, or cover expenses. Unlike debit cards, which deduct funds directly from your bank account, credit cards provide a line of credit that must be repaid within a specified period.

For beginners, a first credit card often comes with features designed to help them learn responsible financial habits. These may include low credit limits, minimal fees, and educational resources. Many first-time credit cards also offer rewards programs, cashback, or introductory offers to incentivize usage and repayment.

Types of First Credit Cards

- Student Credit Cards: Designed for college students with limited credit history, these cards often have lower credit requirements and offer perks like cashback on textbooks or dining.

- Secured Credit Cards: Require a security deposit, which acts as collateral and determines the credit limit. These are ideal for individuals with no credit history or those rebuilding credit.

- Starter Credit Cards: Offered by major banks, these cards have minimal requirements and are suitable for first-time users looking to build credit.

Why is a First Credit Card Important?

A first credit card plays a pivotal role in establishing your financial identity. It serves as a gateway to building credit history, which is essential for accessing loans, mortgages, and other financial products in the future. Lenders and financial institutions rely on your credit score to assess your creditworthiness, and a first credit card is often the foundation of that score.

Using a credit card responsibly can help you develop healthy financial habits, such as paying bills on time, managing debt, and budgeting. Additionally, many first credit cards offer rewards and benefits, such as cashback, travel points, or discounts, which can provide added value to your spending.

Long-Term Benefits of a First Credit Card

- Improved Credit Score: Consistent, responsible use of a credit card can boost your credit score over time.

- Financial Independence: A credit card provides flexibility and security for emergencies or unexpected expenses.

- Rewards and Perks: Many first credit cards offer cashback, travel rewards, or discounts on everyday purchases.

Key Factors to Consider When Choosing a First Credit Card

When selecting a credit card for the first time, it’s important to evaluate several factors to ensure it aligns with your financial goals and needs. Here are the key considerations:

1. Credit Limit

A low credit limit can help beginners avoid overspending and accumulating debt. Look for cards with limits that match your spending habits and income level.

Read also:Did Tyler Baltierras Dad Pass Away Uncovering The Truth Behind The Rumors

2. Annual Fees

Many first credit cards come with no annual fees, but it’s essential to confirm this before applying. Avoid cards with high fees unless they offer significant benefits that outweigh the cost.

3. Interest Rates

Interest rates, or APR (Annual Percentage Rate), determine how much you’ll pay if you carry a balance. Look for cards with low APRs, especially if you anticipate carrying a balance occasionally.

4. Rewards Programs

Some first credit cards offer rewards like cashback, points, or travel miles. Choose a card with rewards that align with your spending habits and lifestyle.

5. Credit Requirements

Understand the credit requirements for the card you’re considering. If you have no credit history, look for cards designed for beginners or those that accept limited credit profiles.

Top Credit Cards for Beginners

Here are some of the best credit cards for first-time users, based on their features, benefits, and suitability for beginners:

1. Discover it® Student Cash Back

- Key Features: 5% cashback on rotating categories, no annual fee, and a cashback match at the end of the first year.

- Pros: Ideal for students, rewards-rich, and offers educational resources.

- Cons: Rotating categories require activation each quarter.

2. Capital One Journey® Student Rewards

- Key Features: 1% cashback on all purchases, 1.25% cashback when you pay on time, and no annual fee.

- Pros: Encourages on-time payments, easy approval for students, and credit-building tools.

- Cons: Limited rewards compared to other cards.

3. Bank of America® Customized Cash Rewards Credit Card

- Key Features: 3% cashback in a category of your choice, 2% cashback at grocery stores, and no annual fee.

- Pros: Flexible rewards, no foreign transaction fees, and a $200 online bonus for new cardholders.

- Cons: Requires good credit for approval.

How to Use Your First Credit Card Responsibly

Using your first credit card responsibly is crucial for building a strong credit history and avoiding debt. Here are some tips to help you manage your card effectively:

1. Pay Your Bills on Time

Timely payments are the most significant factor in building a good credit score. Set up automatic payments or reminders to avoid missing deadlines.

2. Keep Your Credit Utilization Low

Aim to use less than 30% of your available credit limit. For example, if your credit limit is $1,000, try to keep your balance below $300.

3. Monitor Your Spending

Track your purchases to ensure you stay within your budget and avoid unnecessary expenses.

4. Avoid Cash Advances

Cash advances often come with high fees and interest rates, making them an expensive option for accessing cash.

Common Mistakes to Avoid with Your First Credit Card

While a first credit card can be a valuable tool, it’s easy to make mistakes that can harm your financial health. Here are some common pitfalls to avoid:

1. Missing Payments

Even one missed payment can negatively impact your credit score. Always prioritize paying your credit card bill on time.

2. Overspending

It’s tempting to max out your credit card, but doing so can lead to debt and financial stress. Stick to a budget and only spend what you can afford to repay.

3. Ignoring the Fine Print

Read the terms and conditions carefully to understand fees, interest rates, and rewards programs.

Building Credit with Your First Credit Card

Building credit with your first card requires consistent, responsible use. Here’s how you can leverage your card to establish a strong credit history:

1. Maintain a Low Balance

Keeping your balance low relative to your credit limit demonstrates responsible credit management.

2. Use Your Card Regularly

Regular use and timely payments help build a positive credit history. Aim to use your card for small, manageable purchases.

3. Check Your Credit Report

Monitor your credit report regularly to ensure accuracy and address any errors promptly.

Long-Term Benefits of a First Credit Card

A first credit card can offer numerous long-term benefits, including:

- Access to Better Financial Products: A strong credit history can qualify you for lower interest rates on loans and mortgages.

- Increased Financial Security: Credit cards provide a safety net for emergencies and unexpected expenses.

- Rewards and Perks: Over time, you can earn significant rewards, cashback, or travel benefits.

Frequently Asked Questions

1. What is the minimum age to get a first credit card?

In most countries, you must be at least 18 years old to apply for a credit card. However, some cards may require you to be 21 or older if you don’t have a steady income.

2. Can I get a credit card with no credit history?

Yes, many banks offer starter credit cards or secured credit cards designed for individuals with no credit history.

3. How long does it take to build credit with a first credit card?

Building credit typically takes 6-12 months of consistent, responsible use. However, significant improvements may take longer.

Conclusion

Choosing the best credit card for your first credit card is a decision that can have a lasting impact on your financial future. By understanding the features, benefits, and considerations outlined in this guide, you can make an informed choice that aligns with your goals. Remember to use your card responsibly, monitor your spending, and prioritize timely payments to build a strong credit history.

We hope this article has provided you with valuable insights and actionable tips to navigate the world of credit cards. If you found this guide helpful, feel free to share it with others or leave a comment below. For more financial tips and resources, explore our other articles and take the next step toward financial independence today!

Who Is Katt Williams' Son? A Comprehensive Guide To His Life And Career

Katt Williams' Son: A Deep Dive Into His Life, Career, And Influence

Steve Buscemi: The Versatile Actor With A Unique Charm

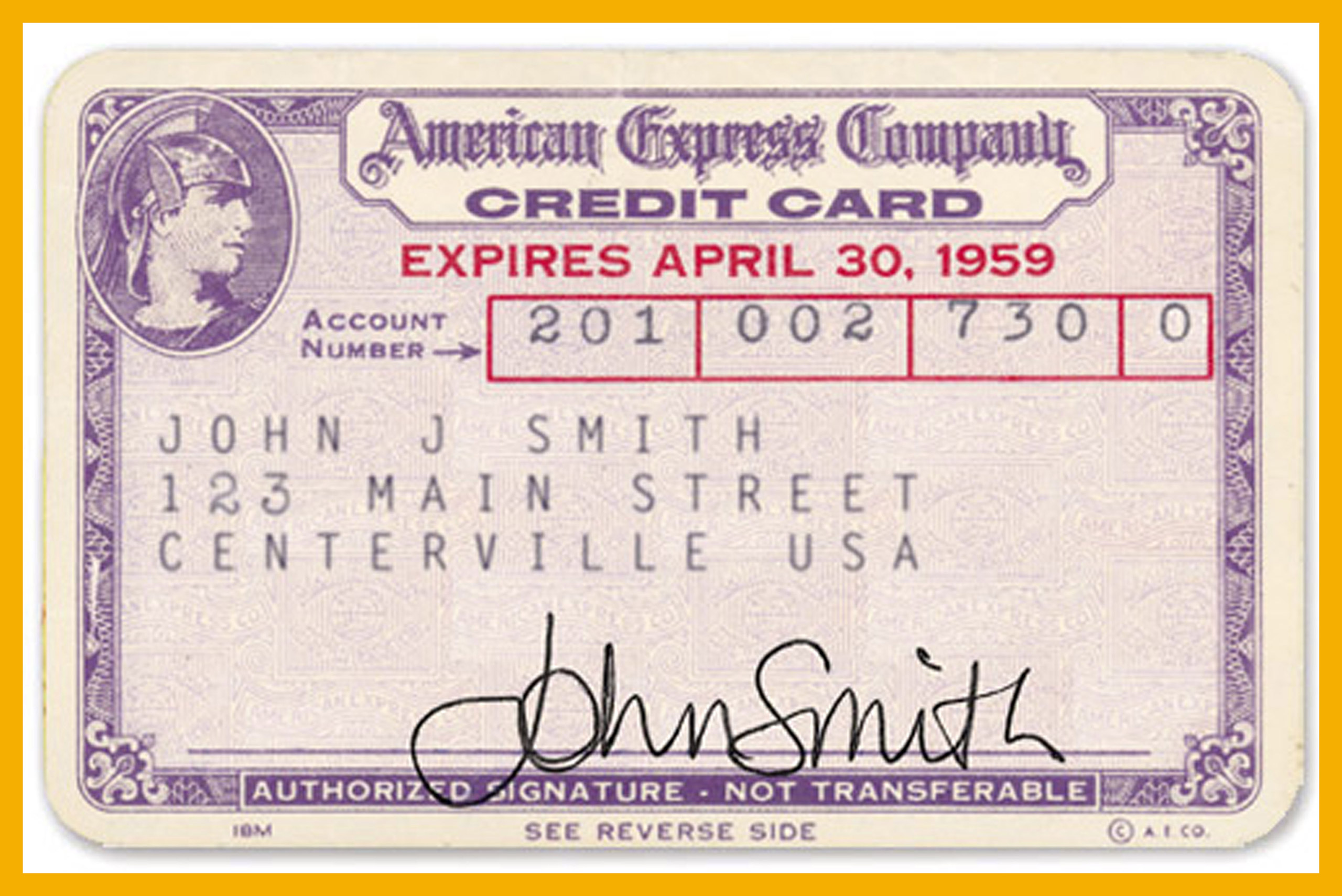

What to Know About Credit What Was the First Credit Card? Time

credit card Britannica